I. Walmart Goes Nasdaq

On Sunday, we wrote, "In effect, our spin is that every company is evolving into a technology company." Today, Walmart transferred its primary listing to the technology-heavy Nasdaq from the New York Stock Exchange, where it has traded since 1972—making it the largest company ever to make that move. Walmart CEO Doug McMillon cited the company's technology progress as the main factor behind its decision to move to the Nasdaq. "Walmart's changed a lot, and we're trying to make sure everybody knows it," he said. In other words, Walmart wants to be another AI play. Its stock price is up 27.3% ytd.

II. Silver Is Soaring

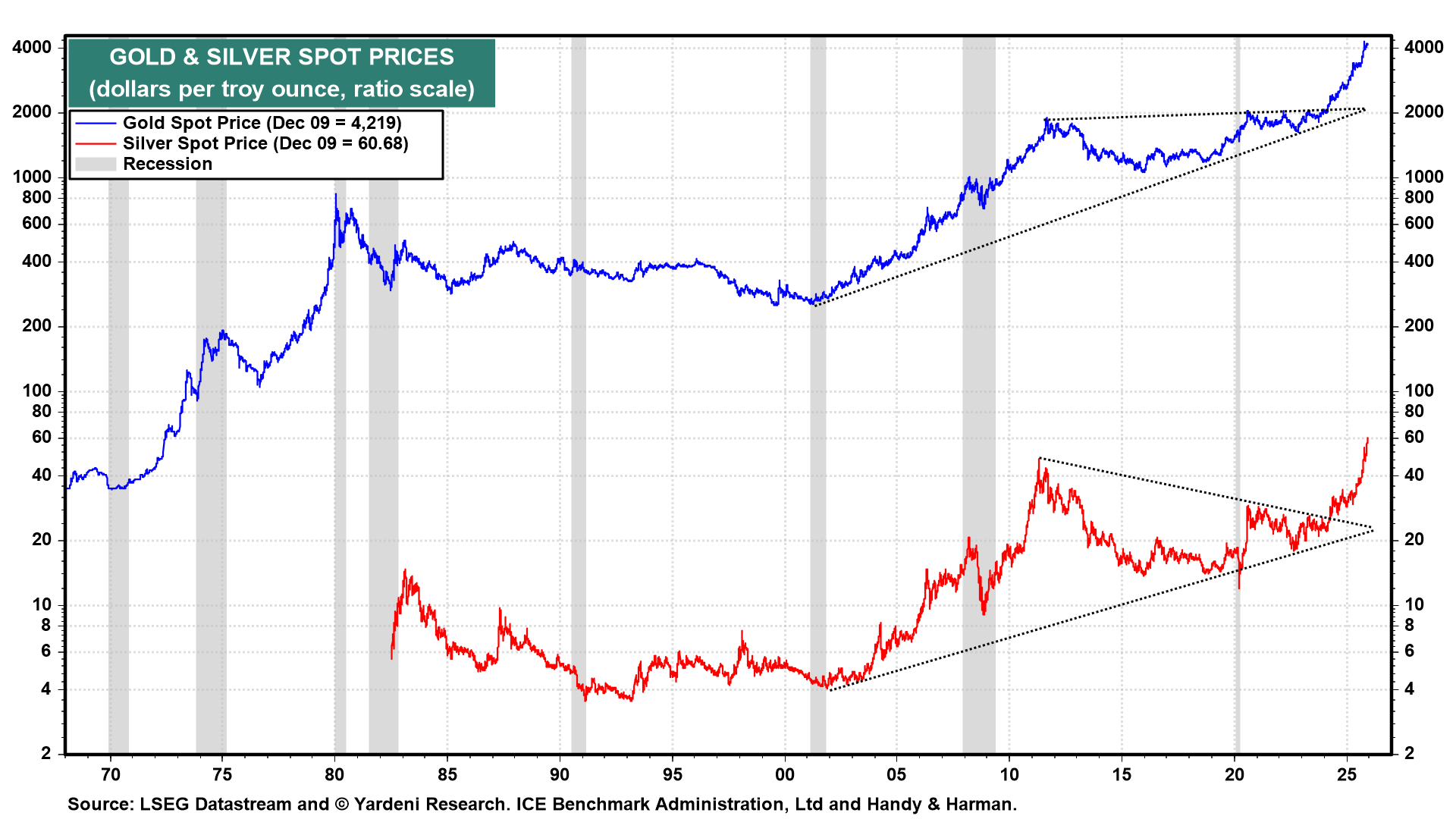

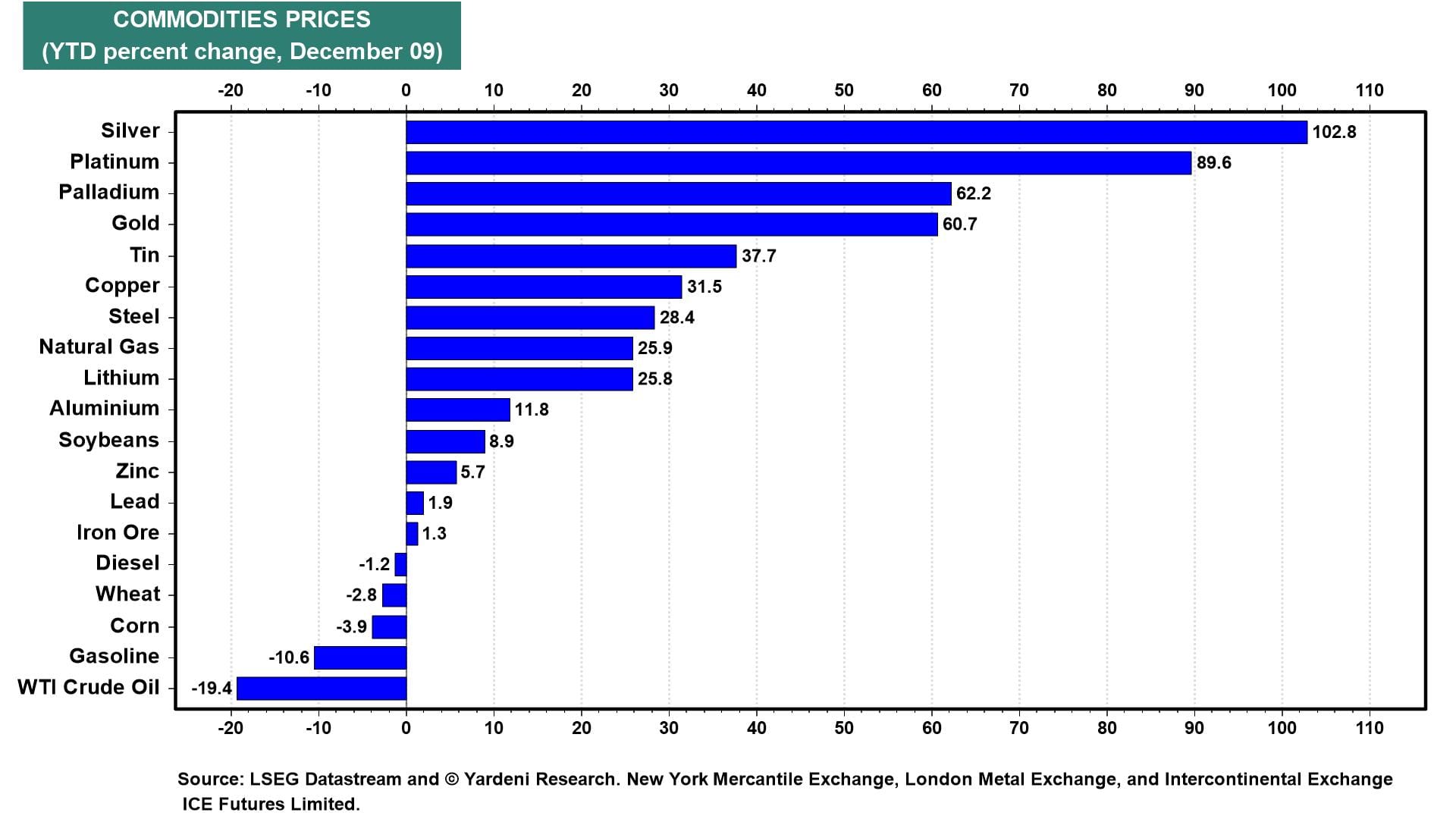

That's a solid increase for Walmart's stock price but chump change compared to the run in silver's price, which is another AI play. Today, silver broke a historical record, surpassing $60 per ounce and doubling in value so far in 2025 (chart). The build-out of AI data centers is intensifying the demand for silver, and so is the ongoing production of EVs (which use more silver than combustion engines).

We turned bullish on gold when it rose to a new high last year. It is up 60.7% so far this year. However, of the four primary precious metals, silver has been the star this year (chart). There have been solid gains in base metals’ prices as well, confirming that the global economy is performing well despite trade tensions between the US and its trading partners.

III. Labor Market Is Okay

Today's labor market indicators weren't bad. But they were lackluster. The JOLTS measure of job openings showed an increase of just 12,000 in October, but it held steady with September's jump of 431,000 (chart). There were 7.7 million job openings in October. That's a relatively high reading compared to those of the pre-pandemic period.