Fed Chair Jerome Powell didn't have much to say at his press conference today. He deflected several questions about the transition as his term as Fed chair ends on May 15. He refused to comment on President Donald Trump's potential pick to replace him or the President's public criticisms of his leadership. He declined to comment on the Department of Justice investigation into himself or the ongoing Supreme Court case regarding the potential firing of Fed Governor Lisa Cook. He repeatedly responded to these questions by saying, "I have nothing on that for you." He said that seven times. Four times, he said, "I don't have anything on that for you."

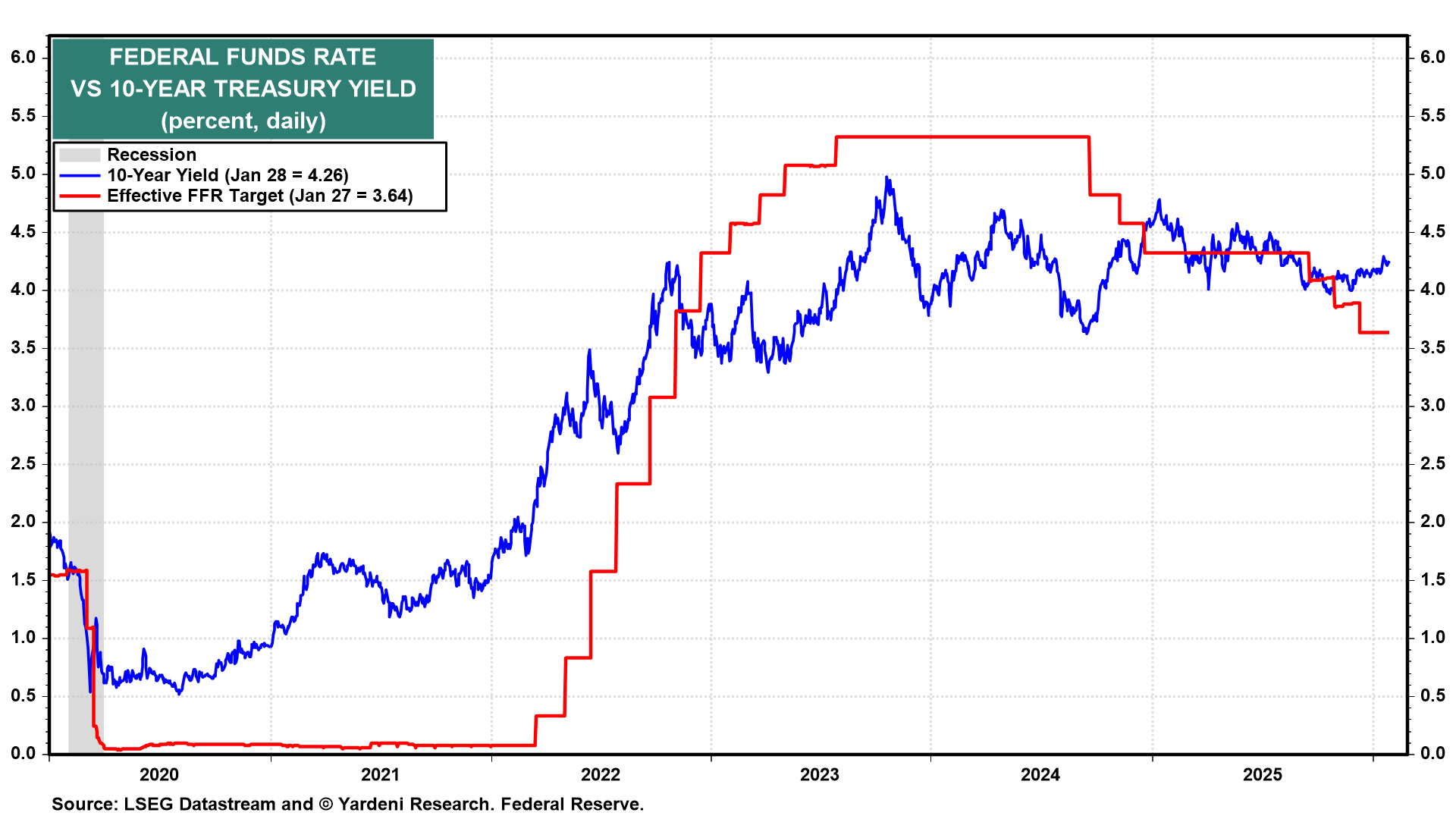

Following the FOMC's decision today to hold the federal funds rate at 3.50%–3.75%, Powell didn't offer any "forward guidance" beyond the standard data-driven, meeting-by-meeting approach. He did acknowledge that the economy is strong. He observed that the unemployment rate has remained low, around 4.4%, in recent months despite the weak pace of employment. He predicted that inflation would moderate as the impact of Trump's tariffs wore off. On balance, he said the risks of higher inflation and higher unemployment are equal, implying that there is no reason for the Fed to do anything. This increases the odds that there will be no change in the federal funds rate during his last two meetings as FOMC chair (chart).

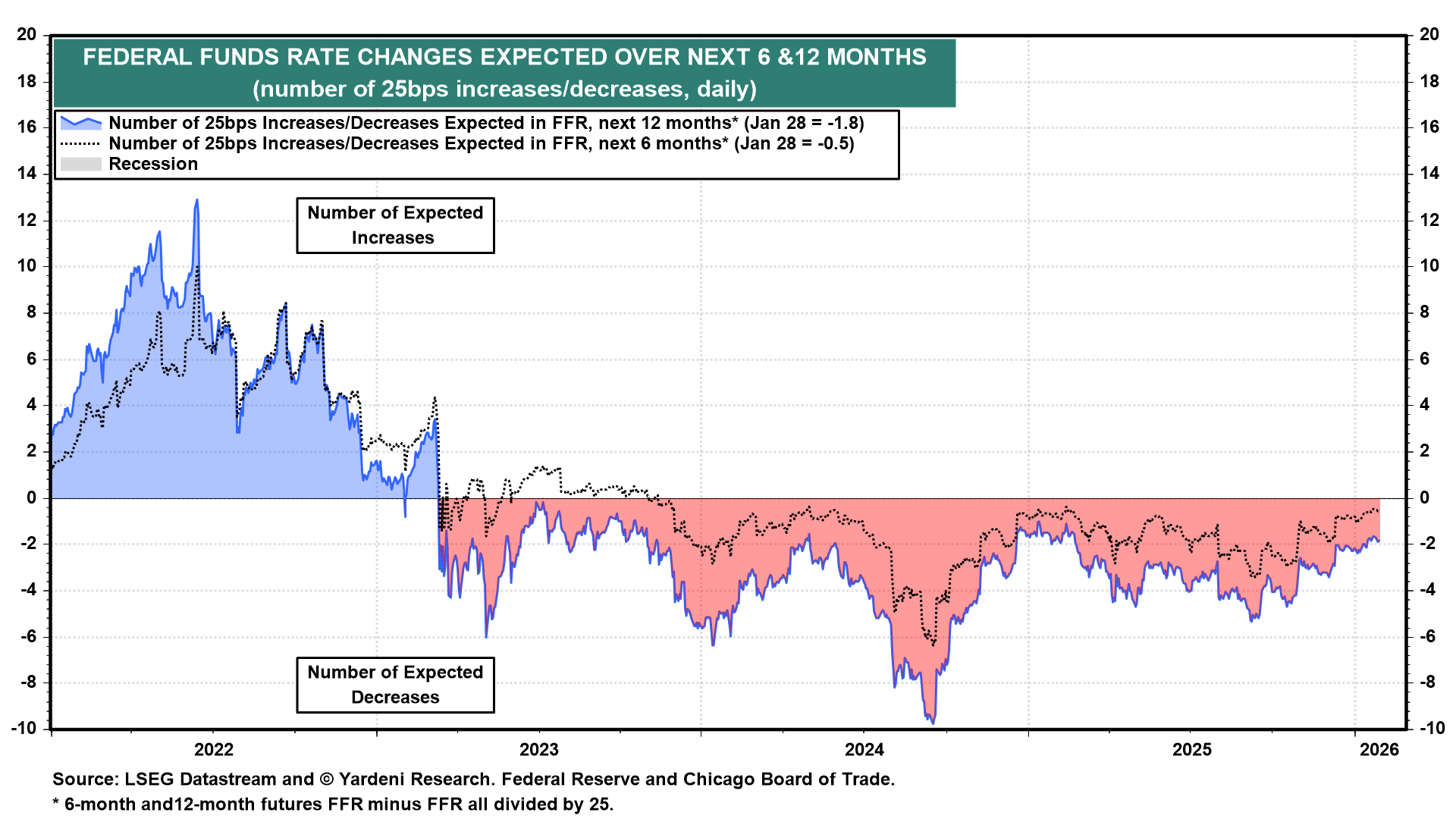

Trump administration officials agree with our Roaring 2020s scenario in which better-than-expected productivity growth boosts real GDP growth and moderates inflation as unit labor cost inflation falls close to zero. They believe that expecting this scenario justifies further cuts in the federal funds rate, and so do two dissenters on the FOMC who espoused that view at the latest meeting.

We disagree. Lowering the FFR further from here would increase the risks of financial instability, specifically a meltup in the stock market. There's already a meltup in precious metals prices. Lowering the FFR would further weaken the dollar, potentially reviving inflationary pressures.

The bond market also disagrees. When the Fed lowered the federal funds rate (FFR) by 100bps in late 2024, the 10-year bond yield rose 100bps (chart). The Fed cut the FFR by 75bps late last year, but the yield held at 4.00% and is now up to 4.26%. We still think the bond yield will trade mostly between 4.25% and 4.75% this year. That was the old normal in the years prior to the Great Financial Crisis.