During a speech in Providence, Rhode Island today, Fed Chair Jerome Powell was asked whether he and his colleagues give any weight to the impact of their monetary policies on financial markets. He responded: "We do look at overall financial conditions, and we ask ourselves whether our policies are affecting financial conditions in a way that is what we're trying to achieve.” Then he opined that "by many measures, for example, equity prices are fairly highly valued." However, he then added that this is "not a time of elevated financial stability risks."

We are inclined to agree with the Fed chair, although he triggered our contrary instincts with that last statement. Financial crises tend to be Black Swans, i.e., events that occur unexpectedly, especially when irrational exuberance is widespread and intensifying. In a December 5, 1996 speech, former Fed Chair Alan Greenspan famously asked, "But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions ...?"

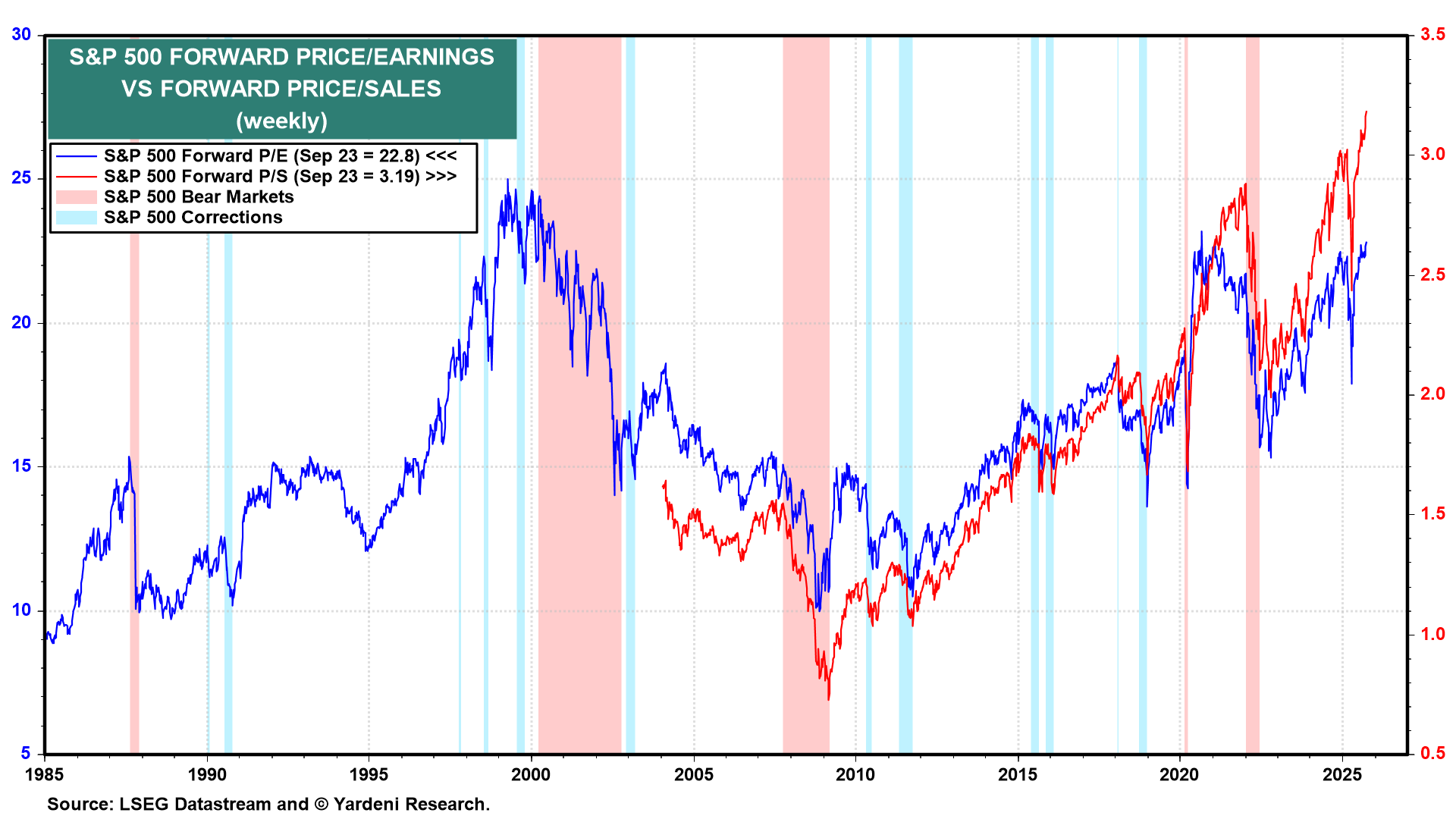

Currently, the weekly S&P 500 forward price-to-sales ratio is at a record high of 3.19 (chart). The S&P 500 forward price-to-earnings ratio is at a near record high of 22.8. The Tech Bubble burst after it reached a peak of 25.0 in late 1999.

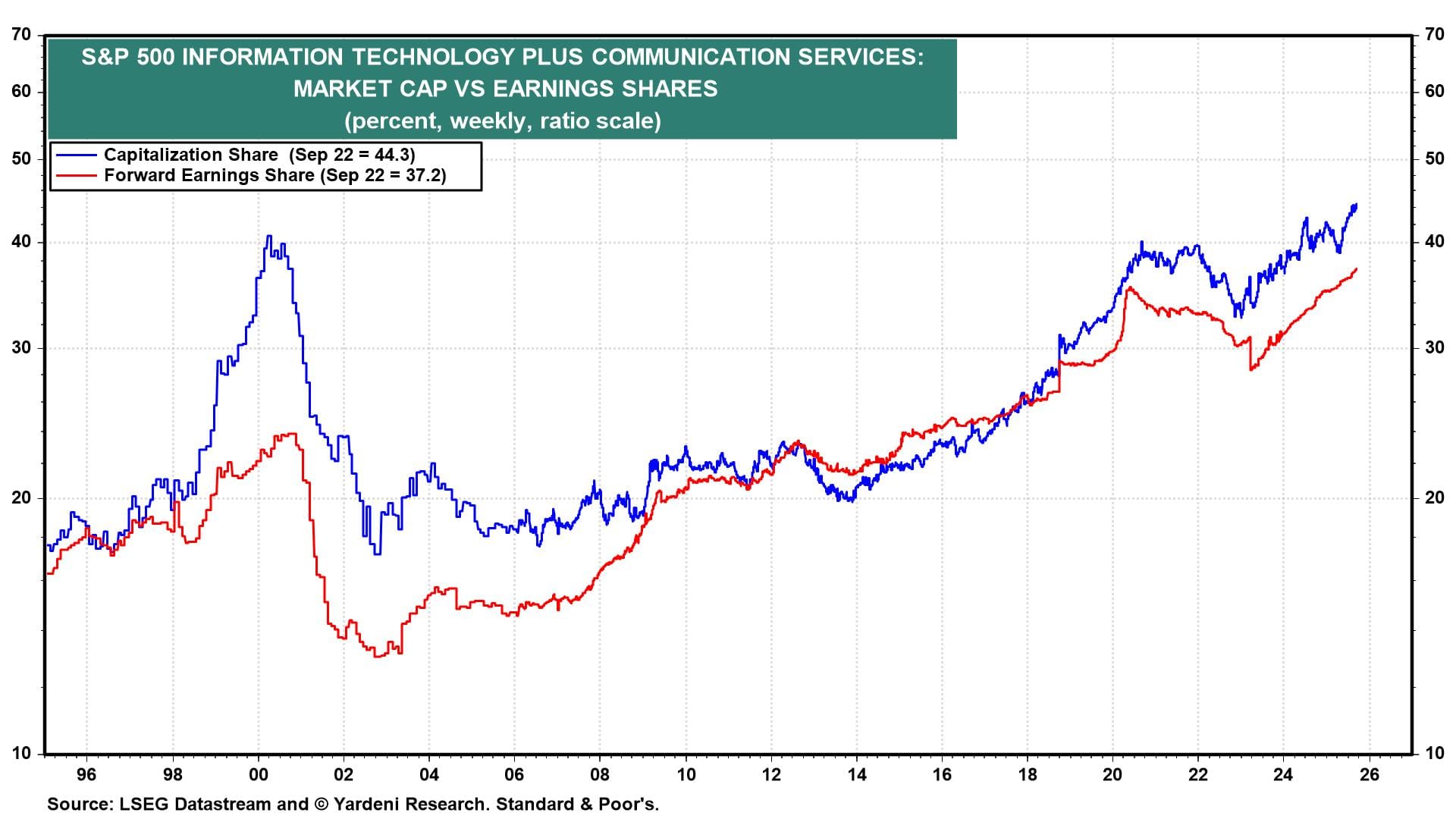

During the Tech Bubble, the market-cap share of the S&P 500 Information Technology and Communication Services sectors combined rose to 40%, while the earnings share peaked at 23% (chart). This time, the former is at a record 44% with the latter also at a record high, of 37%.

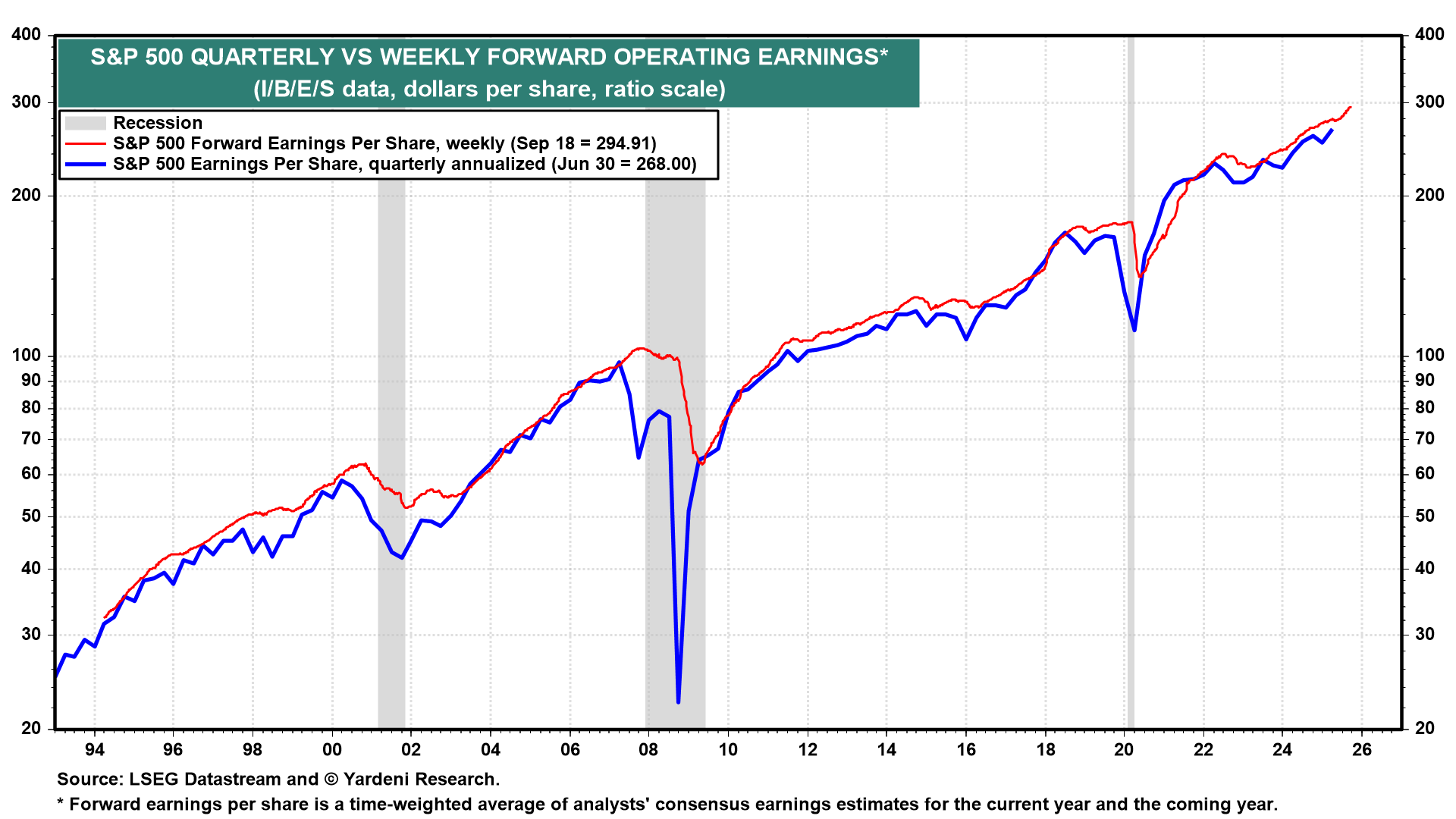

The good news for now is that weekly S&P 500 forward earnings per share has been rising at a faster pace in recent weeks (chart). This suggests that Q3 earnings will rise to another record high.

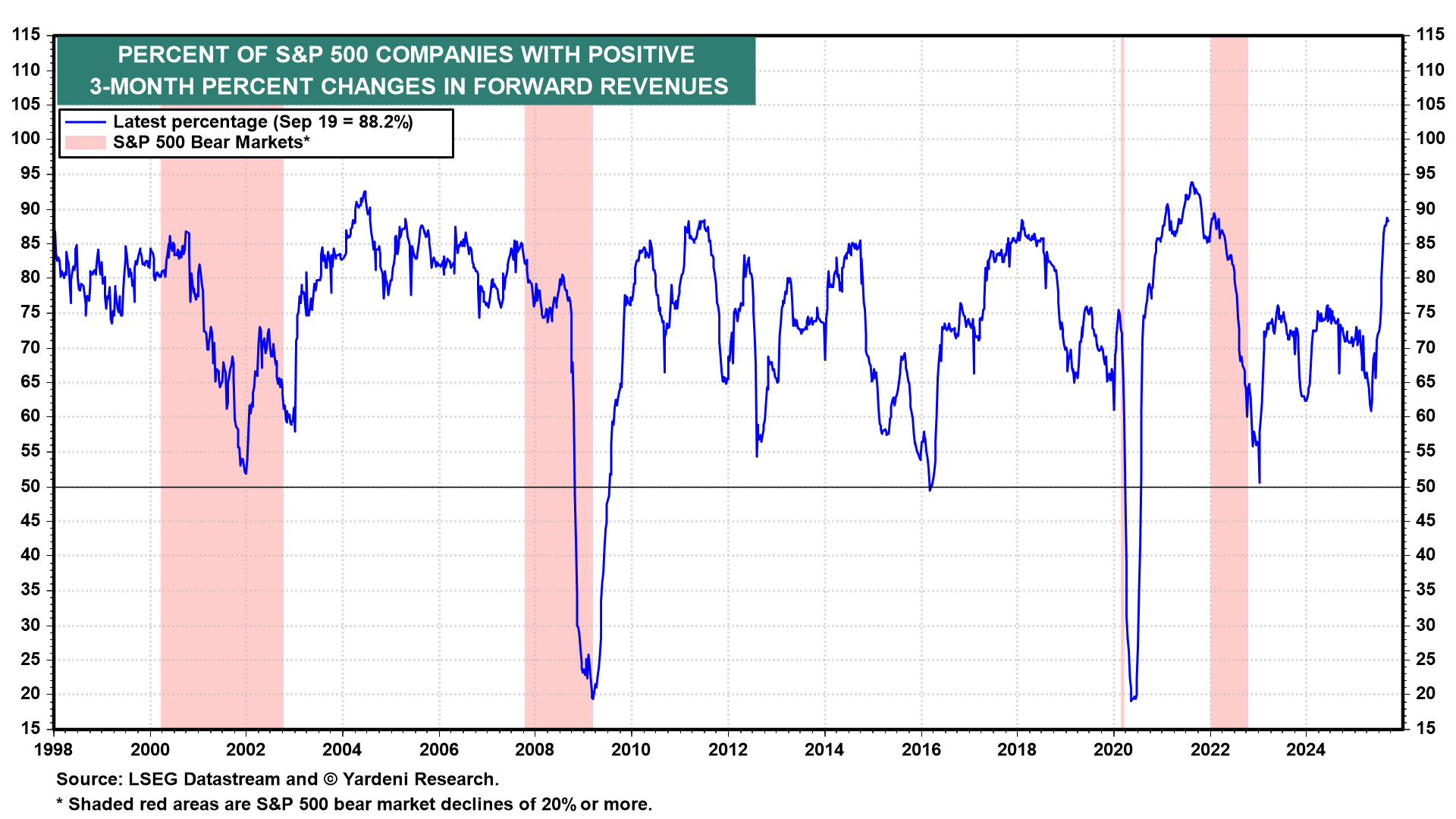

Meanwhile, the recent jump in the breadth of positive three-month changes in forward revenues is remarkable (chart). It belies the widespread perception that the economy is slowing.

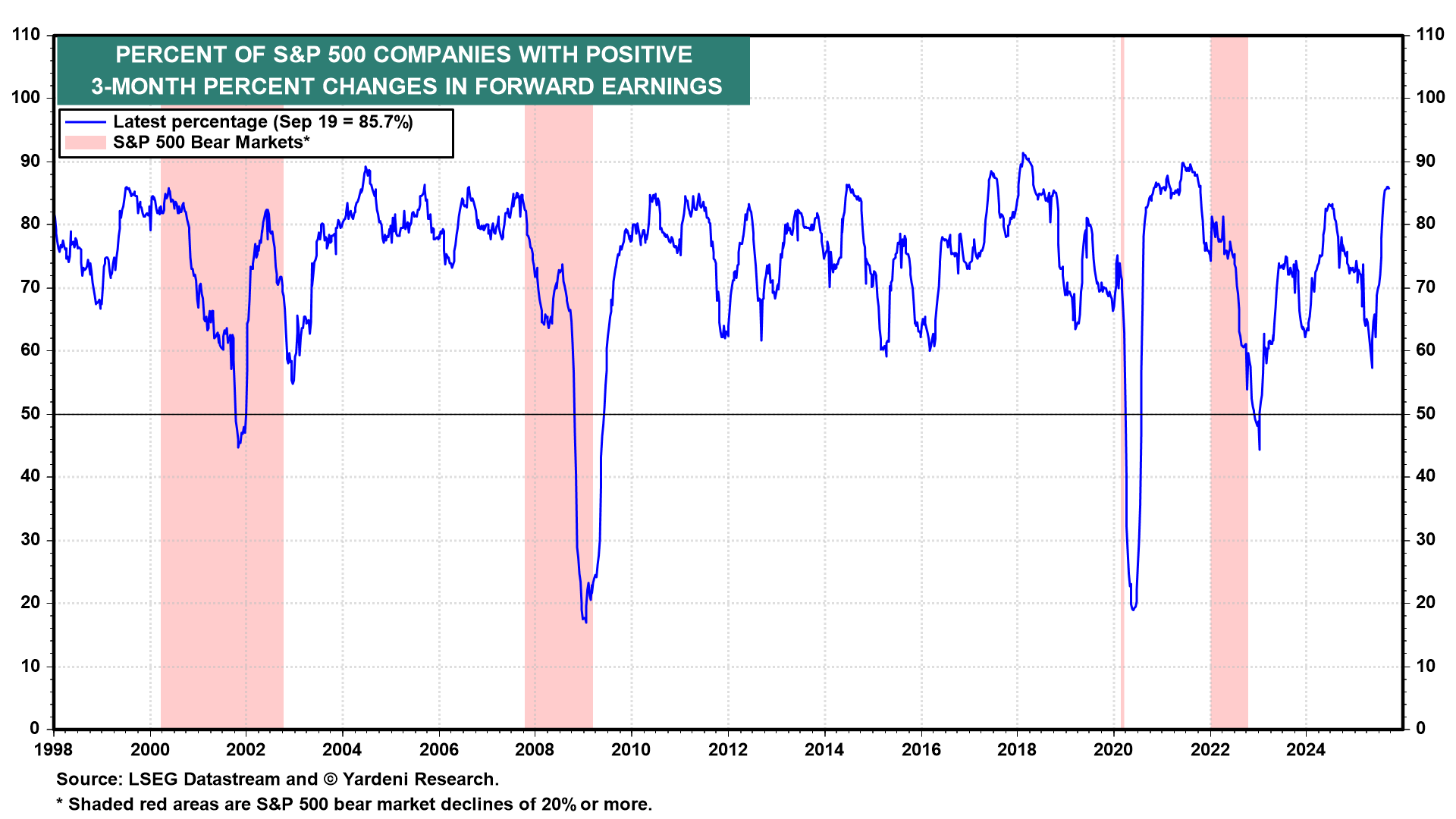

The same can be said for the recent big jump in the percent of S&P 500 companies with positive three-month percent changes in forward earnings (chart).