The financial press was flooded with "American Exceptionalism" narratives throughout 2023 and 2024, and into early 2025. The April 15, 2024 cover story of The Economist was titled, "Riding High: The lessons of American exceptionalism." On May 25, 2024, the cover story of The Economist was "The almighty dollar." It focused on the dollar's enduring global dominance.

The "Sell America" trade—the contrarian bet that the multi-year era of American economic and market outperformance is finally ending—began gaining significant traction in the financial press late in 2024 and accelerated in 2025. Last year, the US dollar was weak, and the US stock market underperformed the All Country World ex-MSCI stock price index.

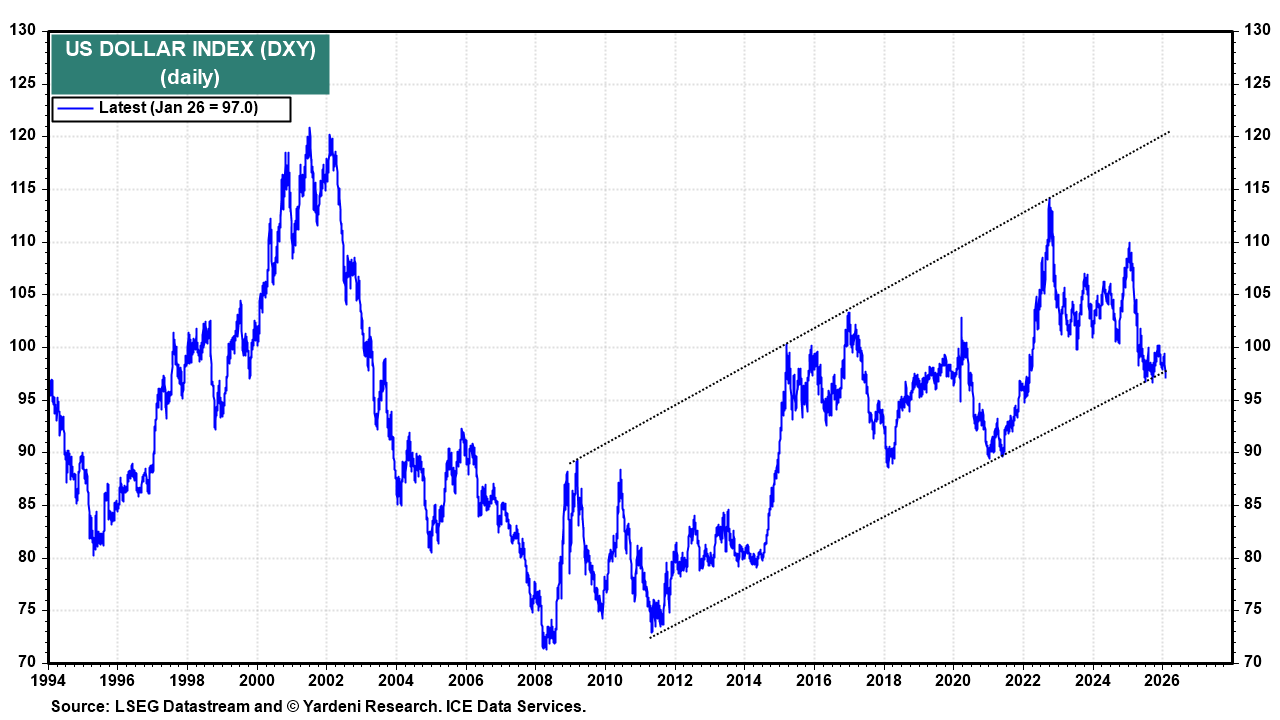

The consensus view was that global investors were selling their US stocks and bonds to buy more of such securities in Europe, Japan, and emerging markets. Soaring precious metals prices last year and so far this year are giving the Sell America trade even more credibility, as is the weak dollar, which seemed to be finding support above its rising uptrend line. It edged below it today as the yen bounced from its recent fall (chart).

We had championed a Buy America investment strategy (which we called "Stay Home" rather than "Go Global") since 2010. It worked very well, as evidenced by the uptrend in the ratio of the US MSCI to the All Country World ex-US MSCI in both local currency and dollar terms (chart). On December 7, 2025, we recommended moving from Stay Home toward Go Global. We don't view it as a Sell America call, but rather as a rebalancing call.