The Q4-2025 earnings reporting season starts with the big banks this week. They are likely to deliver solid earnings, as loan demand is growing, net interest margins are widening, loan losses are manageable, and investment banking is booming. Other S&P 500 industries are also likely to deliver very good results. Indeed, we expect S&P 500 companies’ aggregate revenues per share, earnings per share, and profit margin to have risen to record highs in the last quarter of 2025.

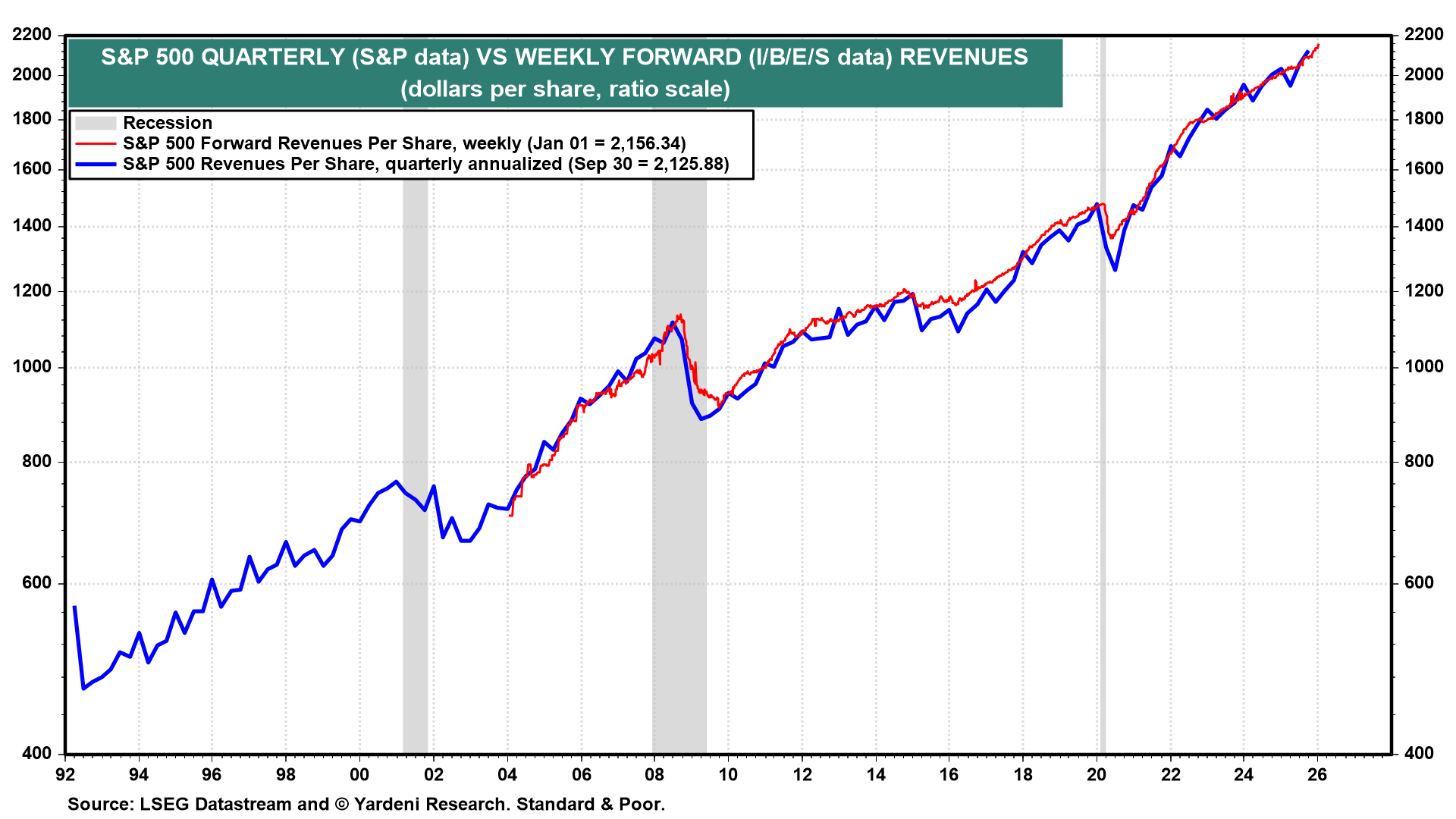

For starters, S&P 500 forward revenues per share rose to a record high during the week of January 1, 2026 (chart). The series did the same in Q2-2025 and Q3-2025, driven by large increases in nominal and real GDP in both quarters. According to the latest reading of the Atlanta Fed's GDPNow, real GDP is tracking at 5.1% for Q4-2025 (saar).

A significant portion of S&P 500 revenues is attributable to the overseas activities of US corporations. The 2025 revenue data we are tracking suggest that the global economy has been remarkably resilient in the face of Trump's Tariff Turmoil.

The weekly S&P 500 forward earnings per share series rose to a new record high during the week of January 8 (chart). Again, this augurs well for another record high in S&P 500 earnings per share during Q4-2025.