Mistletoe is relevant to several cultures. In the advent of the Christian era, mistletoe in the Western world became associated with Christmas as a decoration under which lovers are expected to kiss, as well as with protection from witches and demons. Let's hope its magic lasts into 2026 through next Christmas.

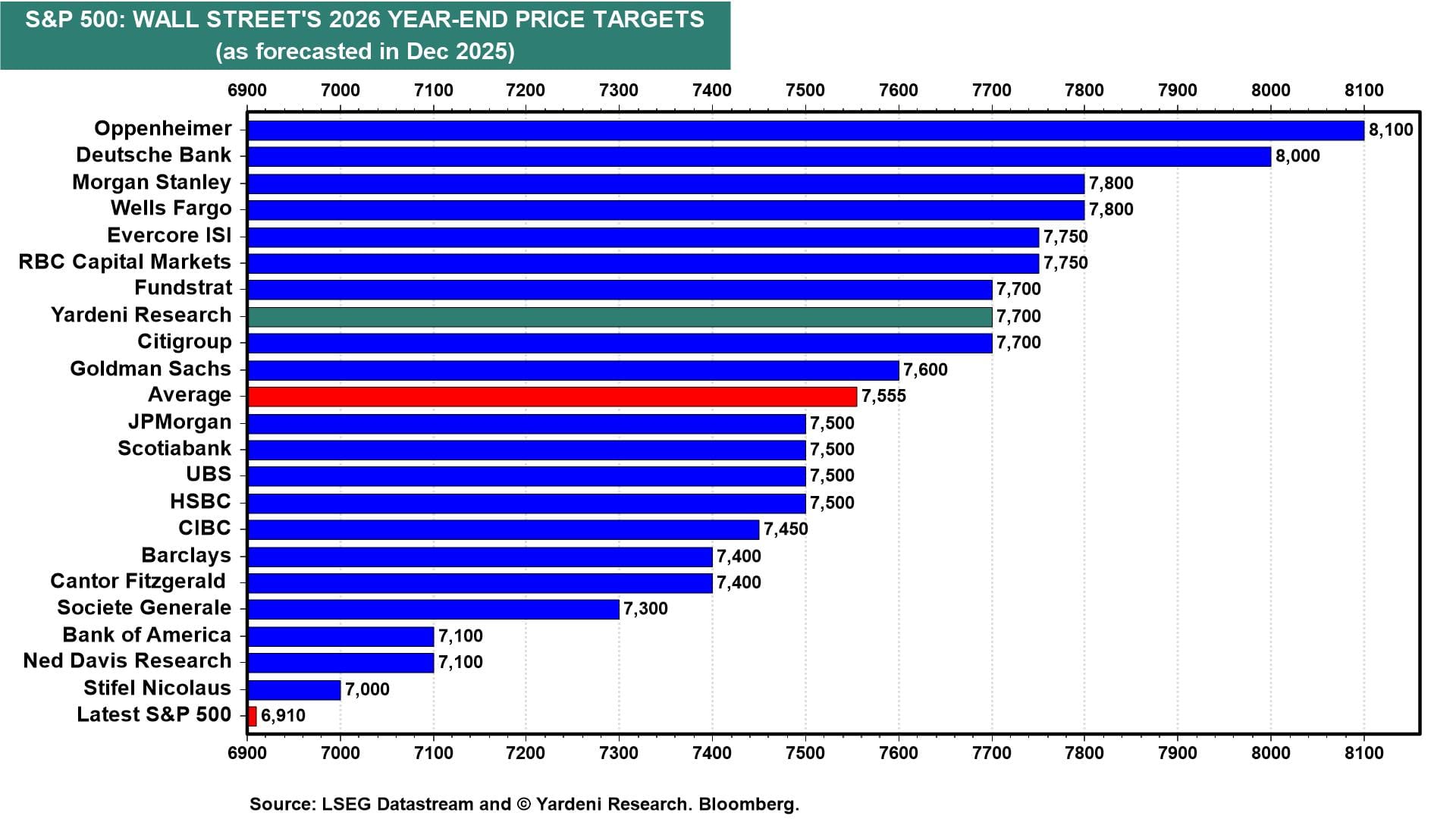

The consensus among Wall Street investment strategists is that the magic will last. According to Bloomberg, their average estimate for the S&P 500 by the end of next year is 7,555 with a low of 7,000 and a high of 8,100 (chart). That average is 9.0% above today's close. Our forecast of 7,700 would be up 11%. However, the first half of 2026 could see a correction if bond yields rise significantly, given mounting concerns that monetary and fiscal policies might be overly stimulative.

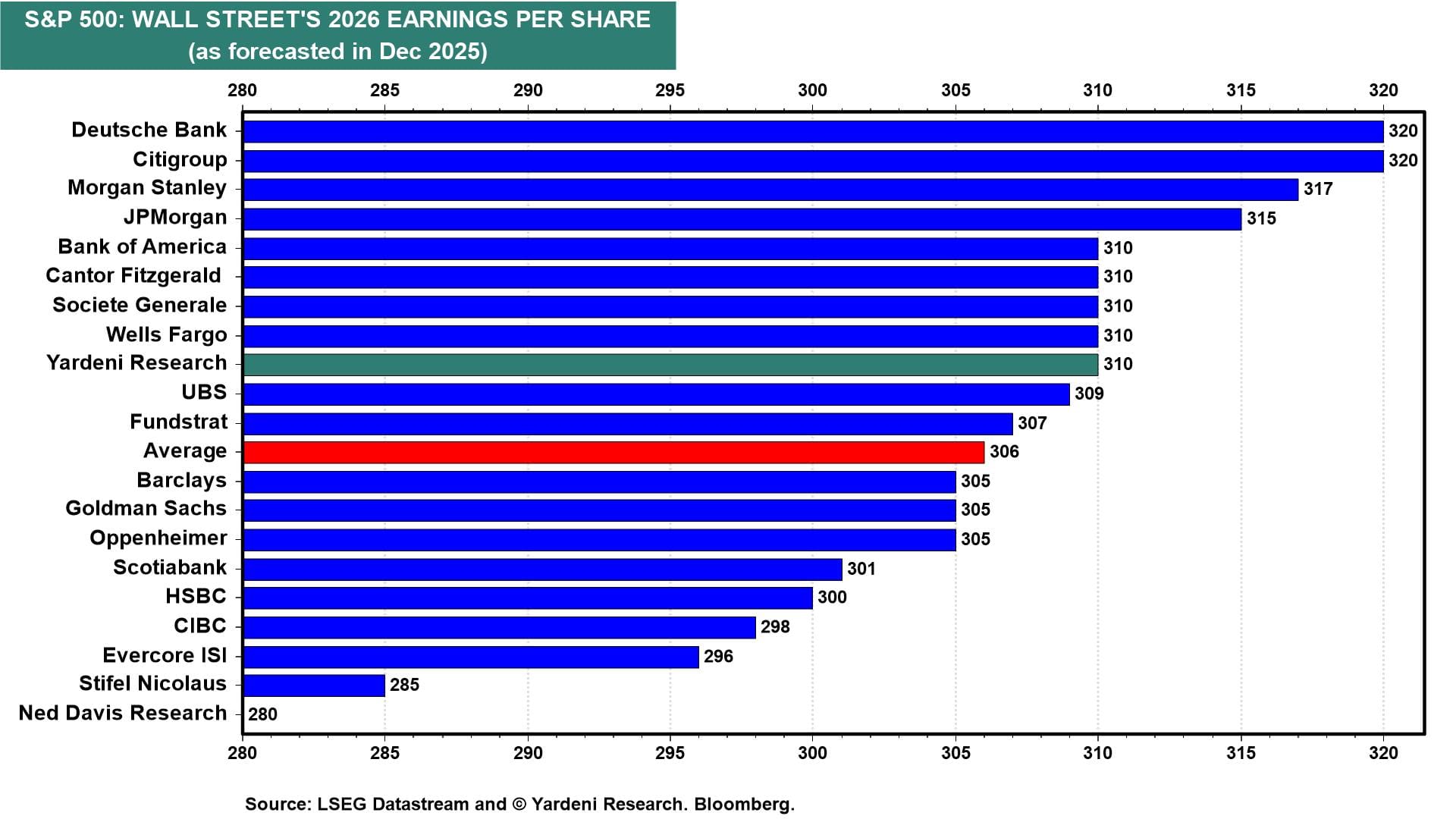

Strategists expect S&P 500 earnings per share to be $306, on average, in 2026 (chart). That would be up 12.5% from the current analysts' consensus estimate of $272. We are close to the consensus at $310. We expect the valuation multiple won't be much lower by the end of 2026 than the current forward P/E of about 22.0.

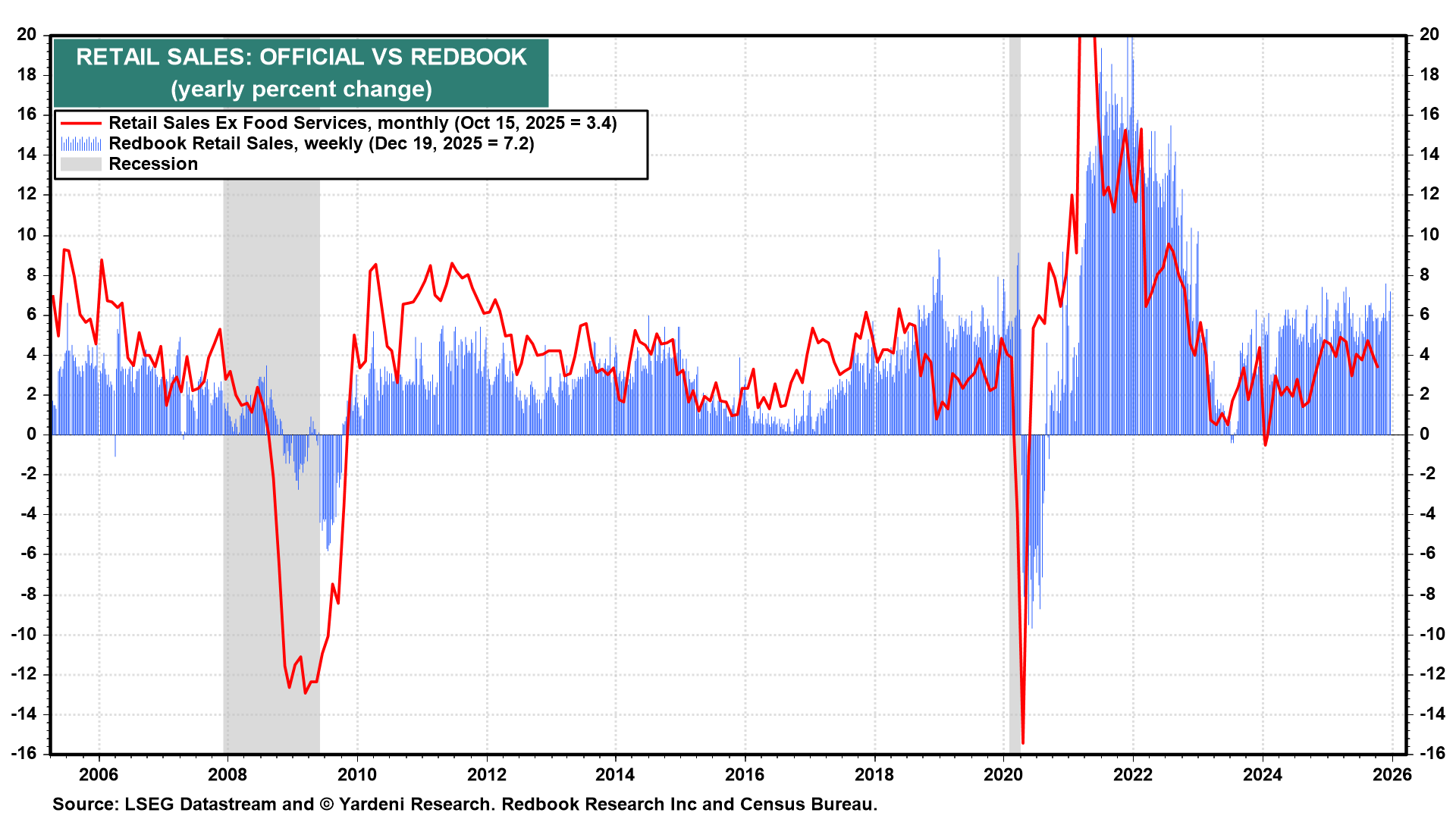

The year is ending on a positive note with an upbeat batch of economic indicators. Real GDP jumped 4.3% to a new record high during Q3. Corporate profits also hit a new record high during Q3. The Redbook Retail Sales Index increased 7.2% y/y during the week of December 19 (chart).

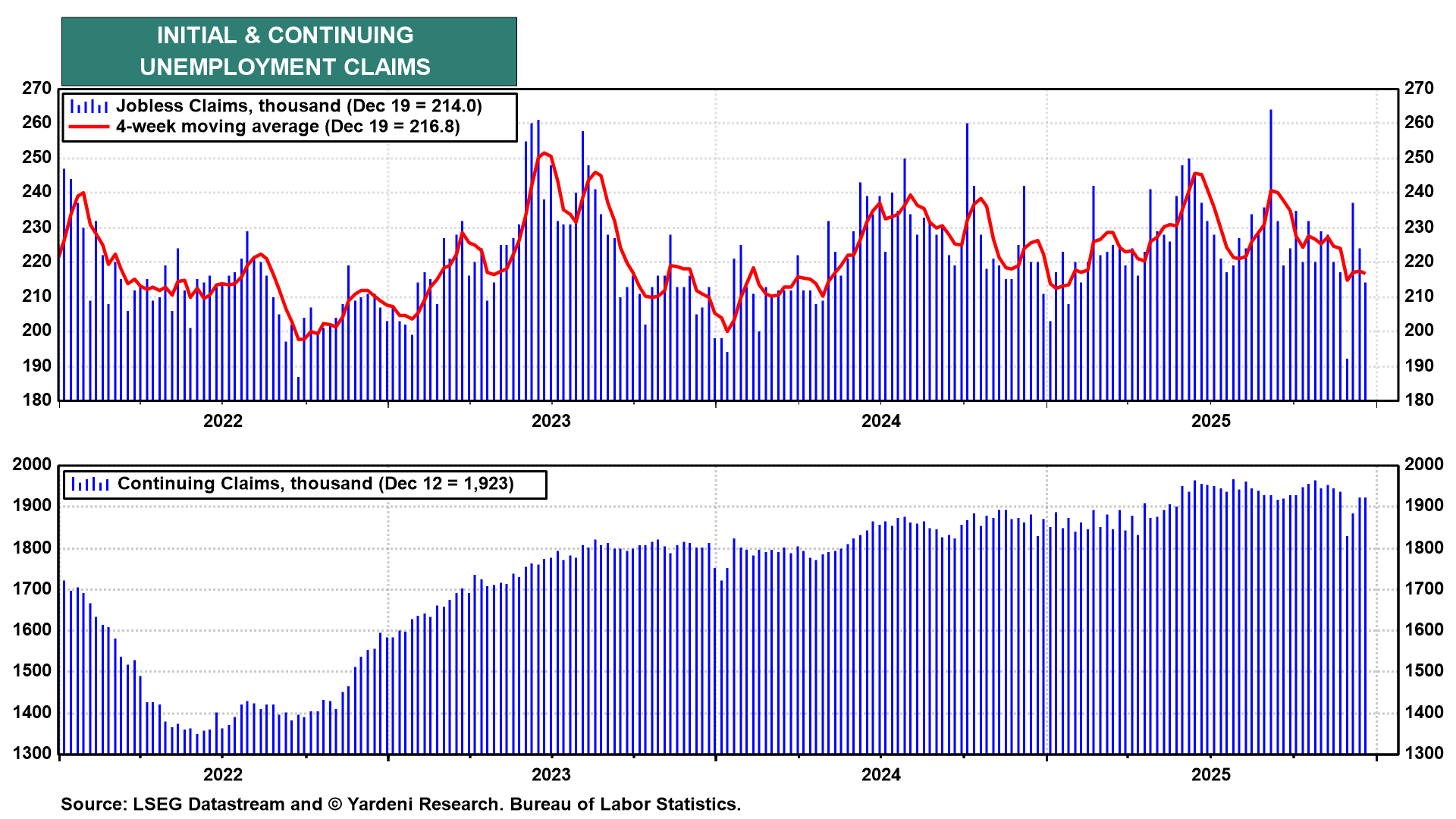

Initial unemployment claims dropped by 10,000 to 214,000 during the week of December 19, suggesting that layoffs remain subdued. Economists had forecast 224,000. Continuing claims edged up to 1.92 million, suggesting more workers are staying on jobless benefits.

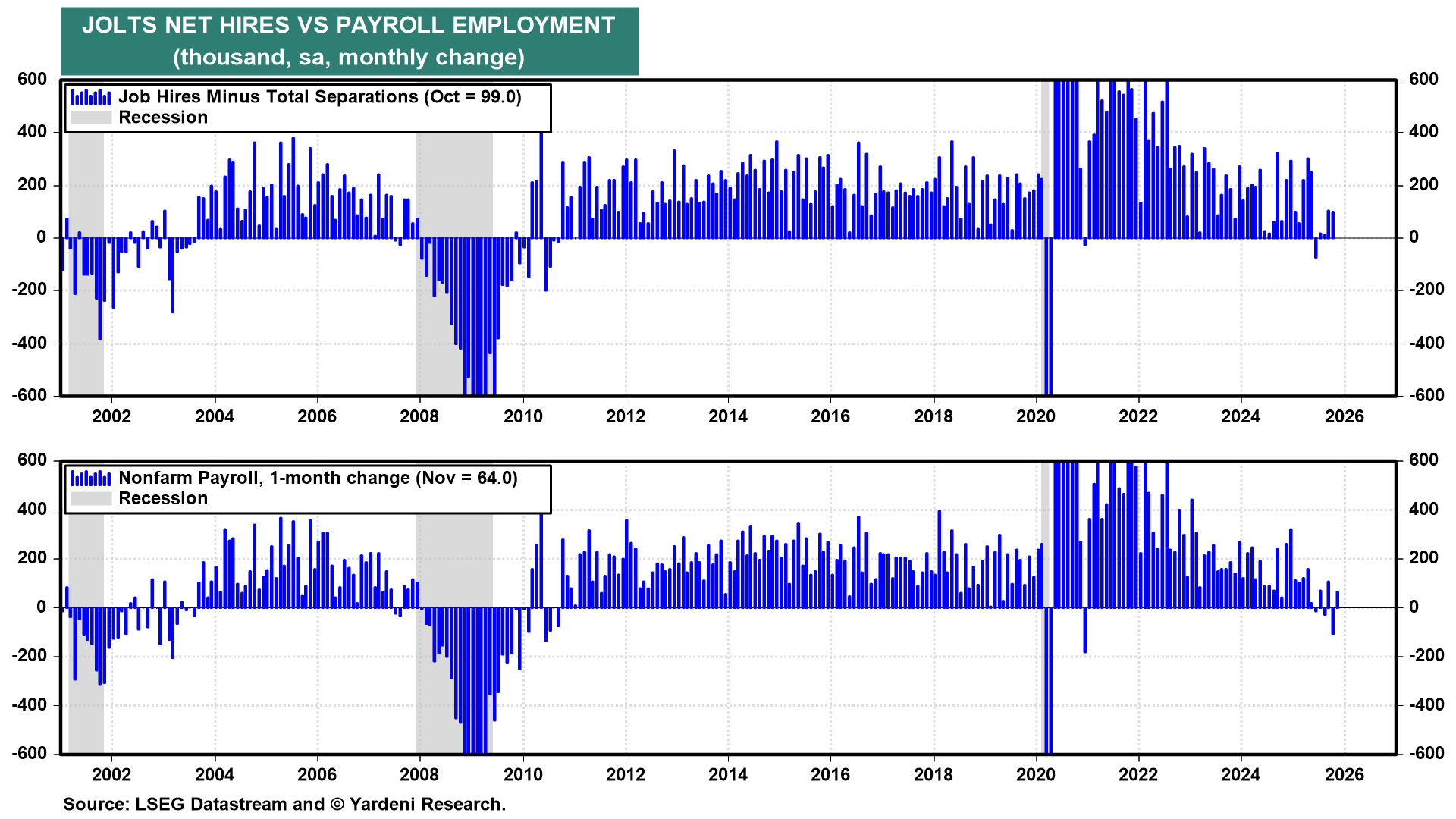

In the new year, we will compare the official BLS payroll employment series with a similar series derived by subtracting JOLTS total separations (including quits and layoffs) from hires (chart). The latter measure has been less volatile recently and has been showing more gains than the former over the past couple of months.

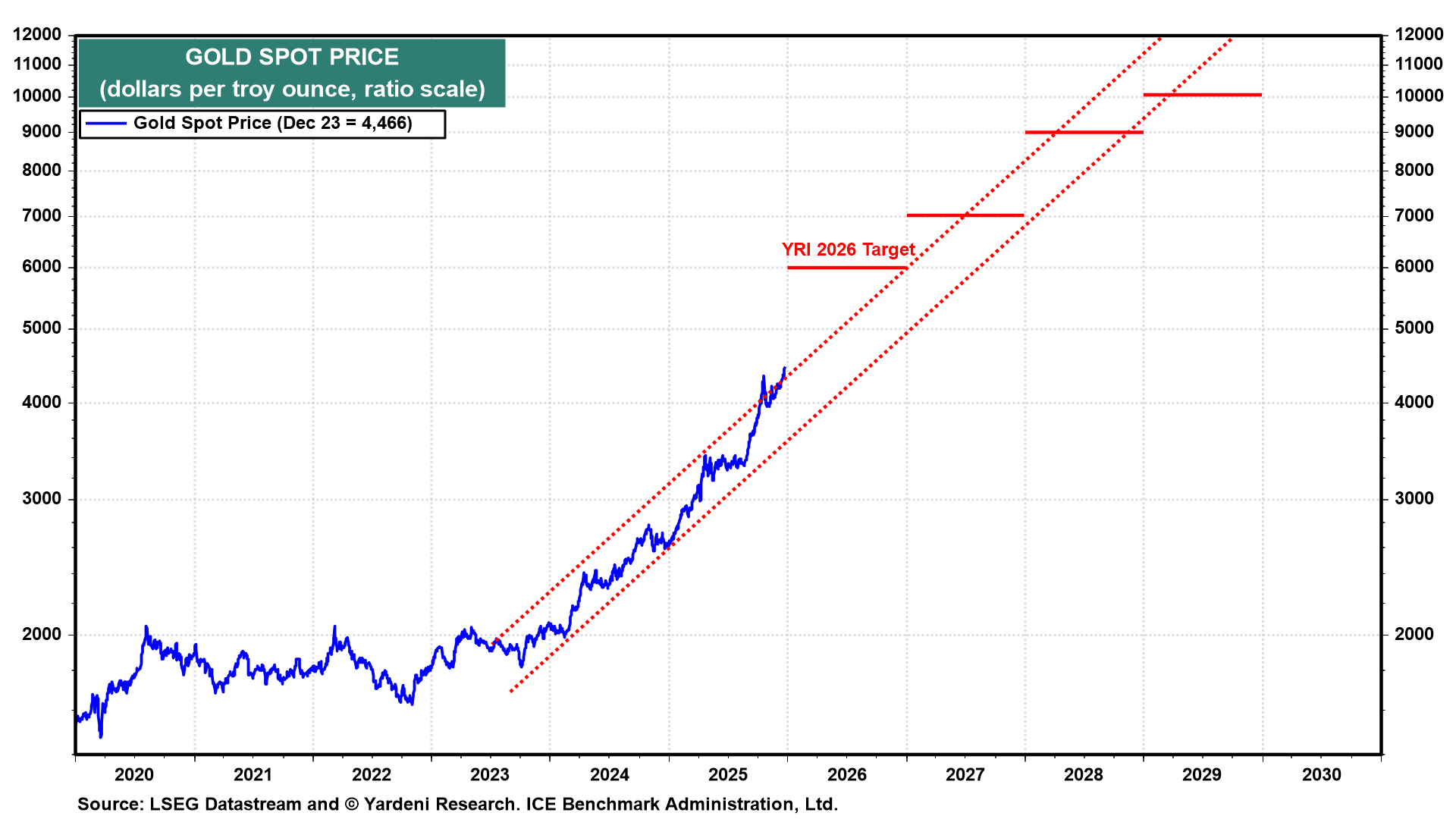

Correction: Monday's QT text about precious metals was correct. We updated the following chart to align with our new target of $6,000 per ounce for gold at the end of 2026. That's up from our previous target of $5000.

All of us at Yardeni Research wish you a Merry Christmas and a Healthy and Happy New Year!