The good news is that almost everyone agrees that an imminent recession isn't very likely. That reduces the downside concerns about corporate earnings. But it increases the downside potential for the stock market's valuation multiple if the bond yield continues to rise. The Bond Vigilantes may be saddling up in response to the widening federal deficit. They don't seem to mind budget deficits when the economy is weak. They don't like to see them when the economy is doing well.

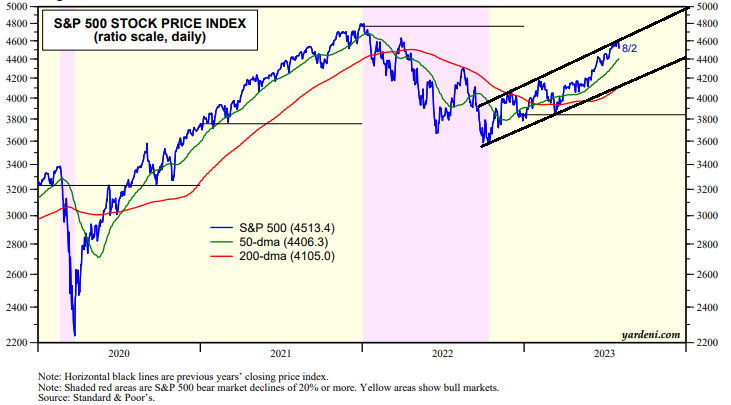

In any event, we are sticking with our yearend 4600 target for the S&P 500, which means that the year's positive performance will have occurred during H1-2023 with the market struggling to do better in H2. That's the opposite of the consensus view at the start of this year when it was widely expected that H1 would be tough, but H2 would be better for stock investors.

The market seems to have run into resistance at 4600 on the S&P 500 exactly at the upper end of its bullish channel (chart). Support at the 50-dma isn't likely to hold, but the 200-dma should hold near the bottom of the channel.

The Investors Intelligence Bull/Bear Ratio continues to hover around 3.00 (chart). Sentiment is too bullish from a contrarian perspective. Wall Street's economists and strategists have been scrambling to boost their outlook for the economy and the stock market.