Stock prices rose this morning as oil prices fell a bit on news reports that the Mullahs want Israel to stop pounding them and are willing to resume nuclear talks with the US as long as the US doesn't start pounding them too. Israel has established air superiority over Iran by knocking out most of the country's air defense systems. Israel is now focusing on knocking out Iran's ballistic missile launching sites to stop Iran's attacks on Israel. Israel is also bombing some of Iran's oil and gas facilities. Israel has yet to land the knockout punch on Iran's nuclear weapons capabilities. That could happen soon, since Israel is warning Iranians residing or working next to nuclear facilities to scram.

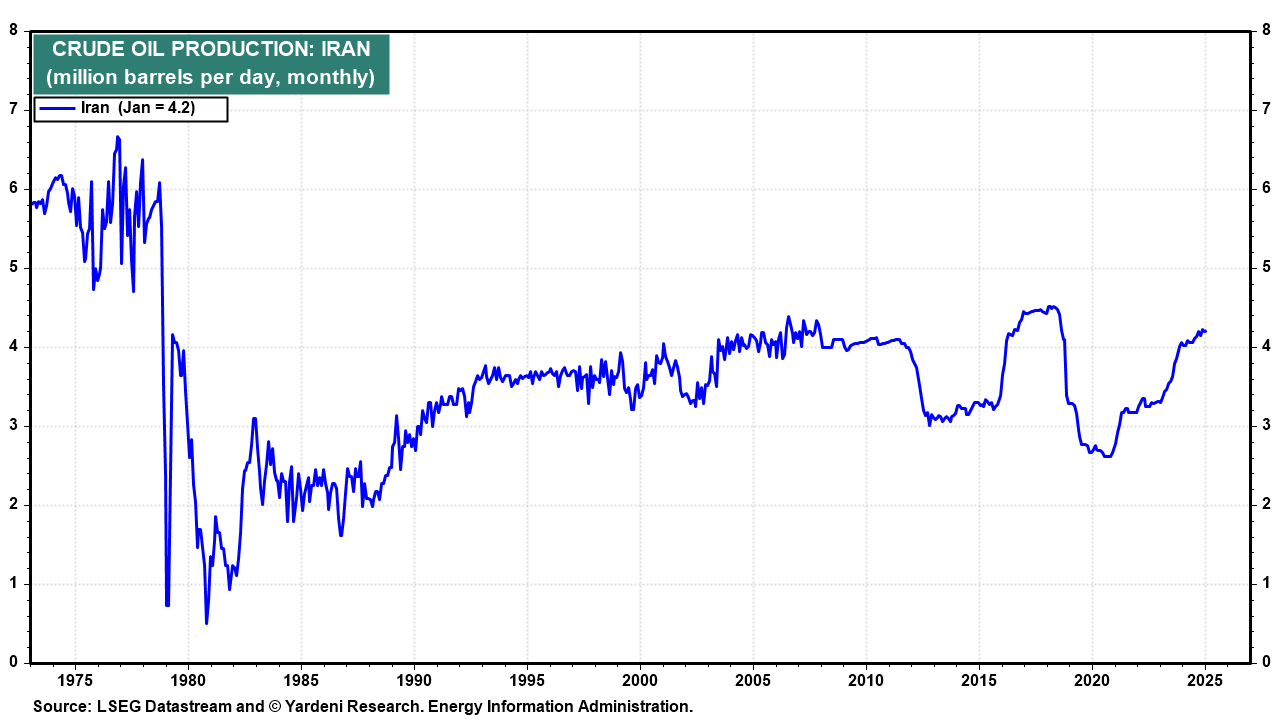

Stock investors have concluded that this war won't last much longer. Furthermore, Iran won't have nuclear weapons or missile delivery systems. And Iran won't shut the Strait of Hormuz. Moreover, there's plenty of excess oil capacity around the world to replace any reduction in Iran's oil production and exports (chart).

We agree with all the above. If we are right, then stock investors should be back to trying to sort out the same issues as before Israel attacked Iran on Friday, including President Donald Trump's tariffs, his Big Big Beautiful Budget Bill, economic growth, inflation, Fed policy, and artificial intelligence.