The banking crisis might be equivalent to a 100bps hike in the federal funds rate. We are just guessing, but financial conditions have surely tightened a lot as a result of the SVB earthquake and its aftershocks. Further hikes in the federal funds rate are no longer necessary to get it into restrictive territory as Fed officials have been aiming to do since they started the latest monetary policy tightening cycle a year ago.

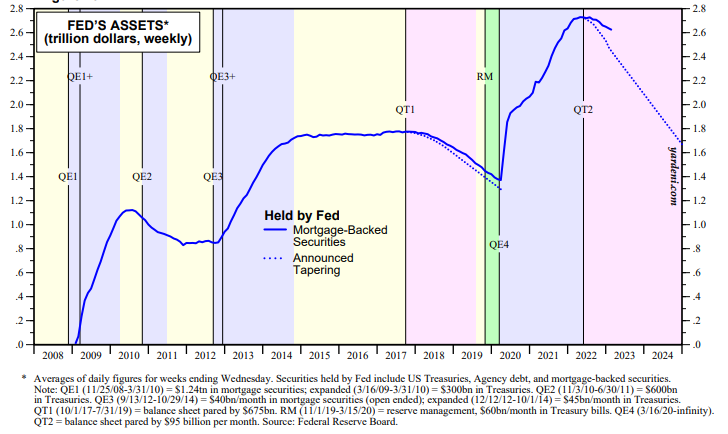

If the Fed stops raising interest rates, will it also stop it's quantitative tightening? It might have to at least stop reducing its holdings of mortgage-backed securities (chart).

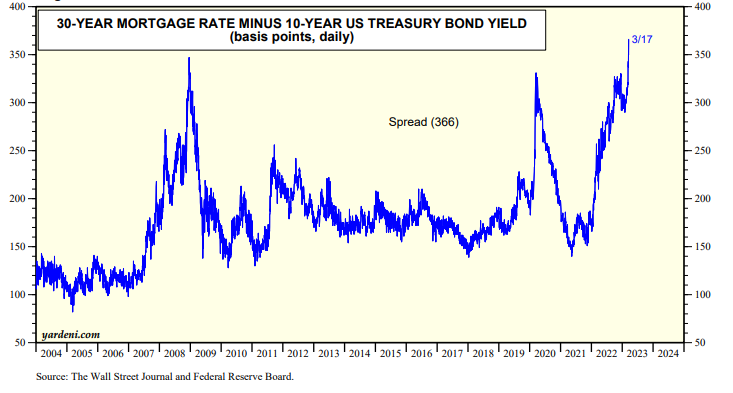

At the start of last year, "Feddie" announced plans to exist the mortgage lending business by letting its huge holdings of mortgage-backed securities roll off as they matured and possibly even sell them outright. As a result, the spread between the 30-year mortgage rate and the 10-year Treasury bond yield more than doubled from 150bps to 320bps (chart). The spread jumped to 366bps at the end of last week exceeding the peak of the Great Financial Crisis.

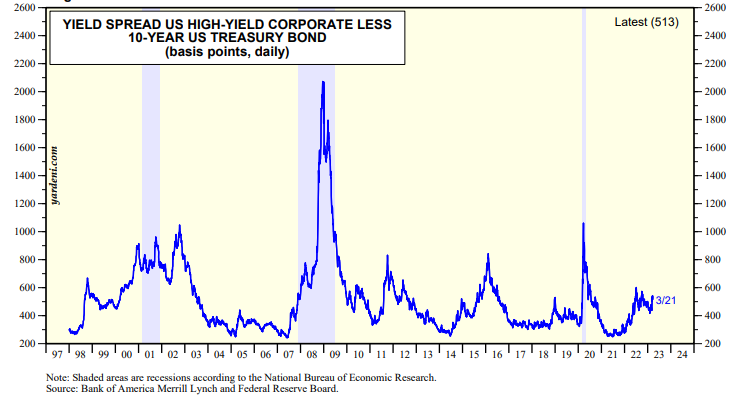

The banking crisis and the widening spread in the mortgage market suggest that Fed policymakers should pause tightening to avoid any further turmoil in the credit markets and even greater financial instability. Today's stock market rally suggests that stock market investors are betting that the banking crisis won't cause a recession if it forces the Fed to cease and desist from any further tightening. The relatively subdued yield spread between junk and Treasury bonds is consistent with this scenario, for now (chart).