The bears disparaged yesterday's stock market rally claiming that Fed Chair Jerome Powell's speech at the Brookings Institution was hawkish and didn't justify the market's bullish spin. We believe that the bulls correctly perceive that inflation peaked this summer and were relieved to hear Powell say that the Fed might be willing to let inflation subside without pushing the economy into a recession.

Today's batch of economic indicators confirmed our soft-landing scenario for the economy rather than the alternative hard-landing one. Consider the following:

(1) Inflation peaking. October's headline and core PCED inflation rates were 0.3% and 0.2% today, slightly less than expected. November's M-PMI prices-received index was off 3.6 points to 43%, indicating inflation is abating in the manufacturing sector.

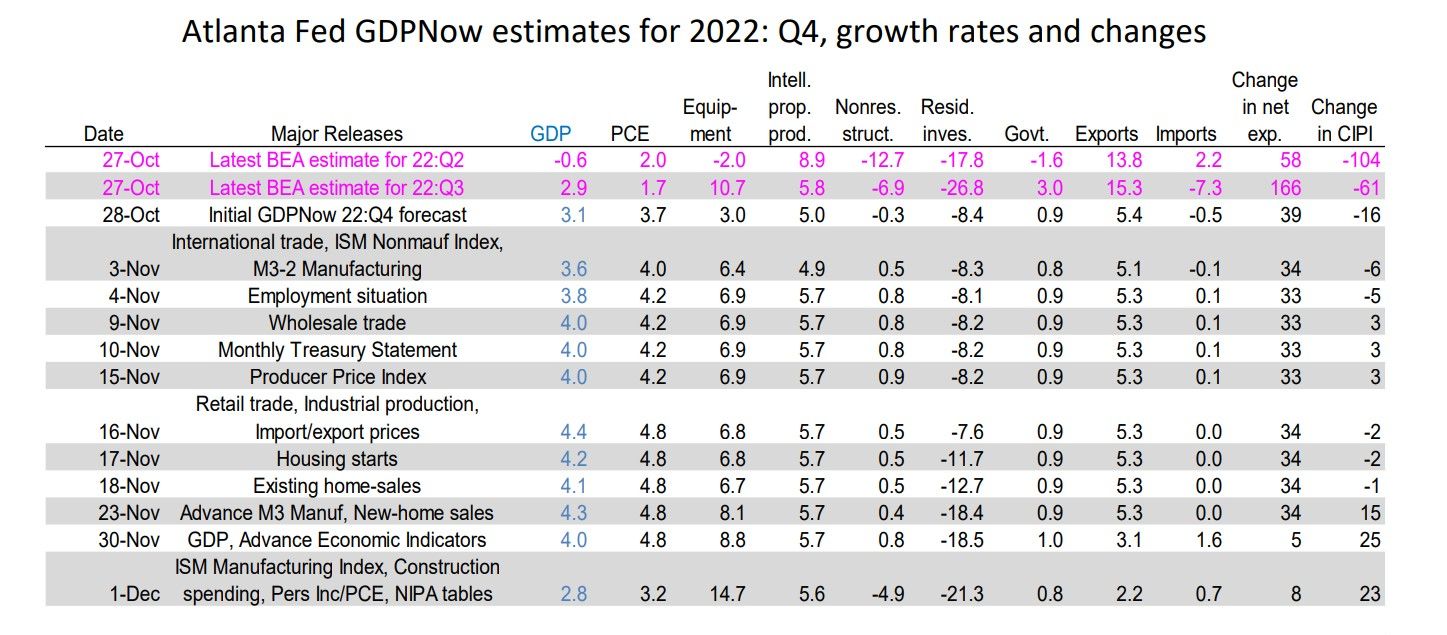

(2) Real GDP & M-PMI slowing. The Atlanta Fed's GDPNow tracking model was updated with today's batch of economic reports showing that real GDP is rising 2.8% (saar) during Q4, down from 4.0% (table). November's overall M-PMI reading was 49%. That's still in expansion territory, but the lowest since May 2020, when lockdowns depressed the economy.

(3) Consumers spending. Unlike the lockdowns, consumers are free to spend and are doing so. October's personal income jumped 0.7% m/m and spending rose 0.8%. Both outpaced inflation. Nevertheless, the GDPNow model revised real consumer spending growth down to 3.2% from 4.8% (table). That is still strong.

(4) Construction weakening. Housing is in a deepening recession. The GDPNow estimate for residential construction was cut from -18.5% to -21.3%. Spending on nonresidential structures was slashed from o.8% to -4.9%.

(5) Bottomline. It all adds up to a soft-landing, which on balance remains bullish for bonds and stocks, in our opinion.