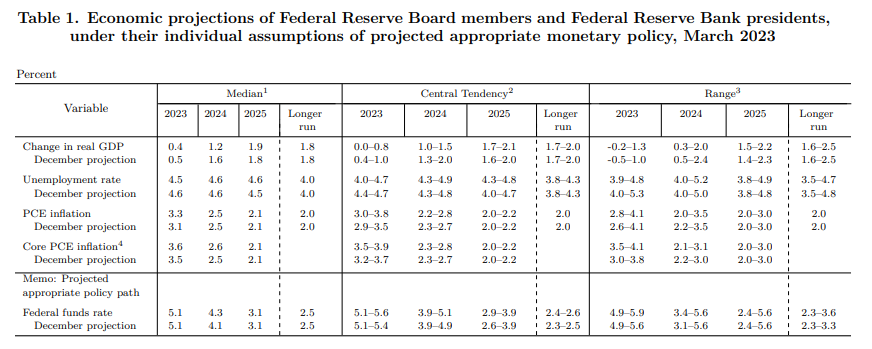

The FOMC raised the federal funds rate by 25bps to 4.75%-5.00%. The committee's statement reassuringly noted: "The U.S. banking system is sound and resilient." Nevertheless, the recent banking crisis undoubtedly turned Fed officials less hawkish. Fed Chair Jerome Powell in his post-meeting presser said that inflation remains too high, yet the median forecast of the federal funds rate in the FOMC's Summary of Economic Projections (SEP) remained virtually identical to the one in the December SEP as did the outlook for the economy (table).

Fed officials hinted that they might be almost done raising interest rates soon in their statement: "The committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time." The statement dropped a phrase used in the previous eight statements that said the committee anticipated "ongoing increases in rates would be appropriate."

The latest SEP suggests one more 25bps hike might be ahead. Powell acknowledged that the banking crisis may be equivalent to a rate hike, which reduces the need for additional tightening by the Fed. In other words, the federal funds rate may be (almost) restrictive enough to achieve the soft-landing scenario outlined in the SEP below.