During his press conference today, Fed Chair Jerome Powell continued to read from the Volcker 2.0 script. His punchline appeared in his prepared remarks: “[W]e still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.”

During the Q&A portion of his presser, Powell repeated “some ways to go” several times to describe the Fed’s path for tightening monetary policy. He also reiterated that the terminal federal funds rate is likely to be higher than suggested by September’s FOMC Summary of Economic Projections, which showed a median forecast of 4.6% next year.

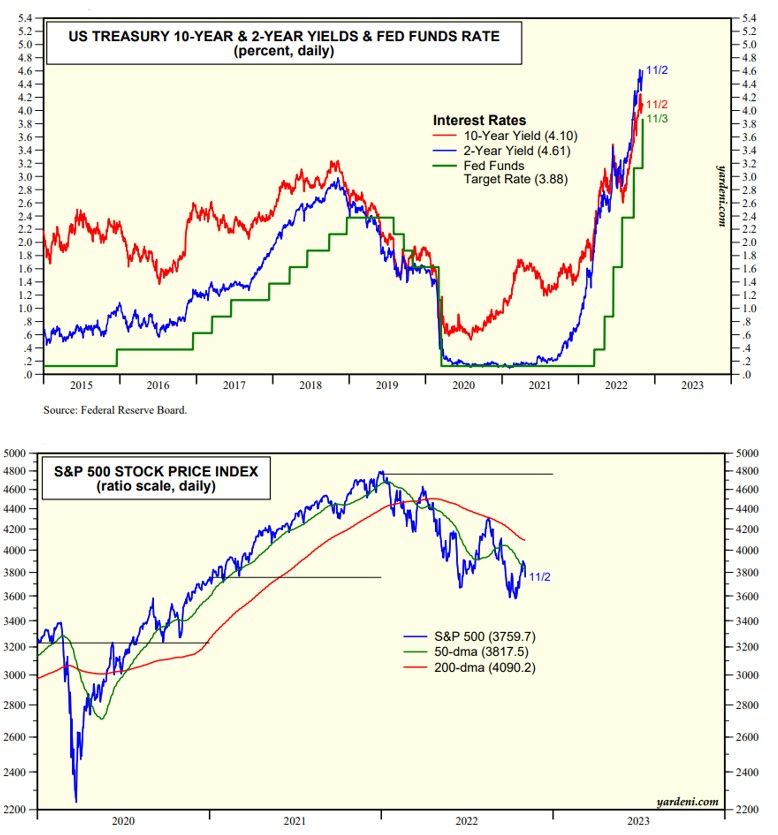

He didn’t rule out smaller rate hikes than the latest 75bps hike (chart), but he did rule out any easing, saying, “The historical record cautions strongly against prematurely loosening policy. We will stay the course, until the job is done.” That statement seemed to rule out any pause in rate-hiking anytime soon. The Fed’s goal is to “moderate demand so that it comes into better alignment with supply” to bring inflation down to 2.0%. In his Q&A, Powell clearly stated that he isn’t convinced that the federal funds rate is restrictive enough yet to do the job.

Stocks sank on Powell’s unwavering hawkishness (chart). Nevertheless, we still believe that the S&P 500 bottomed on October 12. We expect that other Fed officials soon will be speaking publicly in less hawkish terms, effectively toning down Powell’s hawkishness. We also expect that a possible red wave in the midterm congressional elections will boost the stock market. Additionally, we think that the inflation indicators to be released over the rest of the year should show more signs of moderating, which likewise should buoy the market.