The S&P 500 rose today despite a batch of weak economic indicators over the past two days. Investors perceive that bad news is good news if it increases the chances of a Fed rate cut on September 17. Indeed, the odds of that happening are now 97.6%, according to the CME FedWatch Tool. That's a sure thing. We've been at 40% and are now raising that to a still skeptical 60%. We might have to join the consensus if Friday's employment report doesn't surprise to the upside, as we expect.

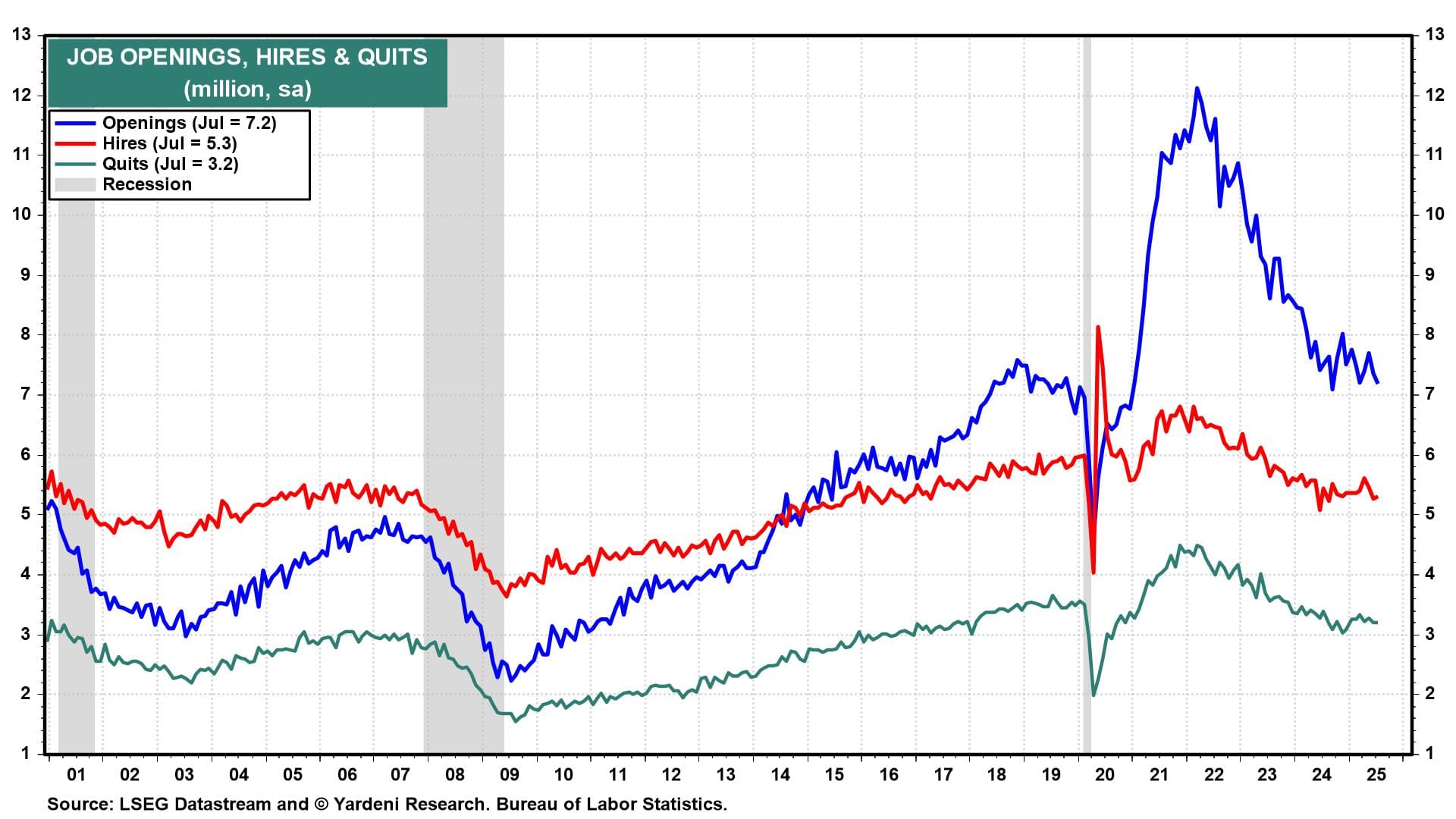

Today's JOLTS report for July showed a downtick in job openings, but this series remains relatively high (chart). The ratio of job openings to the number of unemployed workers was 1.0 during July. The paces of both hirings and quits haven't changed much over the past year, suggesting that the labor market hasn't changed much either.

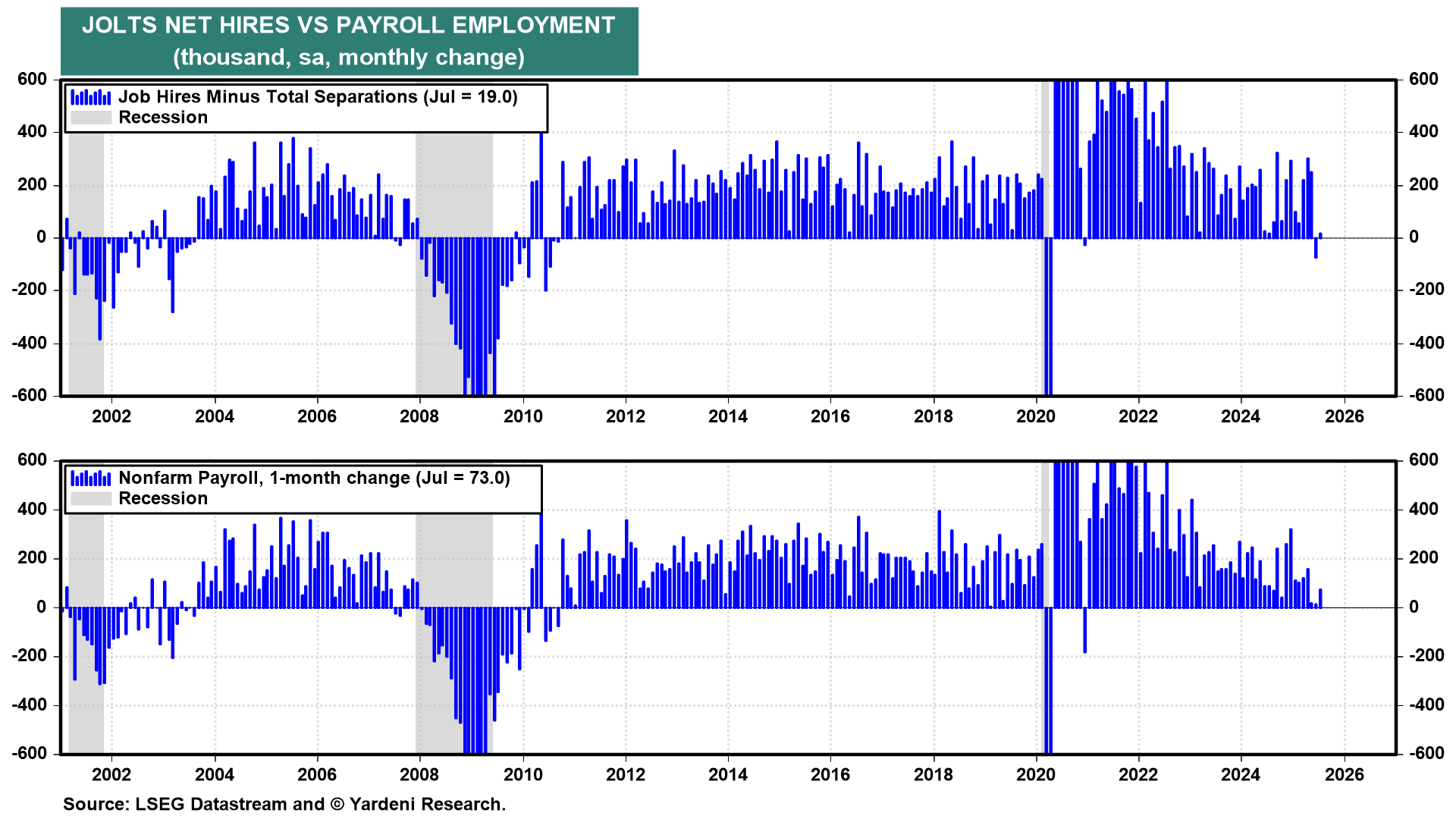

On the other hand, net hirings (i.e., hirings minus separations) rose just 19,000 during July, following a drop of 74,000 during June (chart). These are even weaker readings than shown by payroll employment. We still believe that the weakness in the latter from May through July reflected employers' caution due to uncertainty about tariffs. We expect employers to expand their payrolls in the coming months, as their sales and earnings remain strong despite the uncertainty.

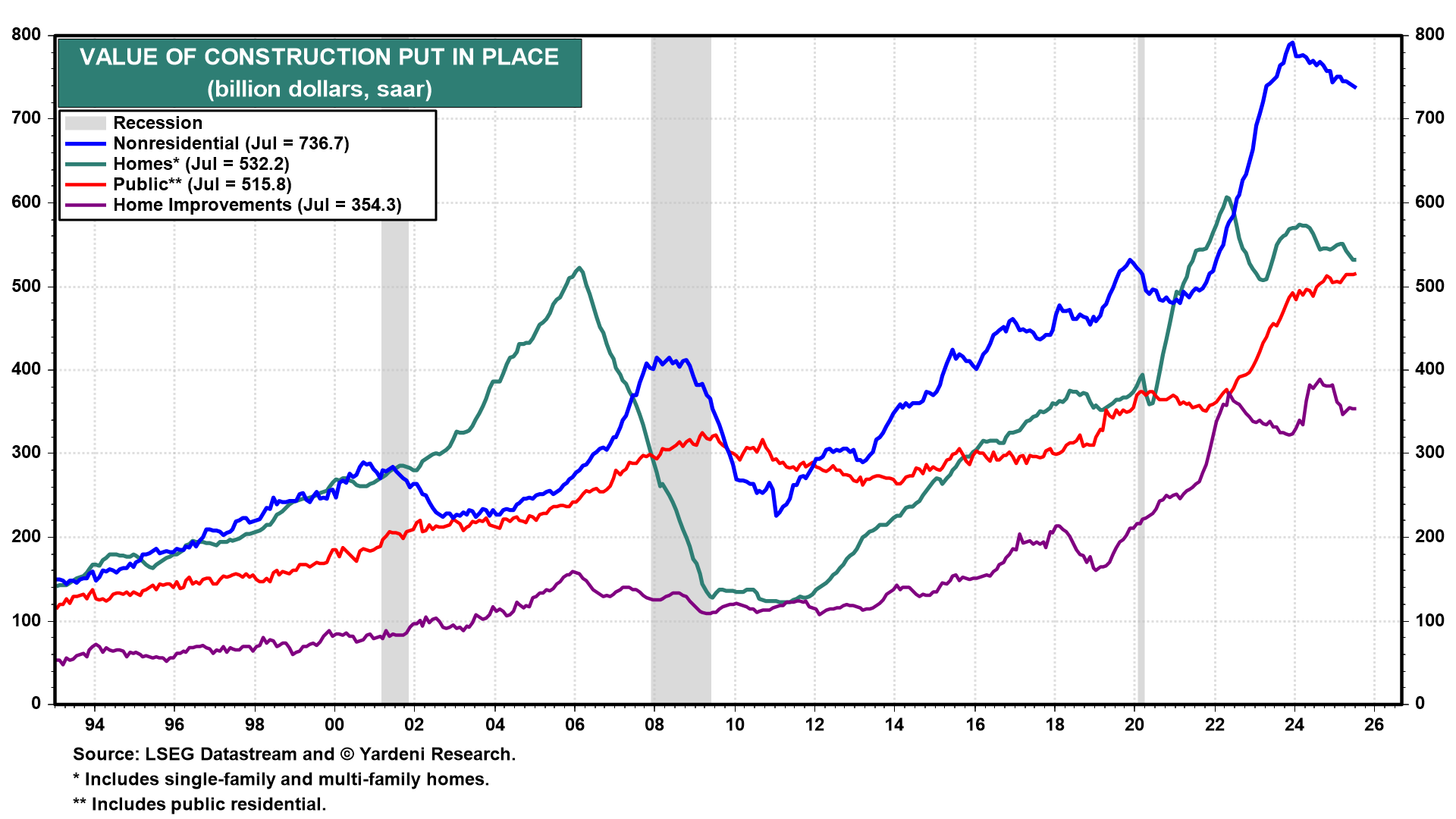

Another set of weak indicators came out yesterday for July's construction spending (chart). Total spending reached a record high of $2.22 trillion in May 2024. It is down only 3.6% since then through July. On the weak side have been nonresidential and residential construction. Public construction spending and spending on home improvements have been relatively stronger.

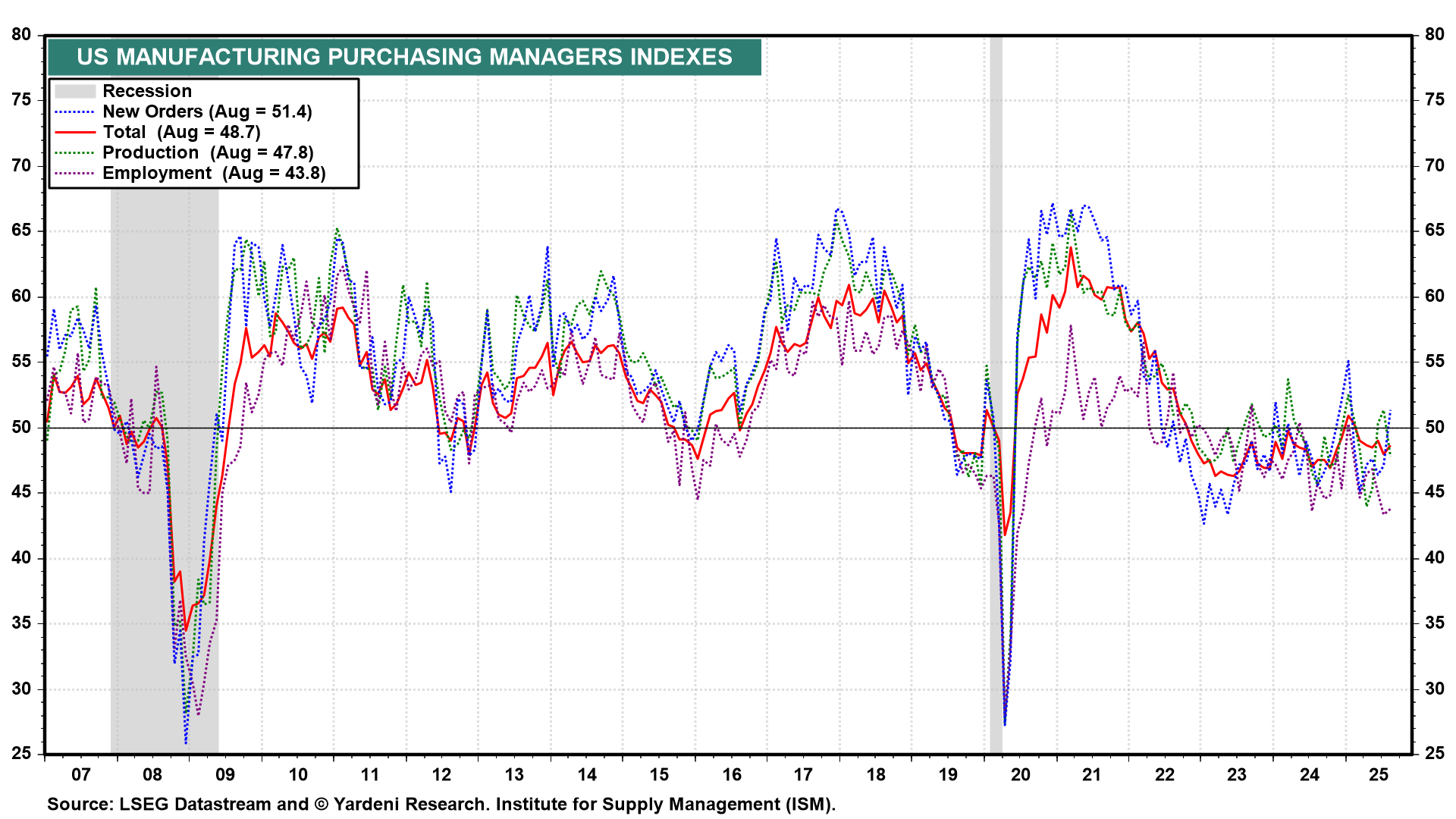

Another weak report was yesterday's manufacturing purchasing managers survey for August (chart). The M-PMI edged up but remained below 50.0. It has been below this level almost every month since November 2022. New orders rose above 50.0, but both production and employment were below that level.

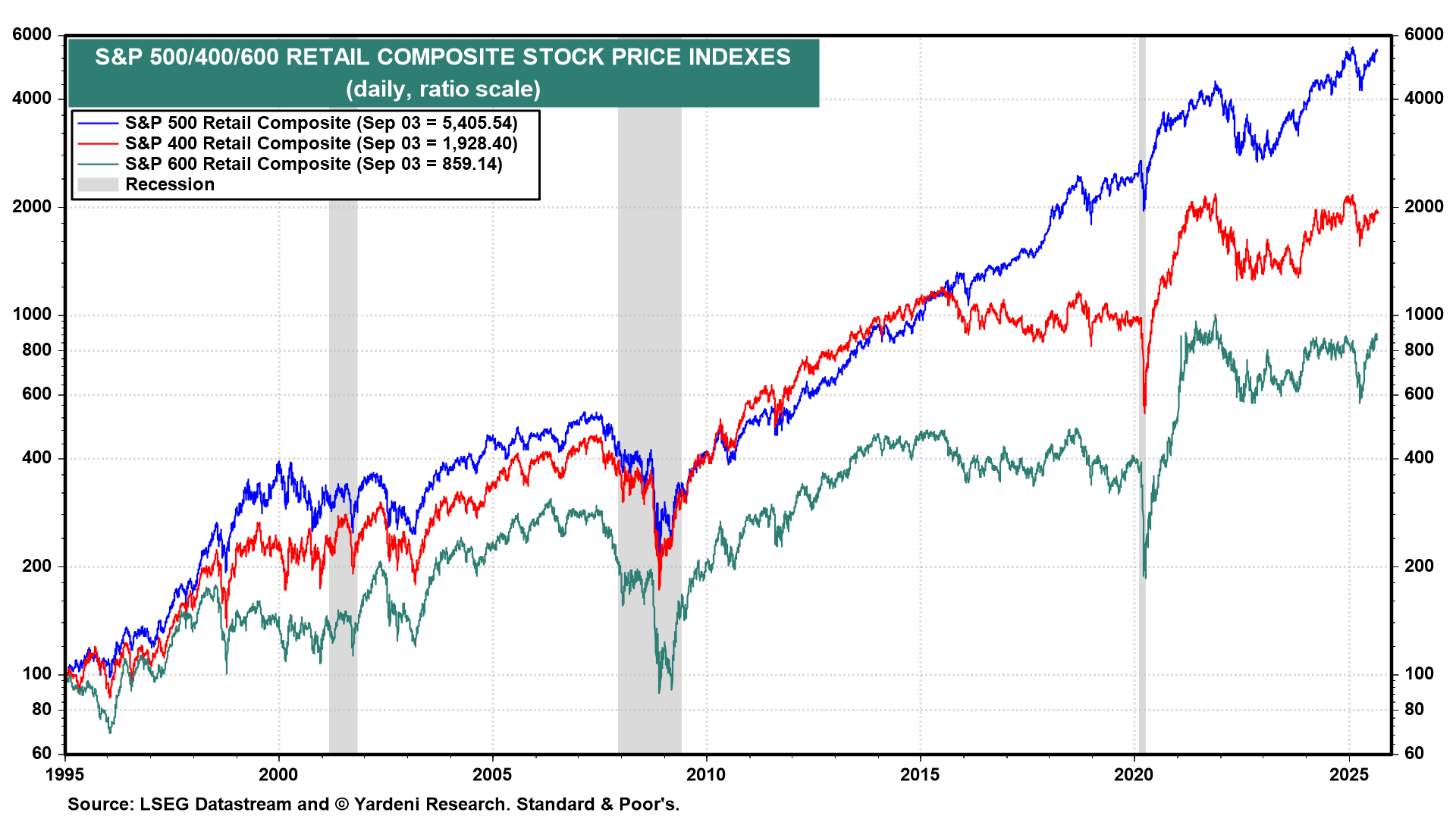

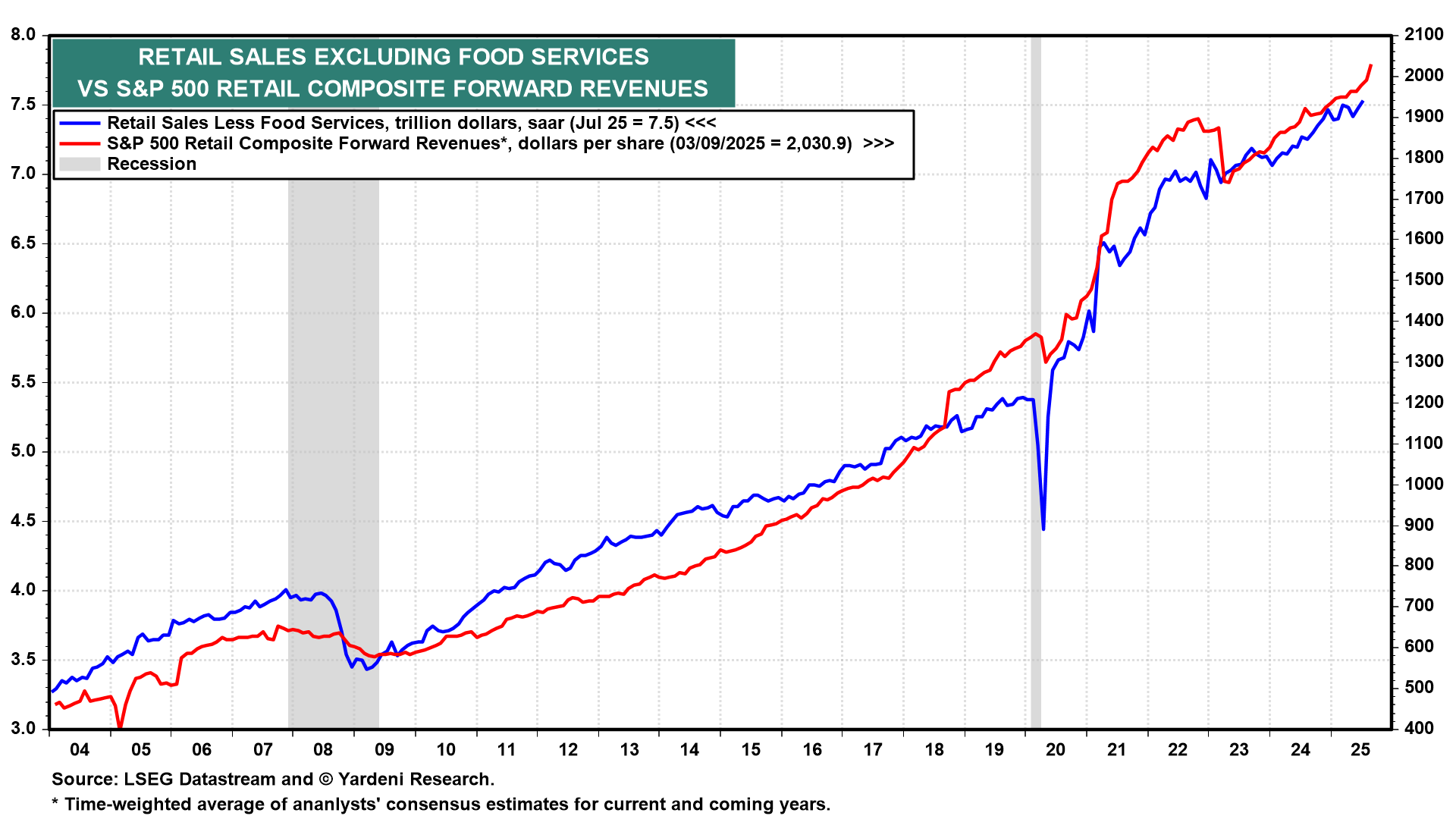

Now for some good news: Retailers mostly beat consensus analysts' expectations for the Q2 revenues and earnings per share of the companies in the S&P 500 Retail Composite industry. The forward revenues per share of this composite jumped over the past couple of weeks to a new record high through the week of September 3 (chart). That augurs well for retail sales in August. It confirms our view that consumer spending remains resilient, as does the overall economy.

Investors agree with our upbeat view of consumers, as evidenced by the strength in the S&P 500/400/600 Retail Composite stock price indexes.