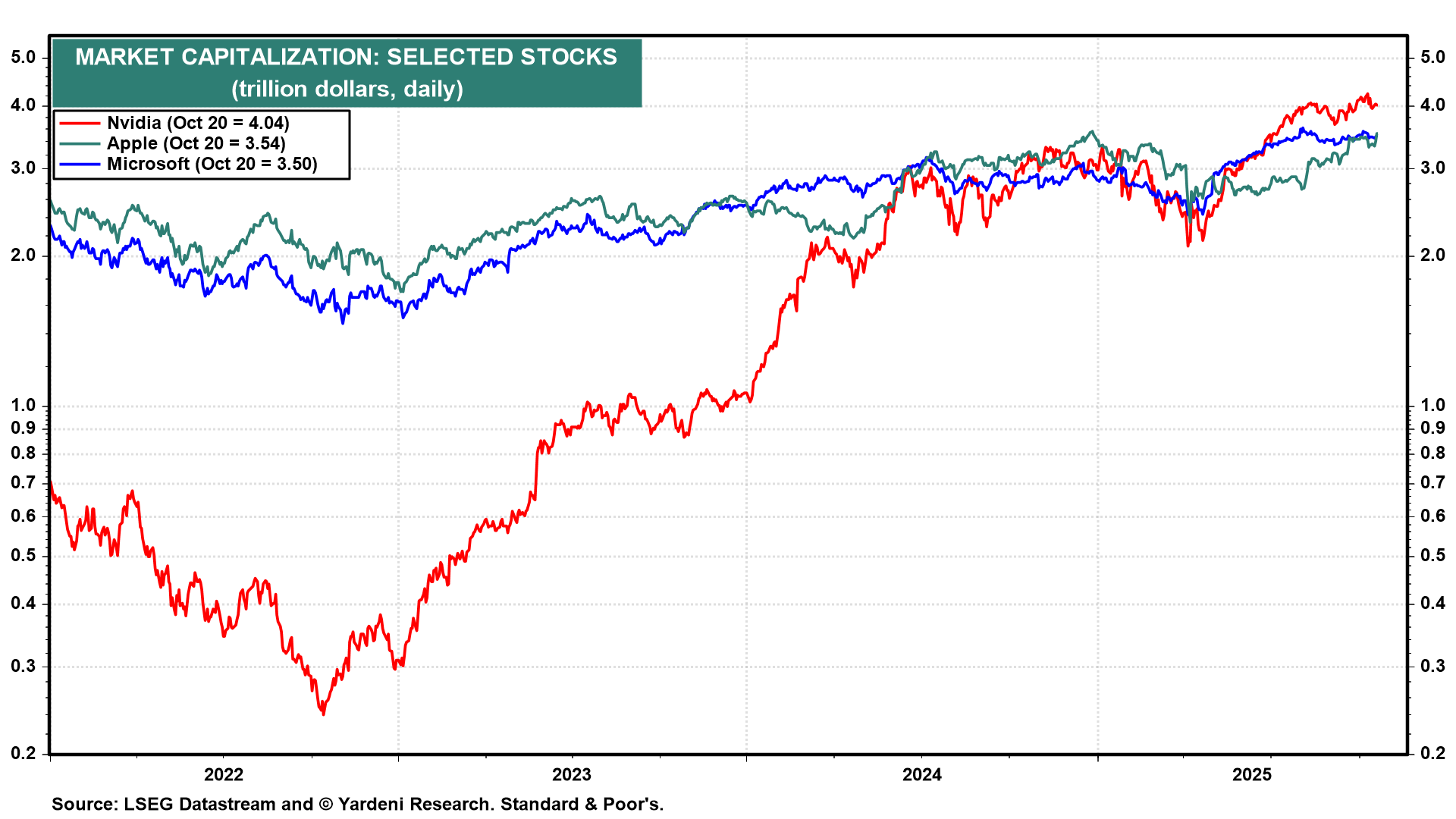

Apple's stock price hit a new record high today on a report that sales of this year's iPhone models had started strongly. Shares of the tech giant climbed 3.9%, closing at $262.24 and helping the company surpass Microsoft to become the second largest in the US by market capitalization (chart). Only Nvidia is larger. That helped to lift the S&P 500 by 1.1%. The recent sharp drop in the index on October 10 in response to President Donald Trump's threat to impose an additional 100% tariff on China and the October 16 decline on regional bank worries have been almost completely reversed. The S&P 500 is only 0.3% below its October 8 record high.

Last Thursday's concerns about more cockroaches in the credit markets have been overcome by strong Q3 earnings reports from the big banks, falling oil prices, and expectations of another Fed rate cut on October 29. A growing glut of oil and fear of a global economic slowdown have pushed US West Texas Intermediate crude prices to their lowest point since fuel markets were rebounding from the Covid crash (chart). That will help push headline consumer inflation rates down and boost consumers' purchasing power.