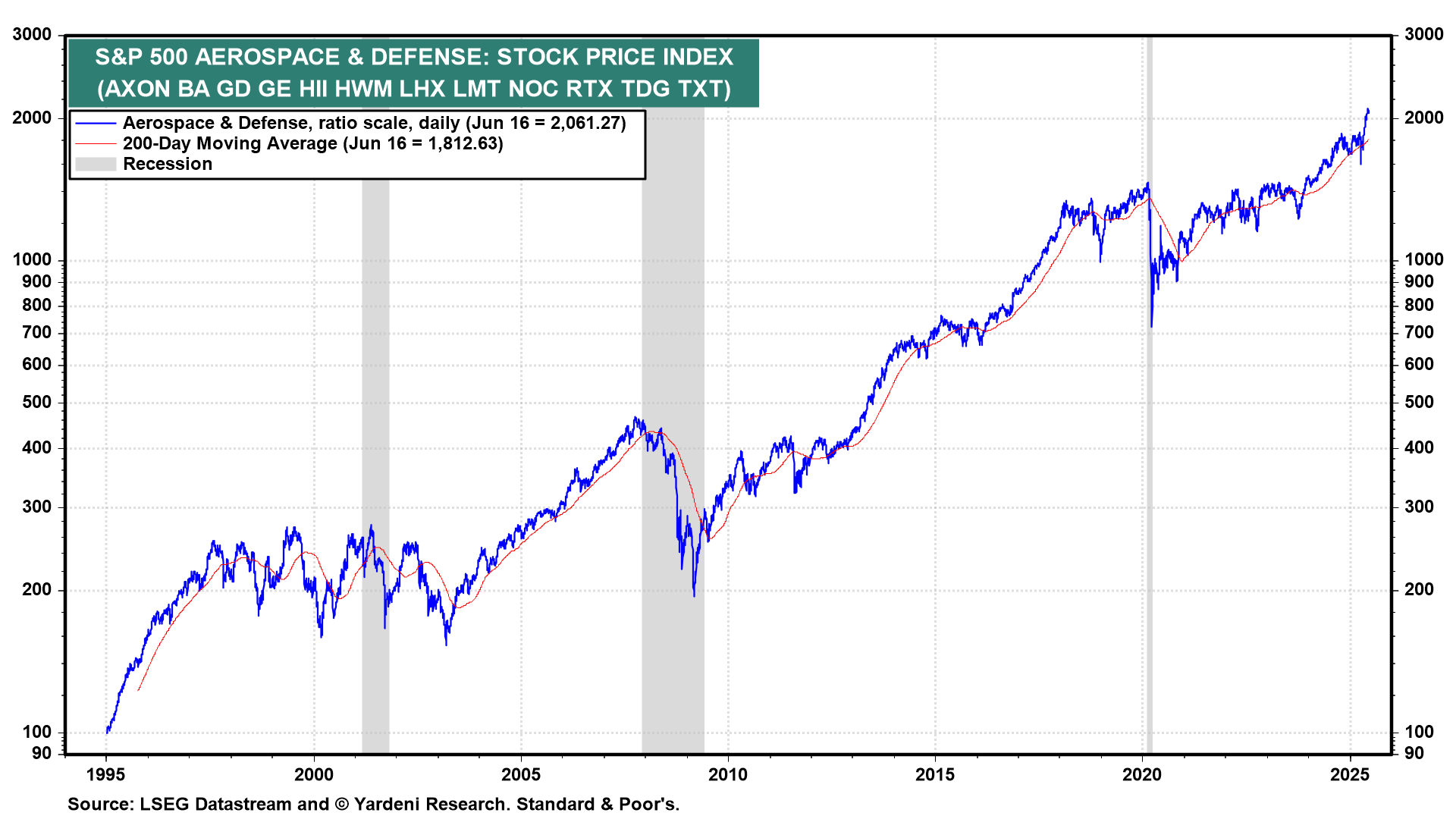

The stock market held up remarkably well today considering that President Donald Trump abruptly left the Group of Seven meeting in the Canadian Rockies this morning. On his way home, he warned Tehran's residents to get out of town immediately. He also warned Iranian leader Ayatollah Ali Khamenei that he is an "easy target" and "our patience is wearing thin." In a subsequent post, he then demanded "UNCONDITIONAL SURRENDER" by Iran. His comments today suggest that the US might enter the war against Iran by dropping bunker-busting bombs on the country's nuclear facilities. The S&P 500 Aerospace & Defense stock price index is soaring in record-high territory (chart).

Under the circumstances, the participants of the Federal Open Market Committee (FOMC) have lots to discuss during their two-day policy meeting that ends tomorrow. What's not on the table is a rate cut anytime soon, in our opinion. That leaves Fed watchers focused on how Fed Chair Jerome Powell spins the range of views following the FOMC meeting at his presser tomorrow afternoon.

Fed watchers also will be focusing on the committee's latest Summary of Economic Projections (SEP). Odds are that its median economic forecasts will show slow economic growth with a slight increase in the unemployment rate and a modest short-term uptick in inflation--all mostly consequences of President Donald Trump's tariffs and now the war between Israel and Iran. The SEP is likely to signal a couple of small cuts in the federal funds rate in coming months. But Powell will certainly reiterate that the FOMC is in no hurry to do so.

Let’s review the highlights of today's economic releases: