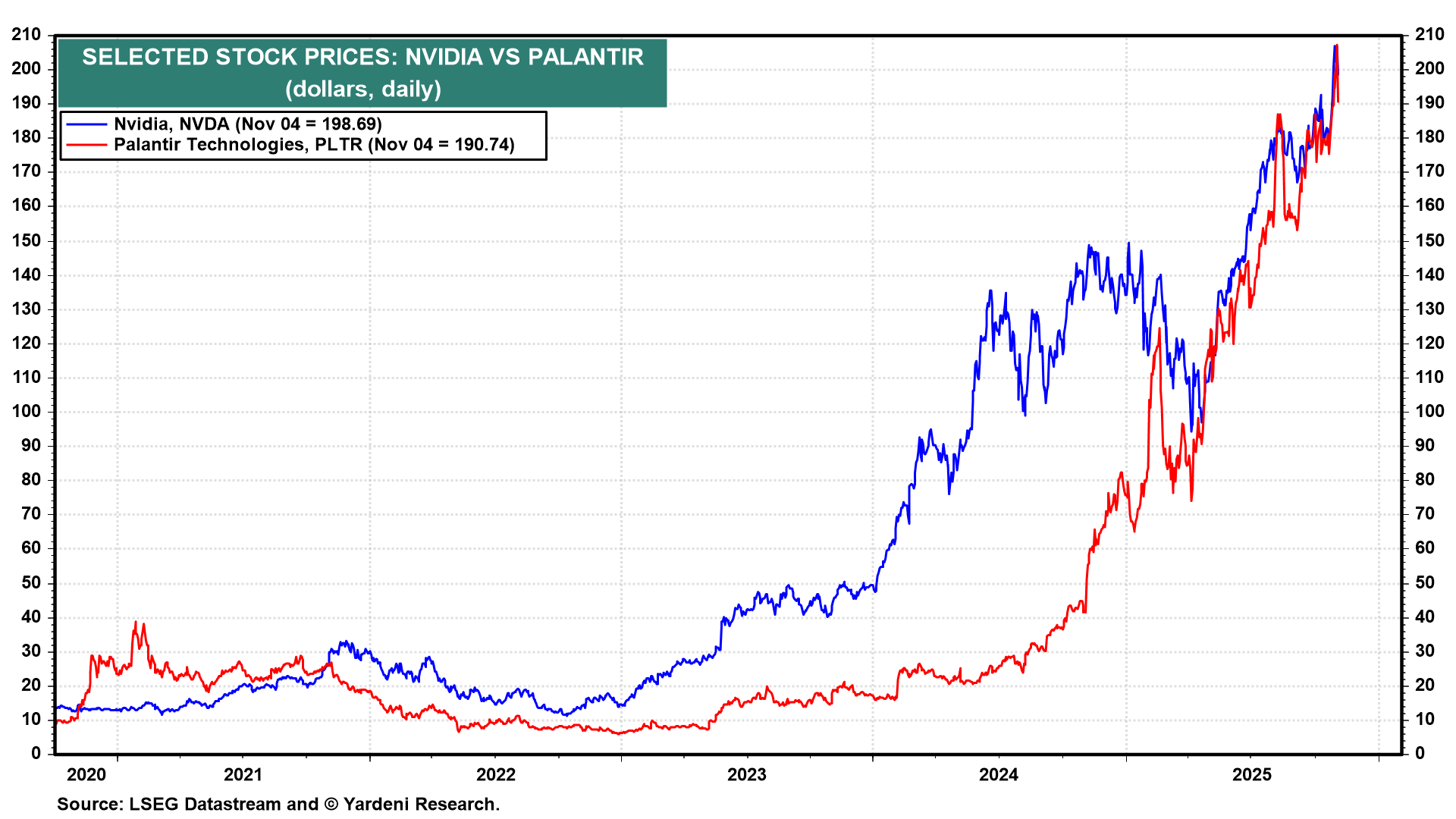

Hedge fund manager Michael Burry was portrayed in the film The Big Short. He bet big against the housing market before the 2008 crash and made a fortune. Now, he is taking another "big short" position against Nvidia and Palantir, two widely held AI stocks (chart). A regulatory filing showed that his hedge fund, Scion Asset Management, has bought put options on the two high flyers.

Investors are sitting on huge stock market gains, and some might have taken profits today, especially in AI-related stocks, in response to Burry's filing news. In the October 27 QuickTakes, we wrote: "The AI mania should continue to fuel the bull market in the S&P 500 Semiconductor index until it doesn't. Significant pullbacks have often followed new record highs in the index. We've been recommending overweighting the S&P 500 Information Technology sector and the Semis for a long time. Both are getting a wee bit frothy."

In Saturday's QuickTakes, we wrote: "While earnings are bullish, sentiment is bearish in the very short term. There are too many bulls."

Today, the S&P 500 Information Technology and Communication Services sectors combined accounted for a record 45% of the S&P 500's market cap and 38% of its earnings (chart). So there is more earnings support for the current tech bubble than the one in the late 1990s. There isn't as much air in the current bubble. It isn't likely to burst, though it might leak some air from time to time.