Earlier this year, US Treasury Secretary Scott Bessent said that he and President Donald Trump were focusing on the 10-year Treasury bond yield as a key metric for economic health, rather than the Fed's short-term interest rate. He stated, "He and I are focused on the 10-year Treasury," indicating a strategy to manage borrowing costs through fiscal policy rather than pressuring the Fed to cut rates. That didn't last long. Within a few weeks, Trump started badgering Powell to lower the federal funds rate.

Today, Fed Chair Jerome Powell poked a stick at the White House. He suggested that bond yields might stay elevated as a result of more frequent "supply shocks," like tariffs. "Higher real rates may also reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the 2010s," Powell said in prepared remarks for the Thomas Laubach Research Conference in Washington, D.C. "We may be entering a period of more frequent, and potentially more persistent, supply shocks—a difficult challenge for the economy and for central banks."

Sounds like Powell is expecting more frequent bouts of stagflation, which was associated with supply shocks in the past. The stock and bond markets didn't react much to the speech partly because today's batch of indicators were mostly ambiguous about the near-term prospects for stagflation. Consider the following:

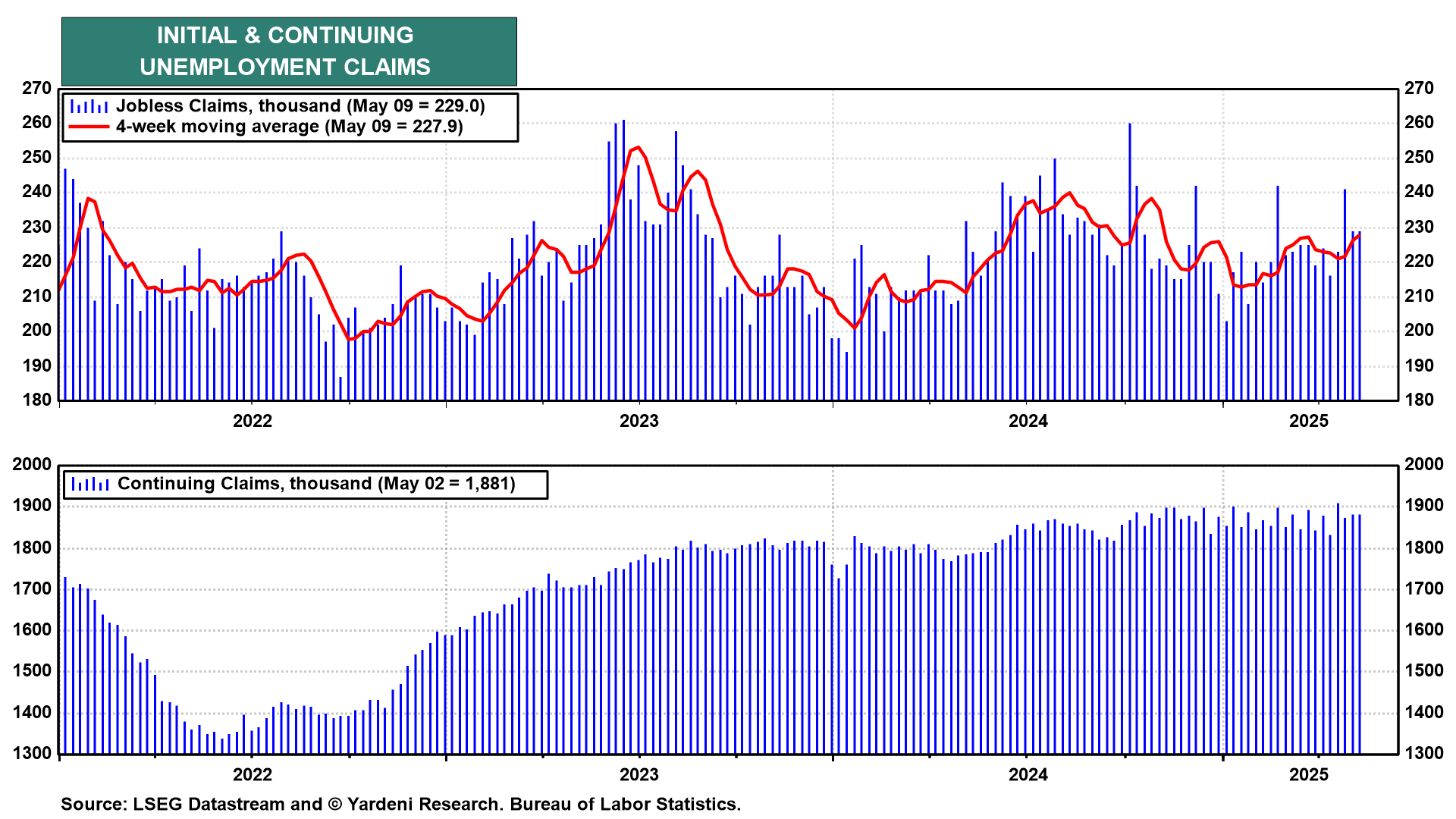

(1) Jobless claims remain in a 205,000-243,000 range, one consistent with a historically low level of layoffs. In the week ended May 10, claims held steady at a seasonally adjusted 229,000 (chart). Continuing claims for the week through May 3 increased marginally to 1.88 million compared with 1.87 million a week earlier. Still, even if the tariffs discourage businesses from boosting hiring, we're not seeing a sudden surge in pink slips.

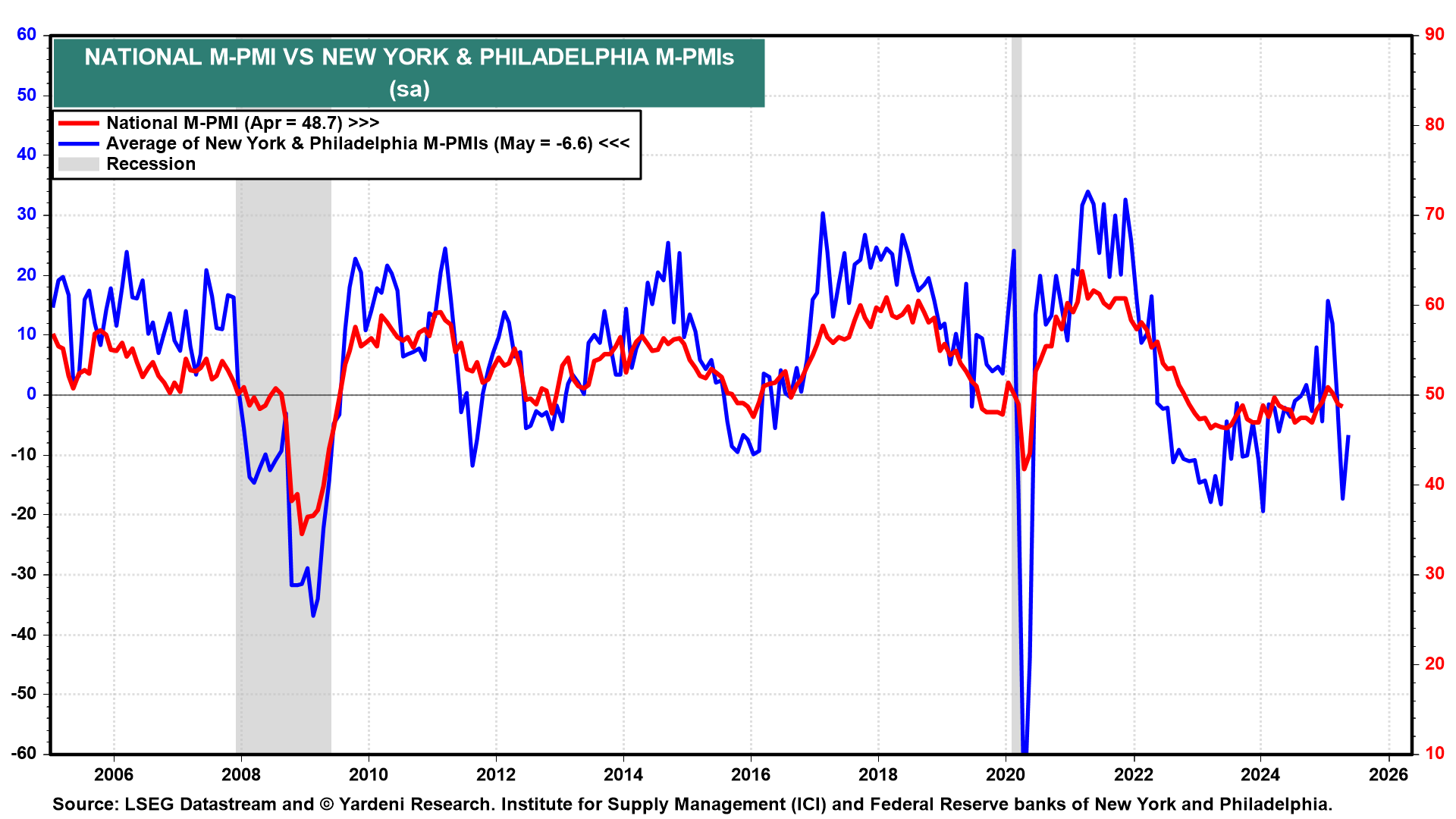

(2) Not surprisingly, manufacturing is showing signs of strain as trade war headwinds increase economic uncertainty. ISM's manufacturing PMI slid slightly to 48.7% in April from 49.0% in March (chart). Clearly, any further movement away from the 50-mark denoting expansion bears watching. But based on the average of the New York and Philadelphia Fed Manufacturing Indexes, which rose in May, the same might happen for the national index. This may be another sign of the resilience of the economy.

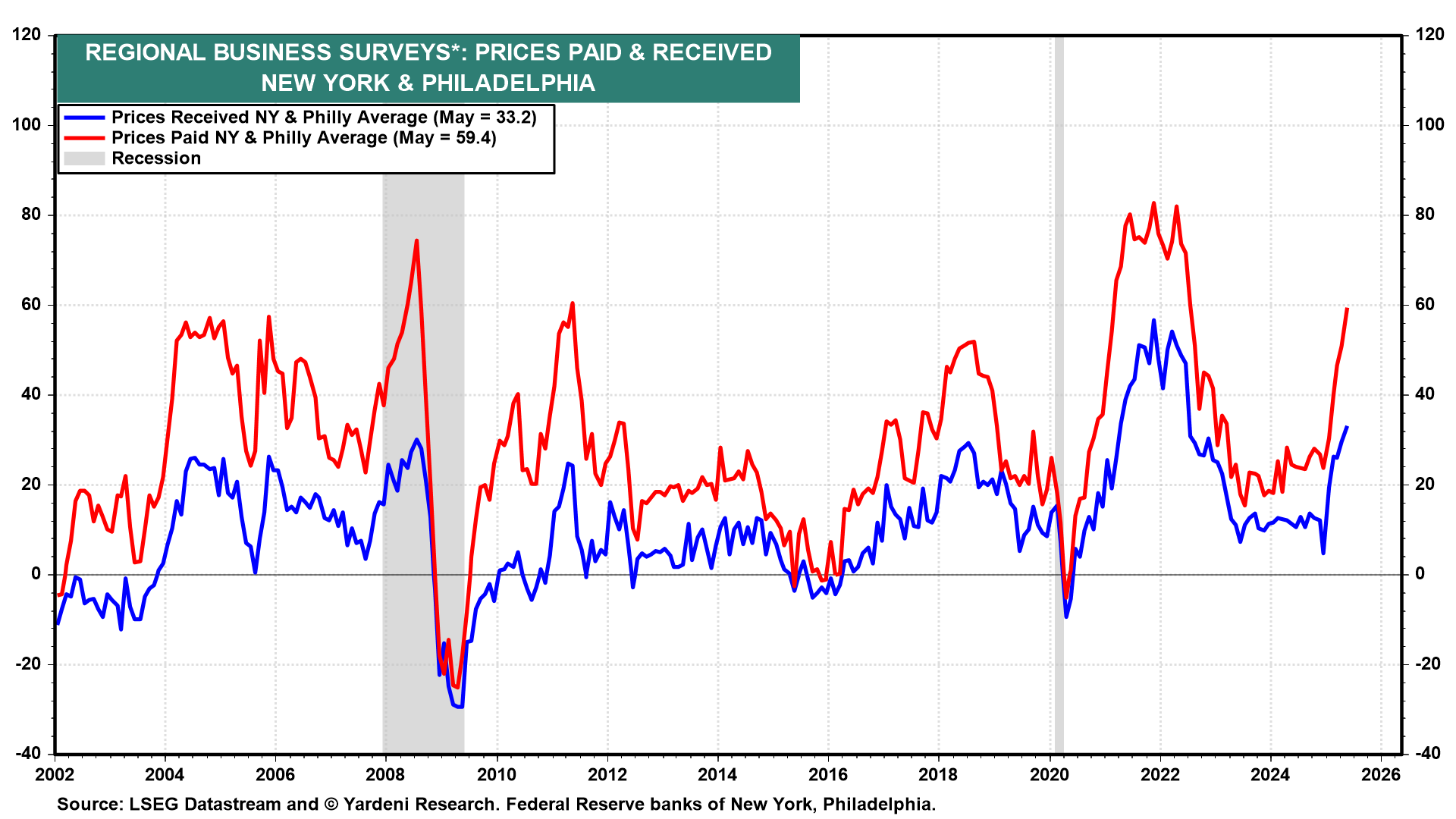

(3) Anyone seeking to make a case for stagflation may find some evidentiary kernels in the latest New York and Philadelphia surveys (chart). Weak energy prices and the de-escalation of the trade war should moderate these inflationary pressures.

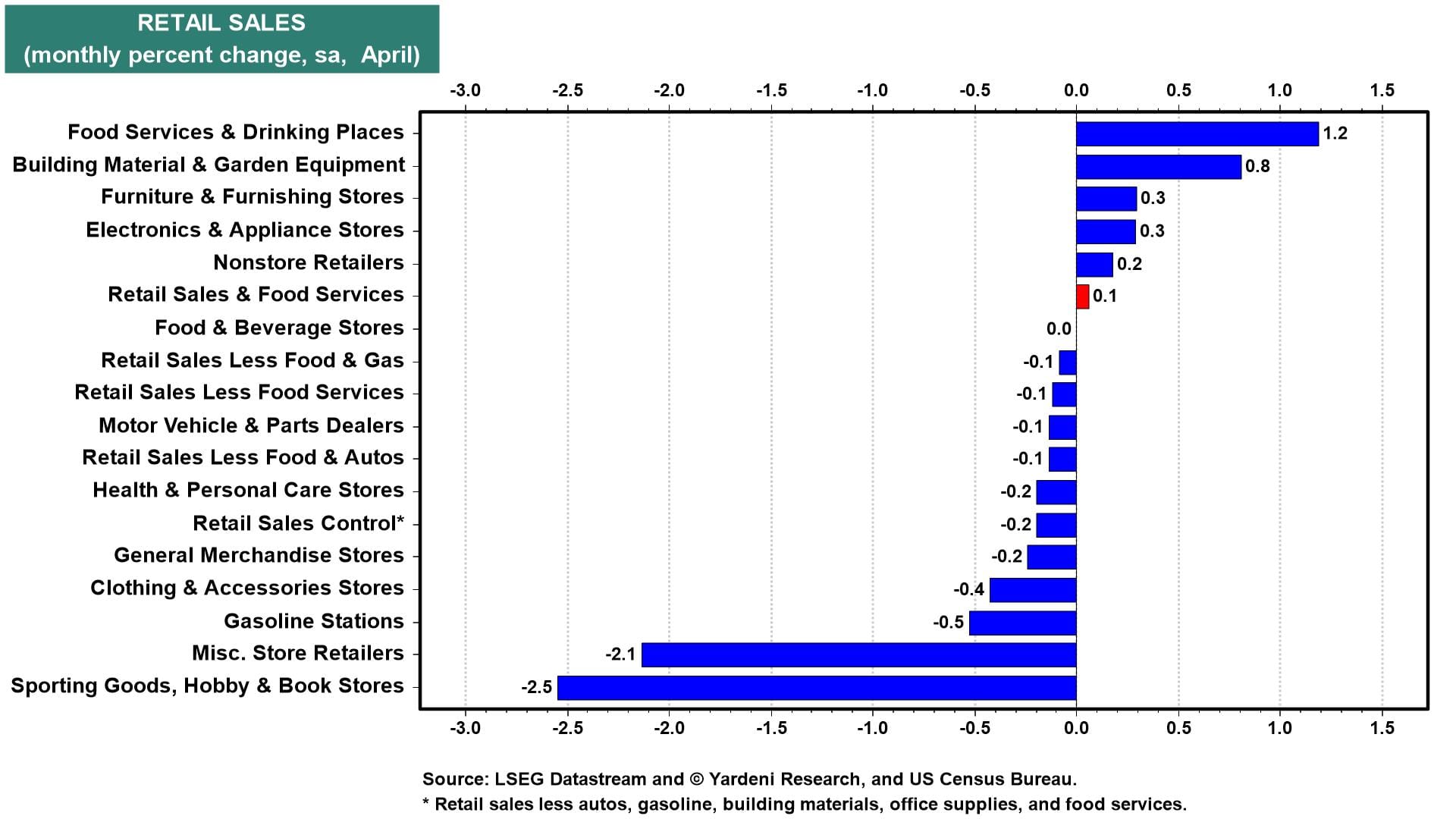

(4) Retail sales rose just 0.1% in April, but that followed a revised 1.7% surge in March. The Atlanta Fed's GDPNow tracking model shows real consumer spending rising 3.7% (saar), up from the previous estimate of 3.3%! Even though polls show US consumers to be in a dark mood, they're still spending away. Brisk business at restaurants and bars, up markedly for two straight months now, shows merrymaking remains in style as the jobs market hangs in there.

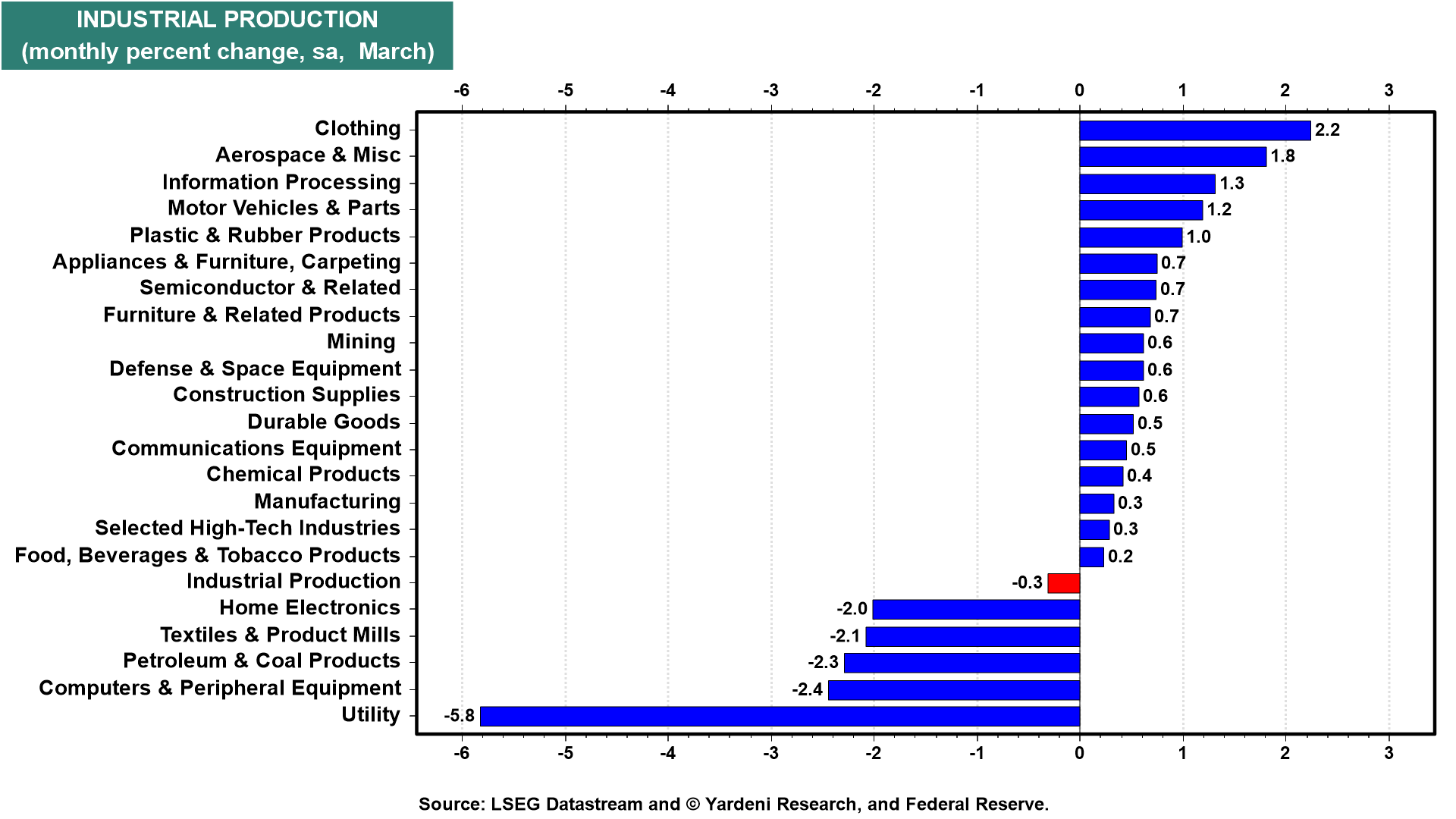

(5) Factory output, meanwhile, is slowing but hardly cratering. The Fed's latest data show industrial production was flat in April, following a 0.3% drop in March (chart). There was a big drop in utilities output, while manufacturing output rose 0.3%.

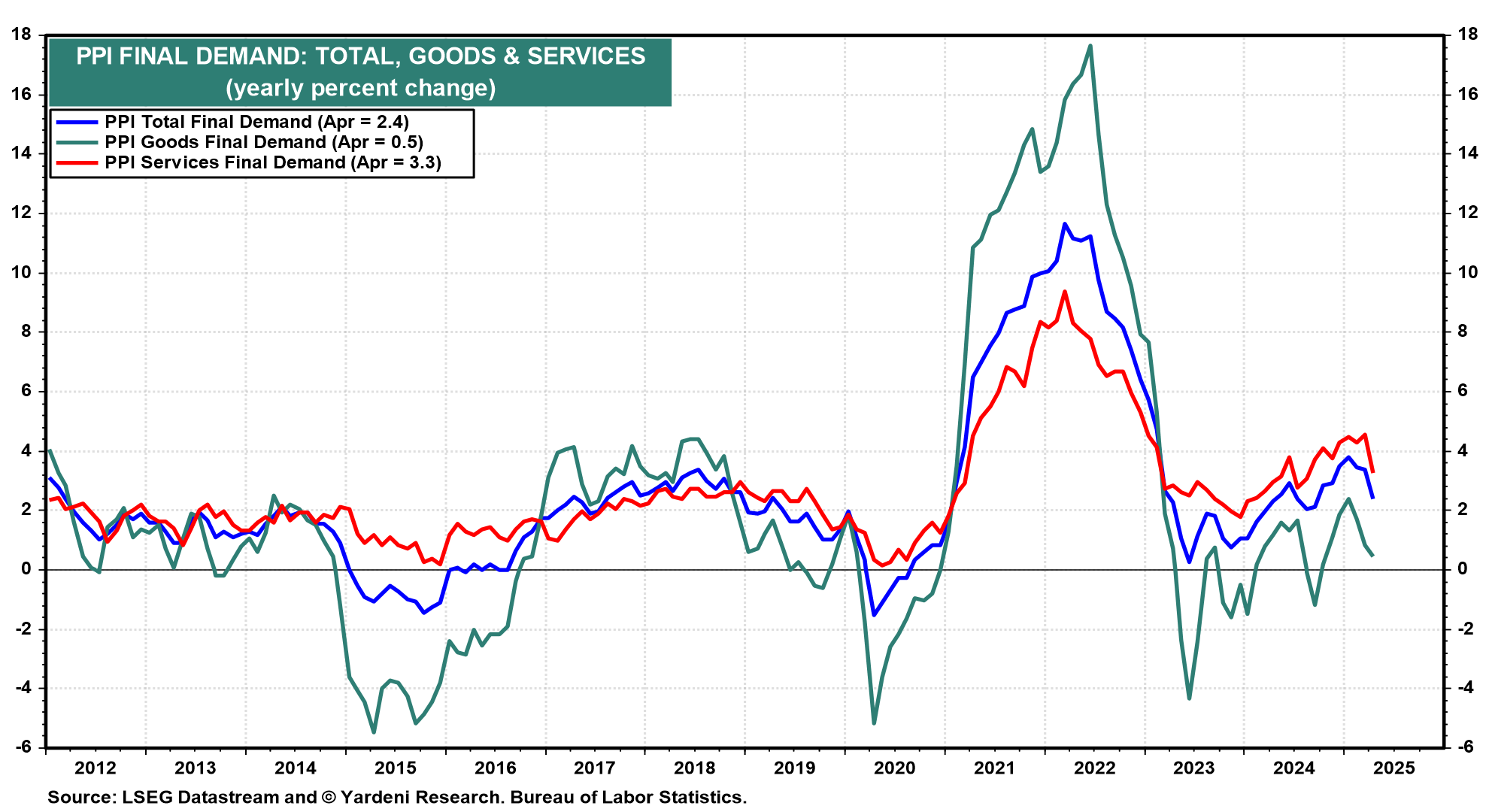

(6) Despite a few signs of "stag," the "flation" part of where the US is headed seems murkier with each data series. Case in point: the unexpected 0.5% drop in the April producer price index following no change in March. Importantly, the PPI for final demand rose a less-than-expected 2.4% year-over-year, slower than 2.7% in March (chart). Light at the end of the inflationary tunnel? So far, the signs seem good though Trump's on-and-postponed tariffs could lift inflation over the next few months before it moderates again later this year.