At the start of this year, the widespread economic consensus was that a hard landing is coming. The consensus changed dramatically during February, when January’s stronger-than-expected economic indicators suggested that a no-landing scenario was more likely. Last week’s batch of economic indicators revived concerns about a hard landing. We watched this rollercoaster ride with our feet firmly planted on the ground. The outlook still looks like a soft landing to us. We think that the economy has been in a rolling recession since early last year and is likely to remain in it during the first half of this year.

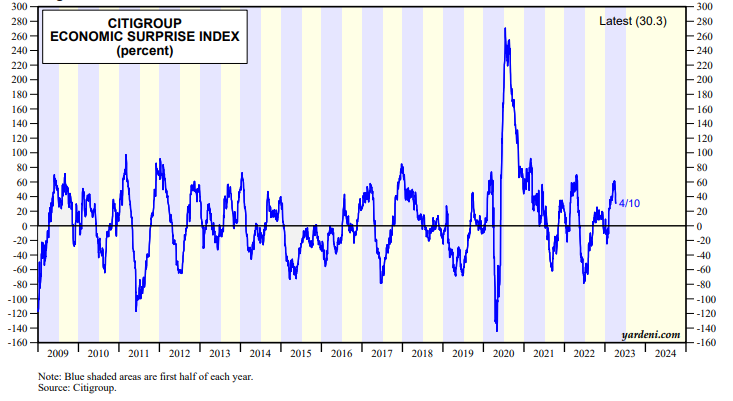

We can see the rollercoaster ride in the Citigroup Economic Surprise Index (CESI) and in the ups and downs of the 10-year US Treasury bond yield. The CESI peaked late last year at 25.5 on October 20 and 21 (chart). It fell to this year’s low (so far) of -24.7 on January 18. It rebounded to 61.3 on March 28. It was back down to 30.3 on April 6.