Tuesday's CPI and today's PPI for January were higher than expected. Thursday's retail sales and today's housing starts for last month were both weaker than expected. The new year is starting with hotter inflation and colder economic growth.

Nevertheless, these hot flashes and chills should be temporary. In our opinion, inflation continues to moderate and the economy remains resilient. The latter forecast is confirmed by today's 2.9% estimate for real GDP growth during Q1 by the Atlanta Fed's GDPNow tracking model. Let's have a closer look at today's numbers:

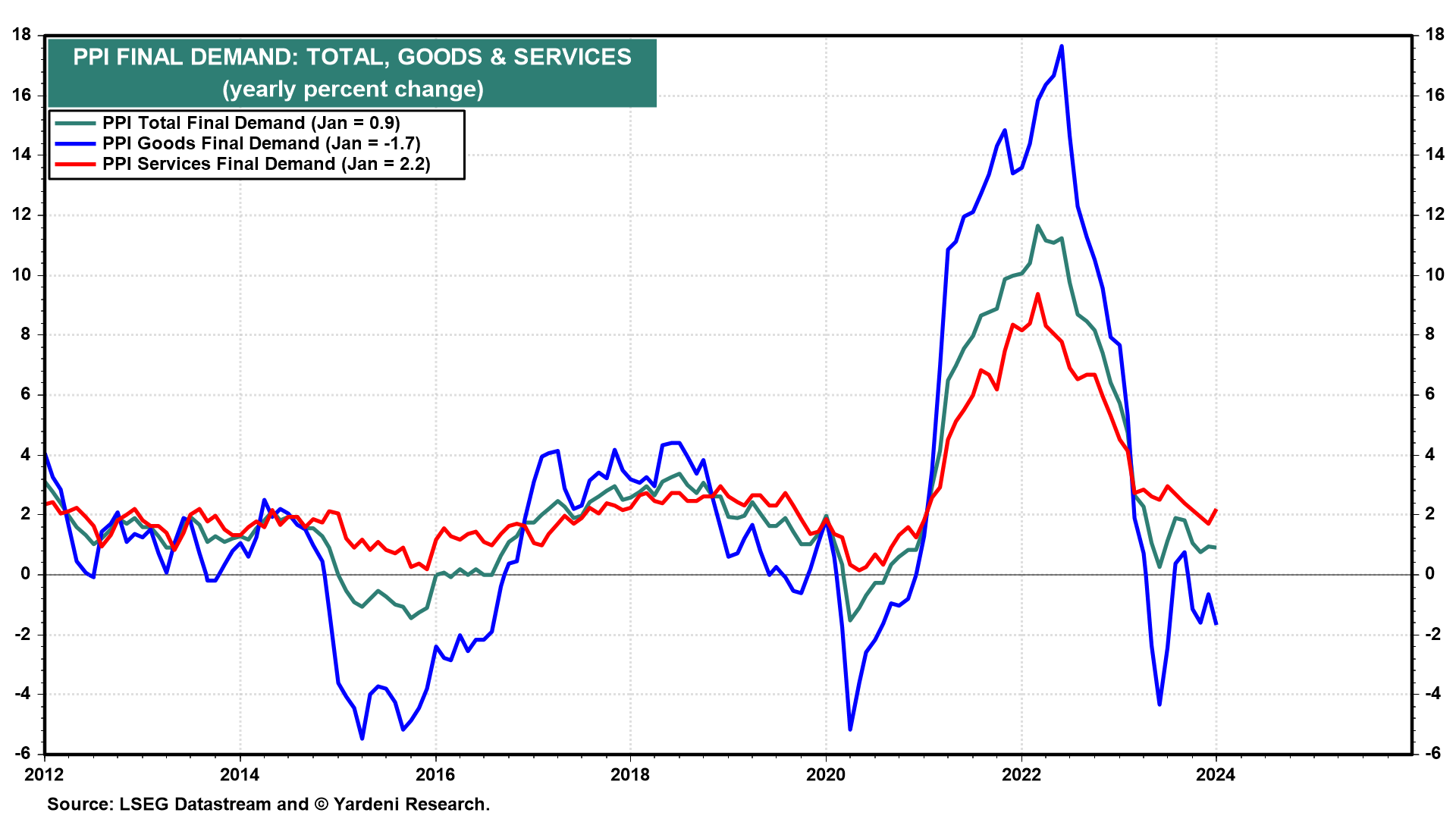

(1) Producer Price Index. The PPI's m/m increases were unsettling. However, the y/y trend in PPI inflation remains downward. The headline number for final demand was up just 0.9% y/y with goods down 1.7% and services up 2.2% (chart).

We tend to focus on the core PPI final demand for personal consumption. It doesn't include rent, but is highly correlated with the core CPI and core PCED inflation rates (chart). It was up just 2.4% y/y in January, while the CPI was boosted by its rent component to 3.9%.