Now that the government shutdown is over, the Bureau of Labor Statistics (BLS) is releasing economic indicators again. However, the quality of the latest releases is an issue. Today's lower-than-expected November CPI inflation report boosted stock and bond prices after its release. But the gains faded as economists started to question the CPI numbers. Indeed, the release included a warning that the government shutdown might have distorted the BLS's efforts to collect the CPI data.

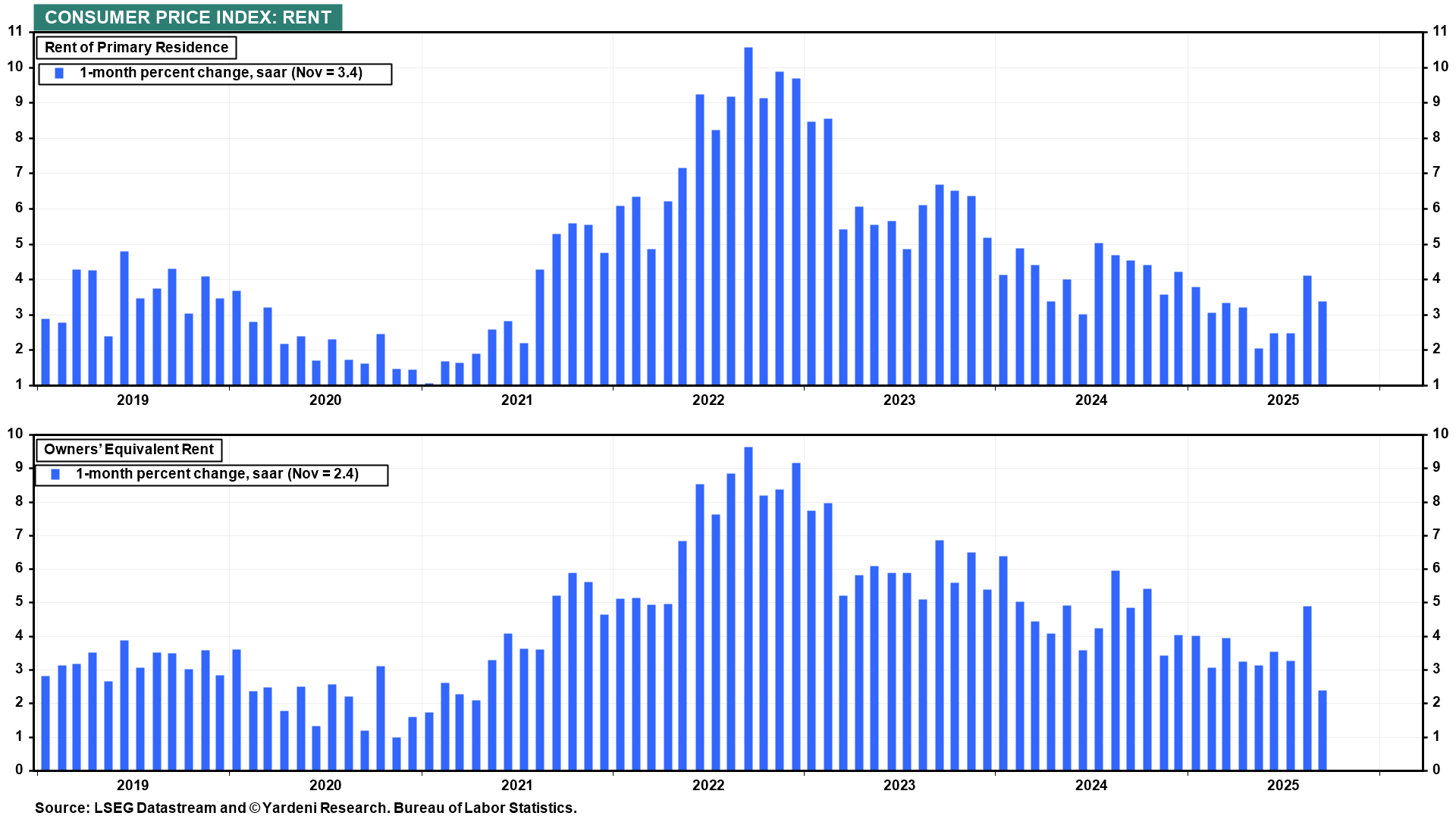

BLS calculates rent and owners' equivalent rent using a six-month panel collection. October's missing CPI data may have distorted the latest inflation report (chart).

The BLS started the CPI data collection on Friday, November 14. By authorizing additional collection hours, BLS attempted to collect data for the entire month of November. However, the survey may have been heavily weighted toward data collected near the end of the month, when holiday discounts depressed durable-goods prices (chart).

At his press conference on December 10, Fed Chair Jerome Powell claimed that the Fed cut the federal funds rate again by 25bps because the BLS is overstating payroll employment: "Payroll jobs [have been] averaging 40,000 per month since April. We think there's an overstatement in these numbers by about 60,000. So that would be negative 20,000 per month."

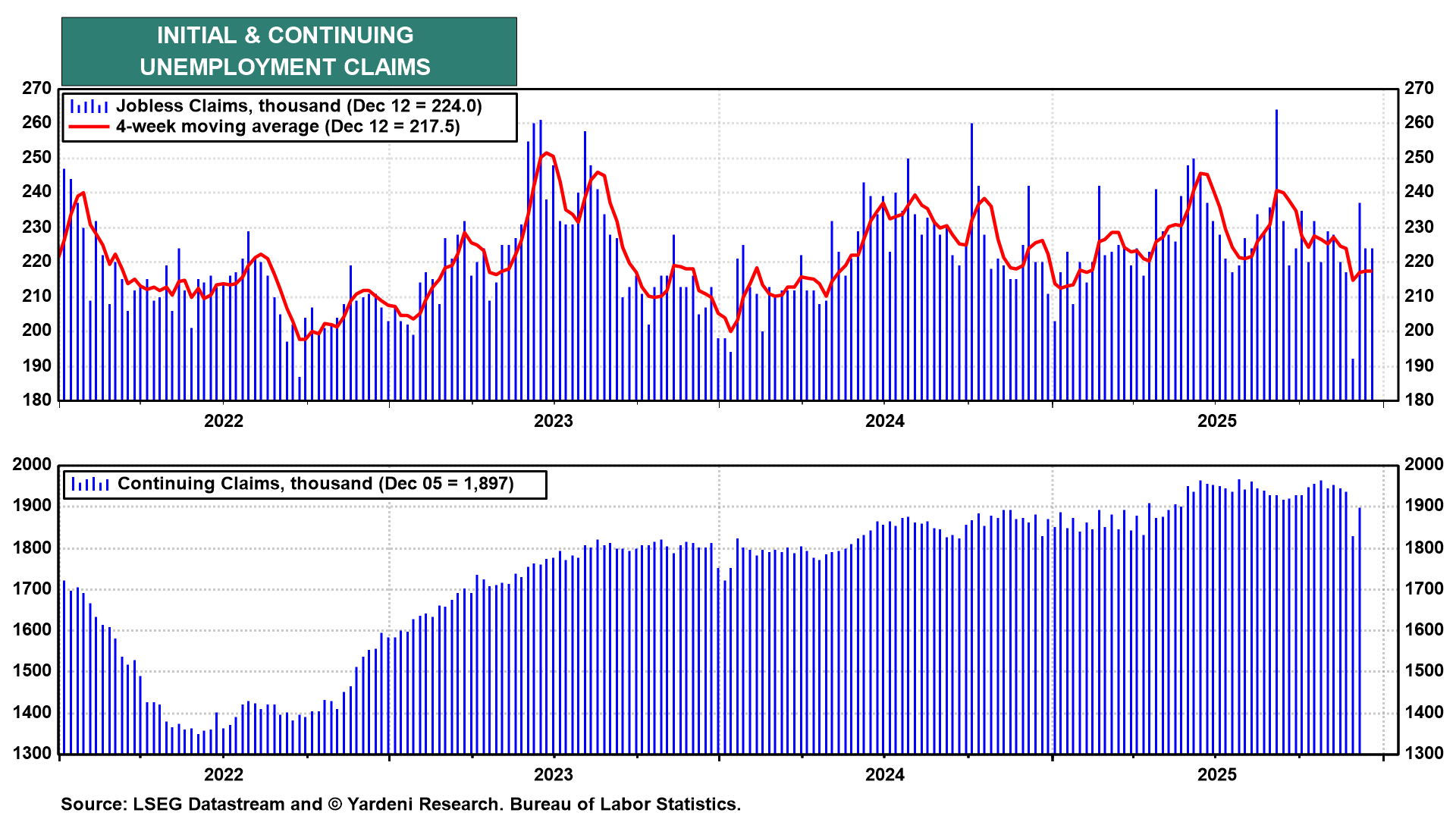

The BLS data in the weekly unemployment claims report appear to remain reliable, though they were distorted during the Thanksgiving holiday (chart). Initial unemployment claims remain low, confirming that layoffs remain low. Continuing unemployment claims suggest that the duration of unemployment declined in late November, although the series was likely distorted by the holiday as well.

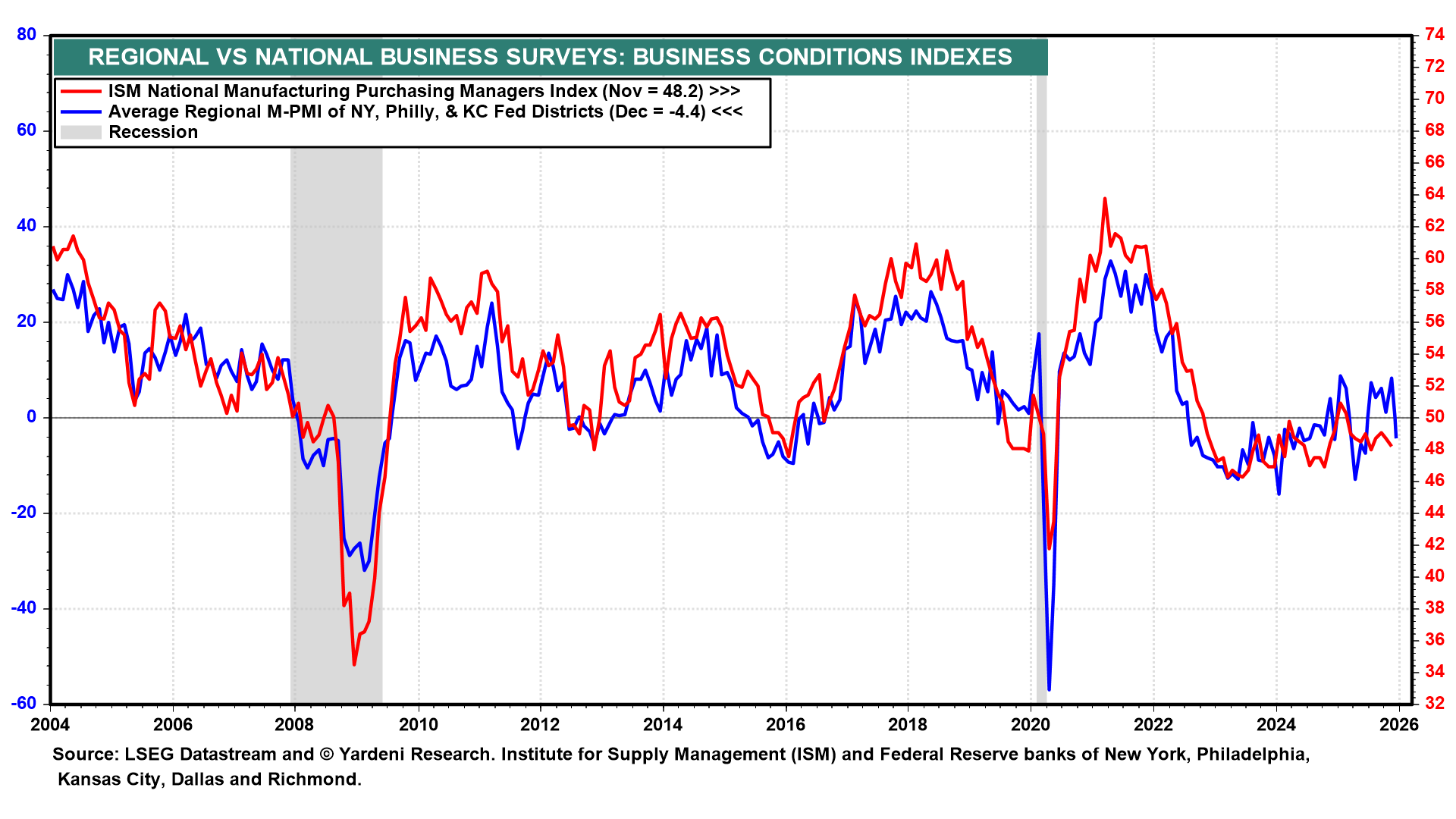

Another questionable data source is the monthly business surveys conducted by five of the regional Federal Reserve Banks. The three available ones for November suggest that the national M-PMI remains weak. That's probably correct. However, both the regional and national business surveys have been much weaker than the growth in real GDP for both goods and services.

We've shared this advice with you many times before: Any data that supports our outlook is good data. Any data that doesn't do so is bad, or it will be revised to support our story.

Most of Yardeni Research will be on break for the next two weeks. However, QuickTakes will continue to appear as the government releases more (questionable) data.

Happy holidays!