As expected by everyone, the FOMC delivered a 25bps cut in the federal funds rate (FFR) yesterday. There was only one dissenter among the FOMC's voting members. That happened to be Stephen Miran, who wanted a 50bps cut. President Donald Trump has publicly called for the Federal Reserve to cut the FFR down to 1.00%, describing such a move as "rocket fuel" for the US economy. That would also lower government borrowing costs, allowing the administration to finance the high and rising deficits expected from his spending and tax-cut bill.

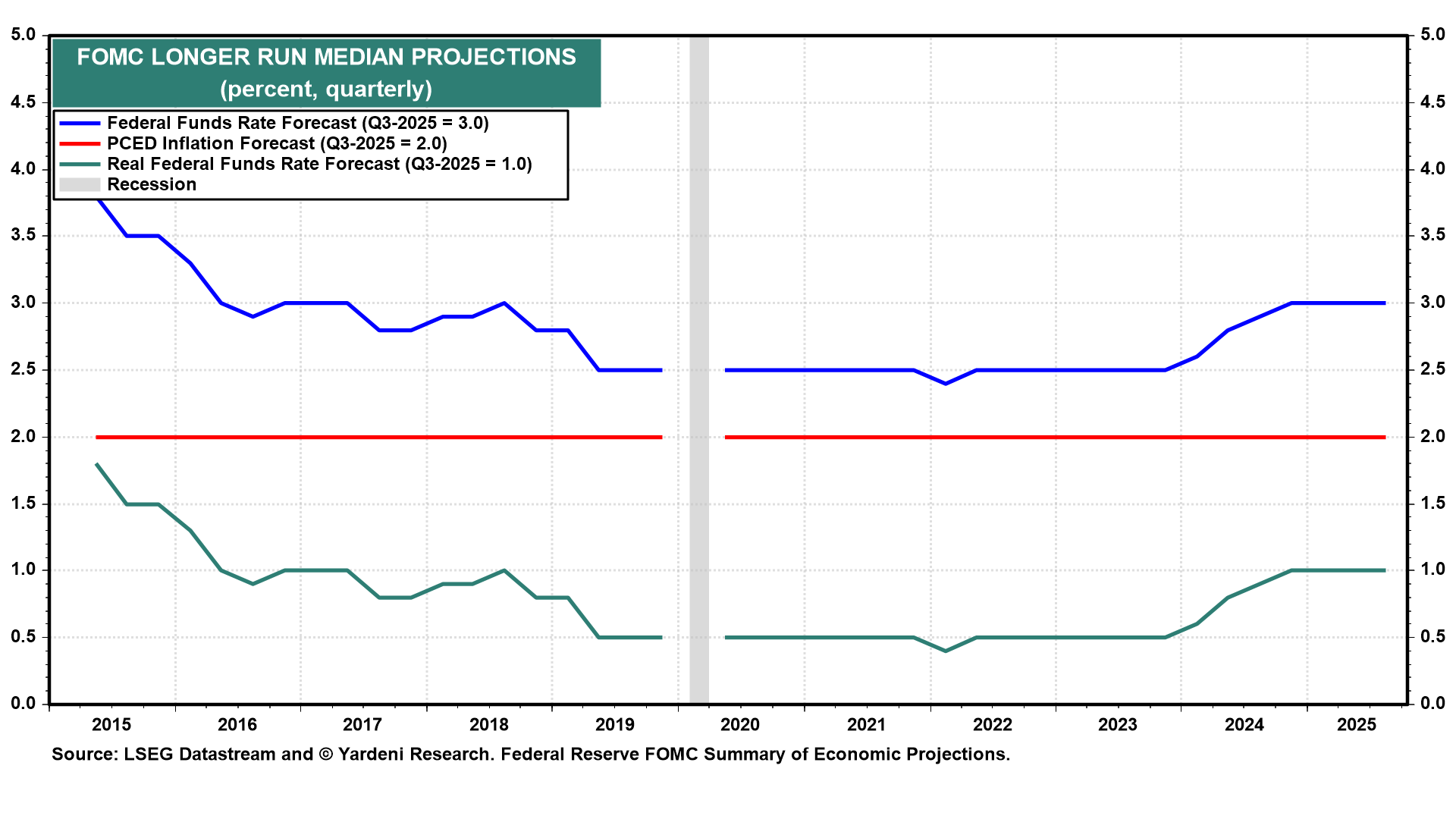

In their latest Summary of Economic Projections (released yesterday), FOMC participants indicated that they collectively believe that 3.00% is the "long-run" neutral rate for the FFR (chart). That's 2.00ppts above Trump's wish. It's at least 1.00ppts lower than our 4.00%-4.50% estimate, that is based on the fact that it seems to be working toward achieving the Fed's dual mandate of maximum employment with stable prices without raising the risk of financial instability.

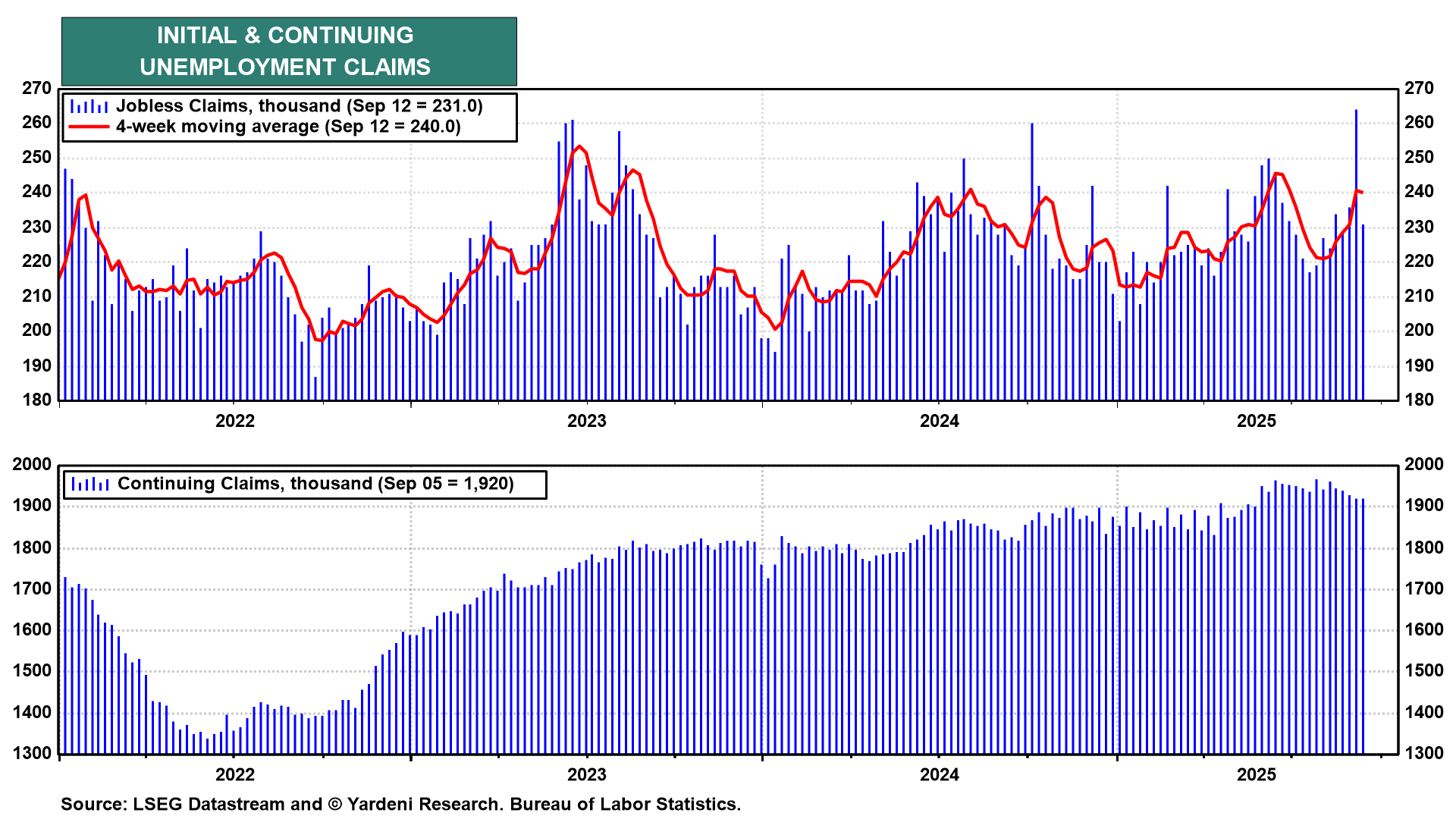

Fed officials voted for the rate cut because of the recent weakness in payroll employment data. Some of them might also have been spooked by the 263,000 spike in initial unemployment claims during the first week of September (chart). We viewed it as an aberration that occurs from time to time. Sure enough, jobless claims fell 33,000 to 231,000 last week. So layoffs remain low. In addition, short-term unemployment (i.e., under 27 weeks) is falling along with continuing unemployment claims (which terminate after 26 weeks of unemployment). That may be due to an increase in long-term unemployment and/or fewer people losing their jobs.

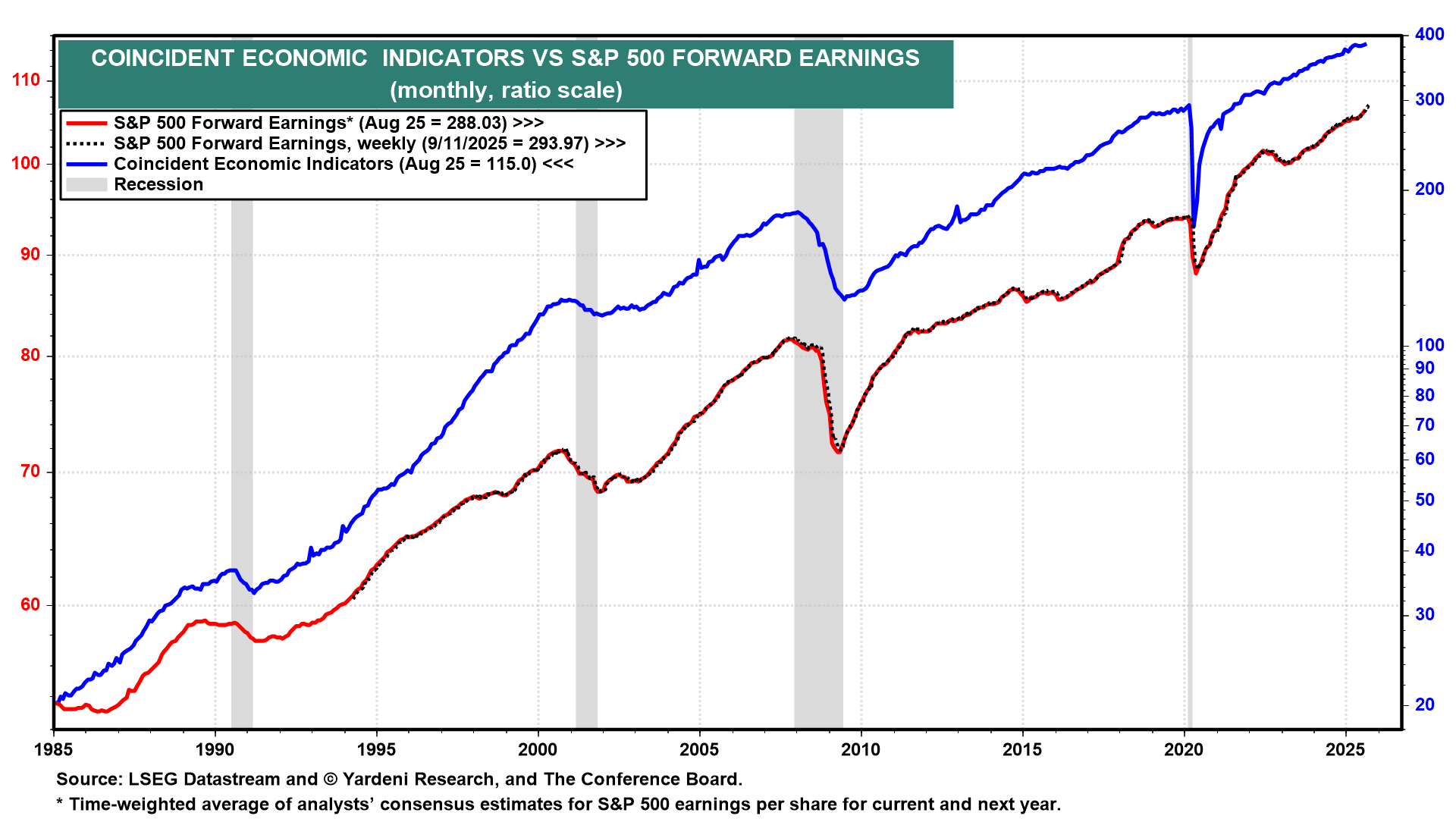

Meanwhile, the Conference Board reported today that the Index of Coincident Economic Indicators (CEI) rose 0.2% m/m in August to yet another record high (chart). That's not surprising since S&P 500 forward earnings is also rising in record high territory, and suggests that September's CEI will do so as well.

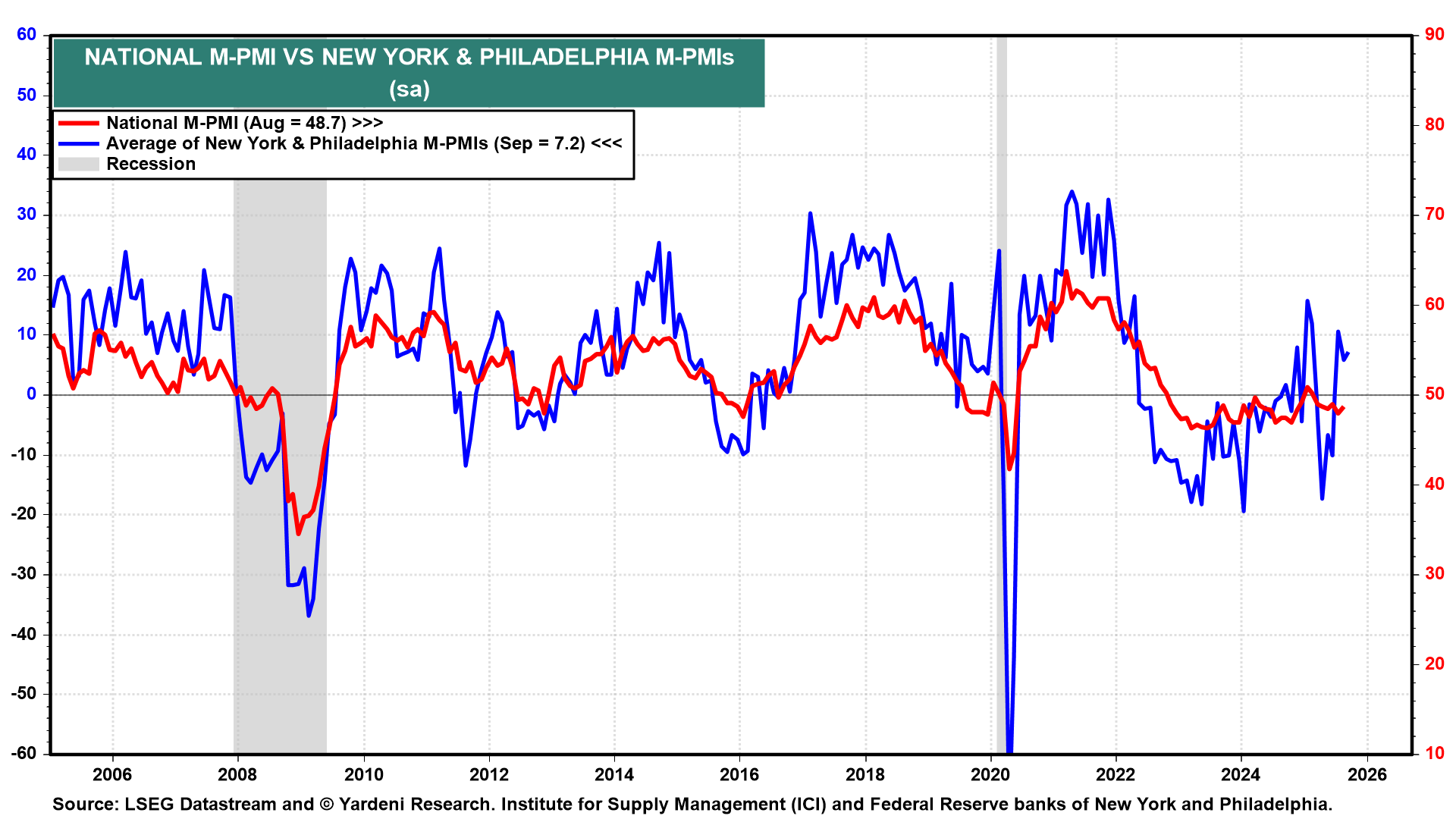

So far, the average of two of the regional business surveys conducted by five of the Fed's regional banks remained in expansion territory during August, suggesting that the national ISM manufacturing purchasing managers index should be doing the same soon (chart).

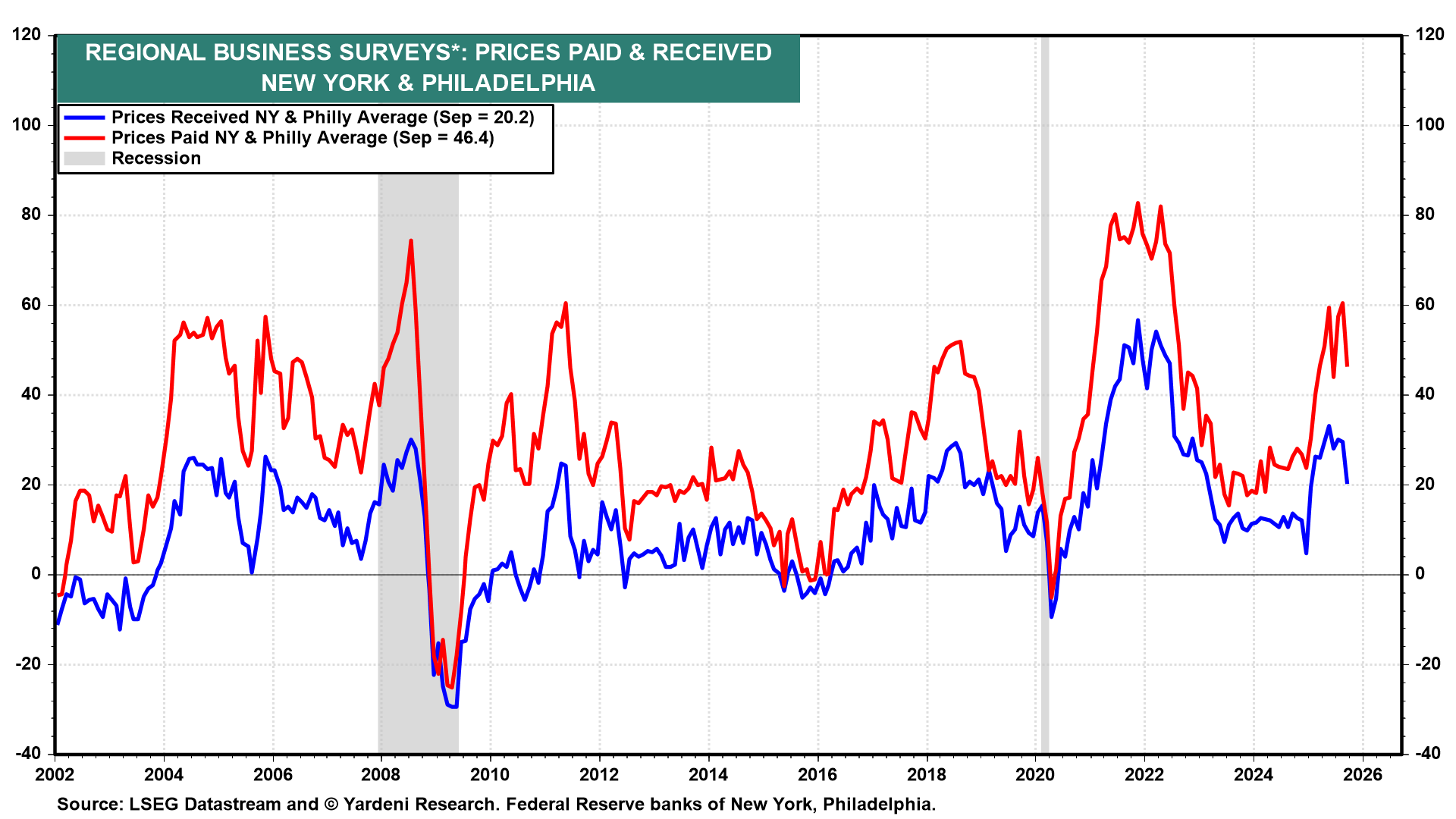

The averages of the two surveys' prices-paid and prices-received indexes are topping, suggesting that tariff-related inflationary pressures are abating (chart).

This morning's financial market action suggests that the latest batch of data is showing economic strength that might once again convince Fed officials that there is no rush to lower the FFR again. The 10-year Treasury bond yield has risen back to 4.11%. The DXY dollar index is up 0.5%. The price of gold is down due to the strength of the dollar. The S&P 500 is up 0.7%, while the Russell 2000 is up 1.43%. That all makes sense to us.