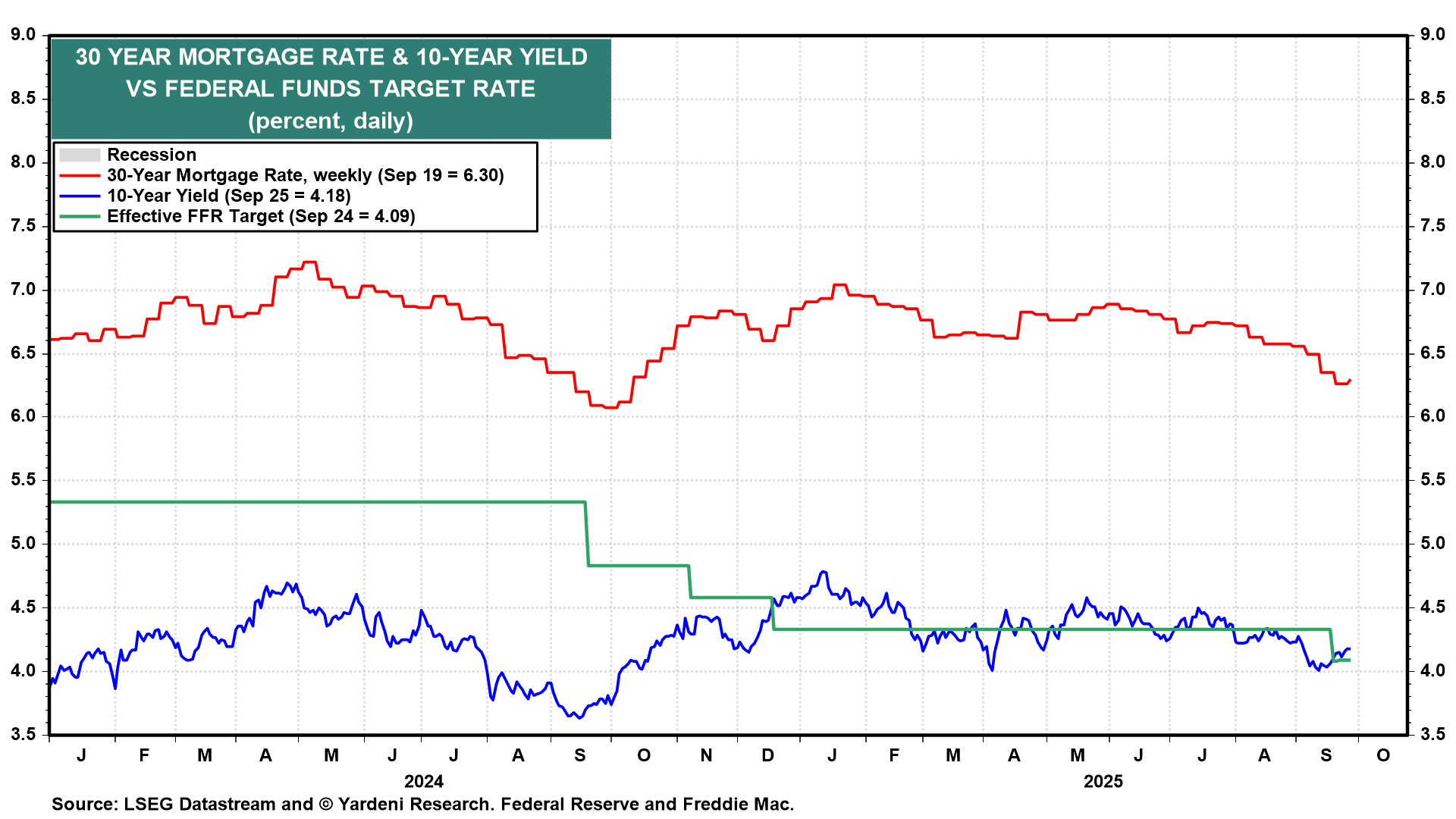

The Fed just won't listen to us. Last year, we warned Fed officials not to cut the federal funds rate (FFR) because we had more confidence in the economy than they did. We also observed that inflation remained above their 2.0% inflation target. We predicted that the 10-year Treasury bond yield and mortgage rates would likely rise rather than fall if the Fed lowered the FFR. They ignored us last year and proceeded to cut the FFR by 100bps between September 18 and December 18. However, the bond yield rose by 100bps (chart).

This year could be déjà vu all over again. The Fed ignored us again and cut the FFR by 25bps last Wednesday. Once again, the bond yield rose from 4.00% to 4.18% today. The Bond Vigilantes are getting restless!

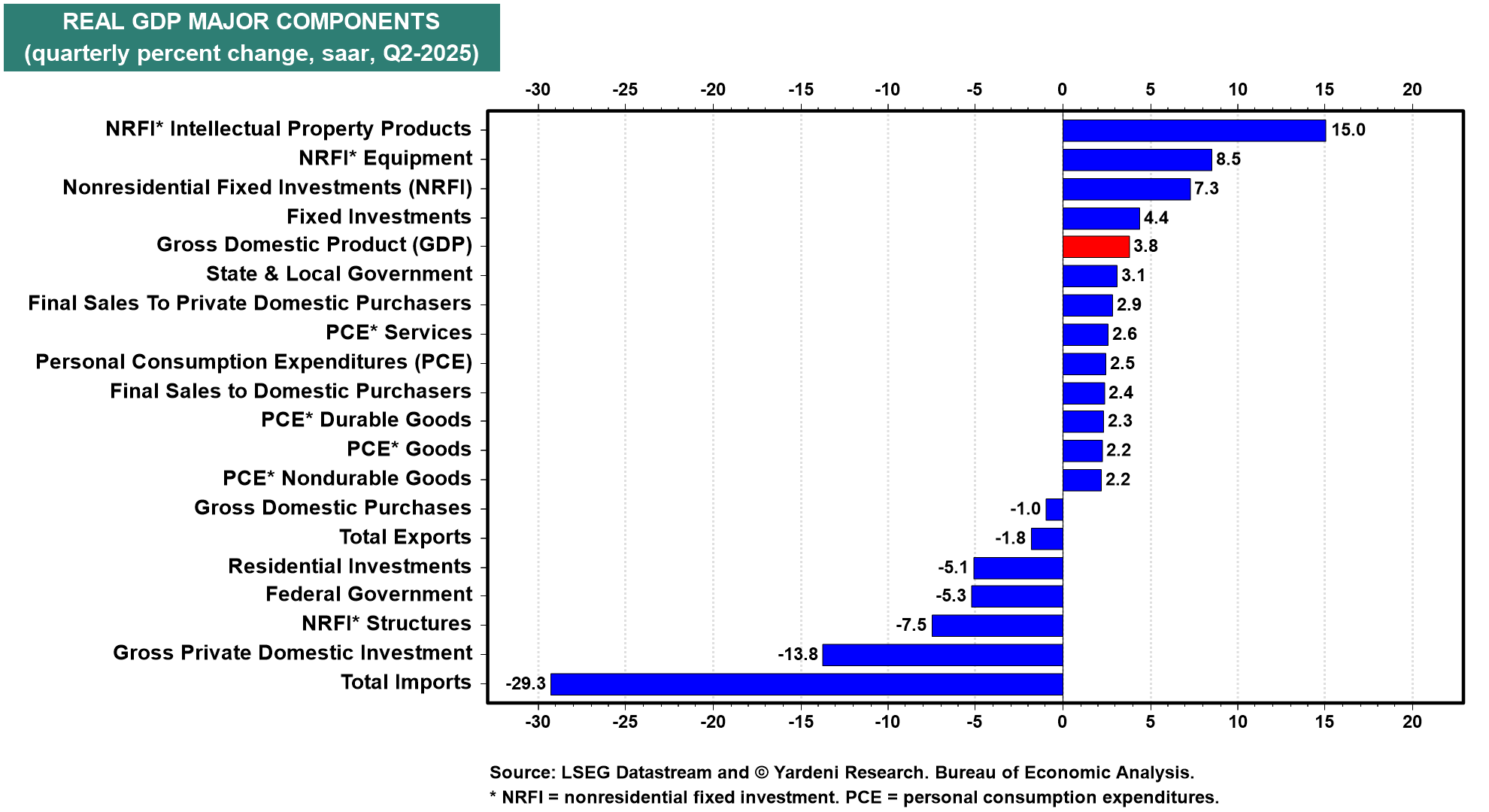

Today's revision to Q2's real GDP growth rate, from 3.3% (saar) to 3.8%, confirms that the economy is in excellent shape (chart). Real consumer spending was revised up significantly from 1.6% to 2.5%.

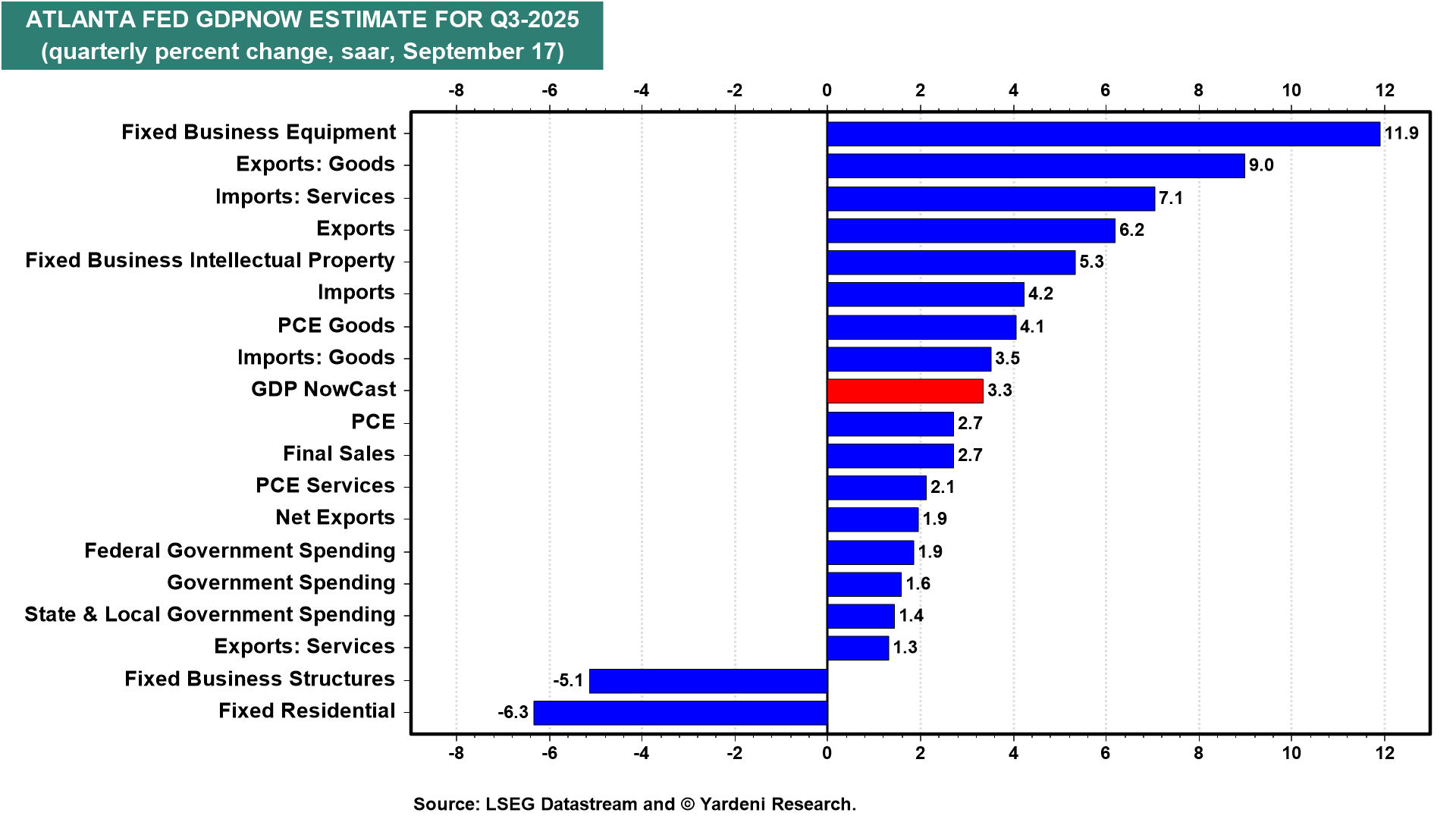

The current quarter's growth rate is tracking at 3.3%, according to the Atlanta Fed's GDPNow tracking model (chart).

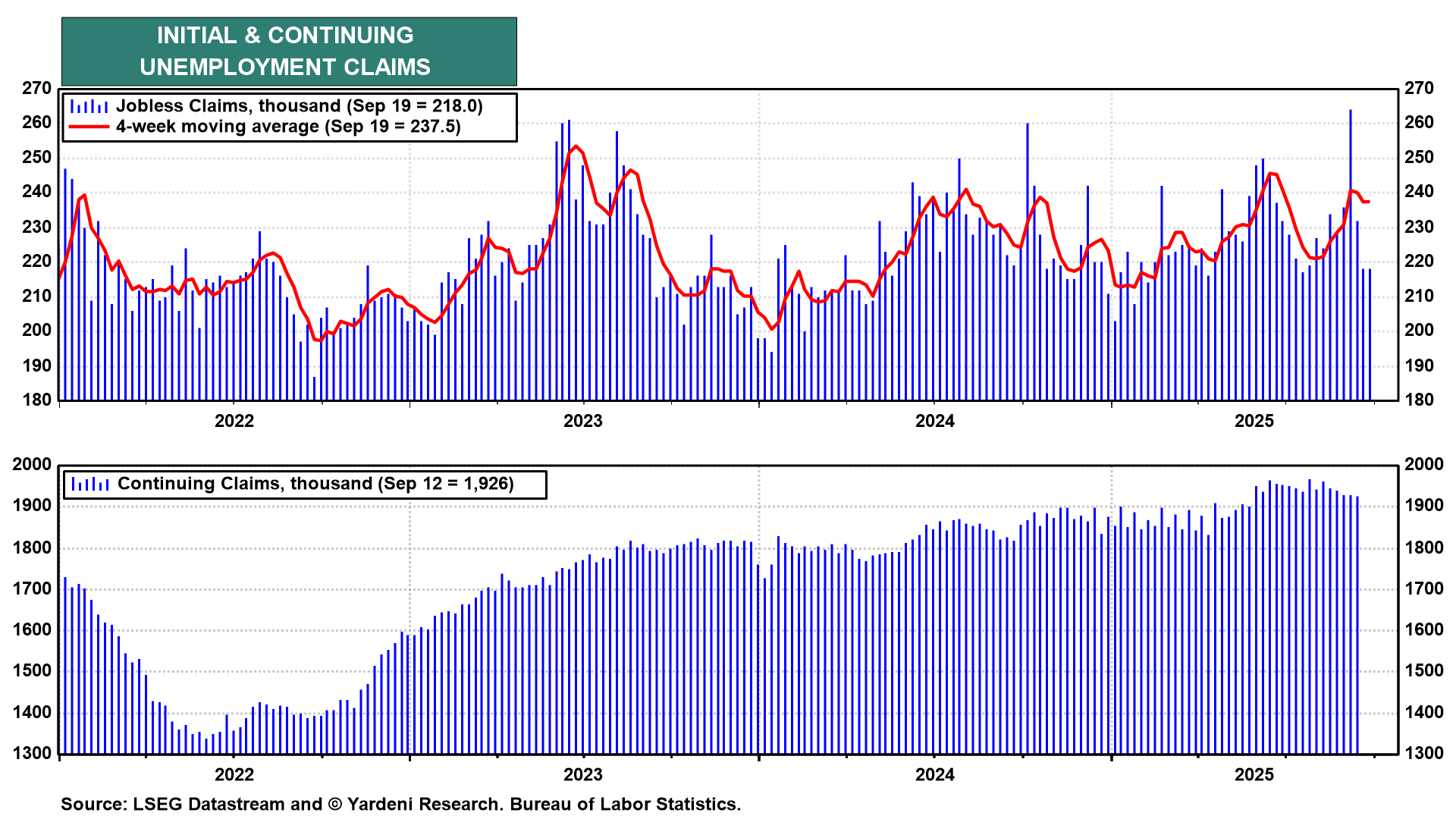

Of course, the Fed lowered the FFR last week in response to weak payroll employment data, including a significant downward benchmark revision. However, today's initial unemployment claims report suggested that layoffs remain very low (chart).

The upward revision in real GDP and the downward revision in employment suggest that productivity growth will be revised higher. The Fed lowered the FFR last week to revive demand, which doesn't need reviving given the strength of real GDP growth during Q2 and Q3. The weakness in the labor market is likely structural, with several factors depressing the supply of workers, and AI possibly weakening the demand for entry-level employees.

The Fed's easing is unlikely to fix the structural problems plaguing the labor market. Demand for goods and services doesn't need to be stimulated, but by doing so, the Fed risks boosting inflation and bond yields, and increasing the risk of financial instability, including a possible meltup in the stock market followed by a meltdown.

We propose that monetary policy be outsourced. We'd like to reiterate our previous offer to do what the Fed does for half the price.