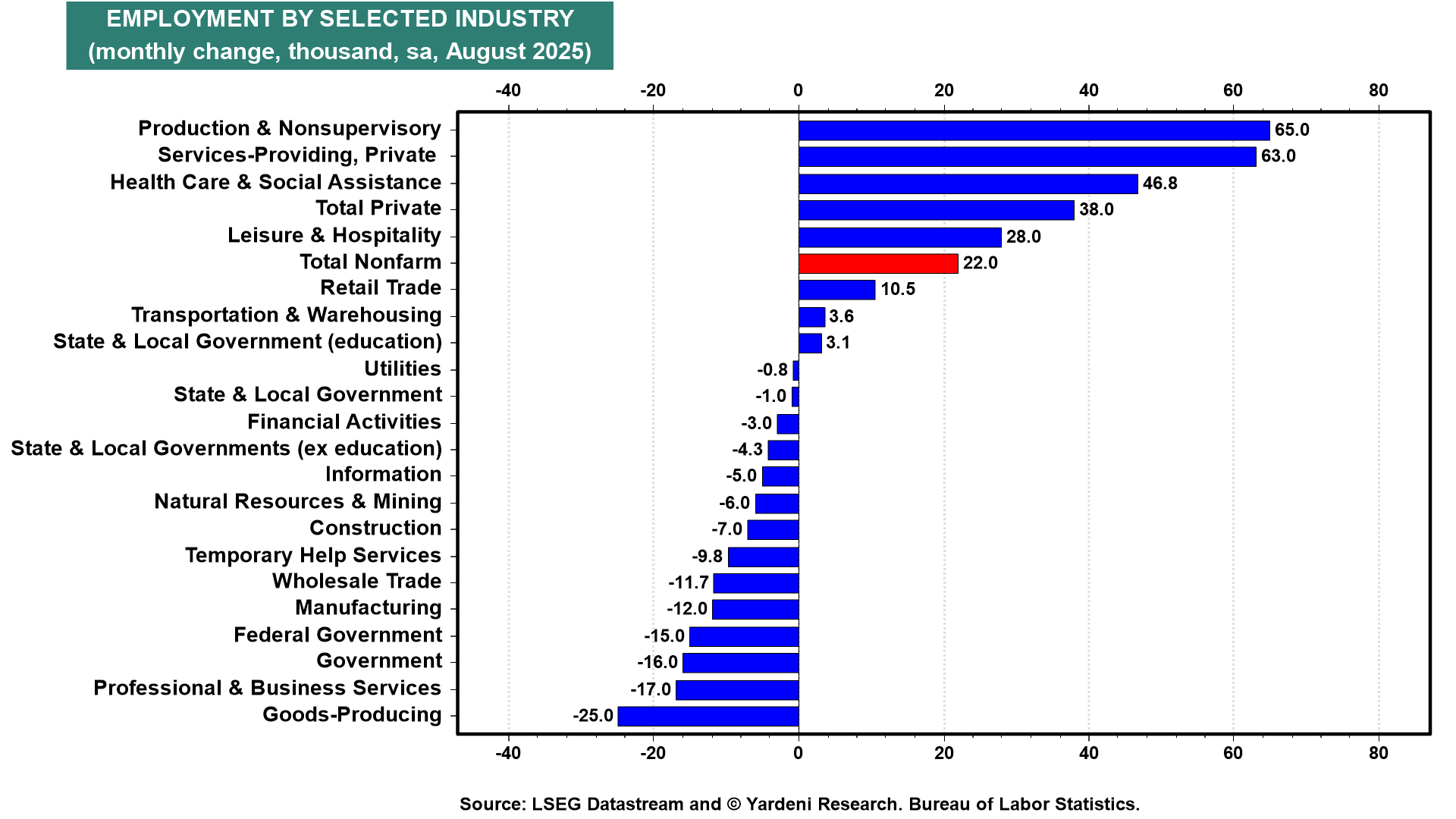

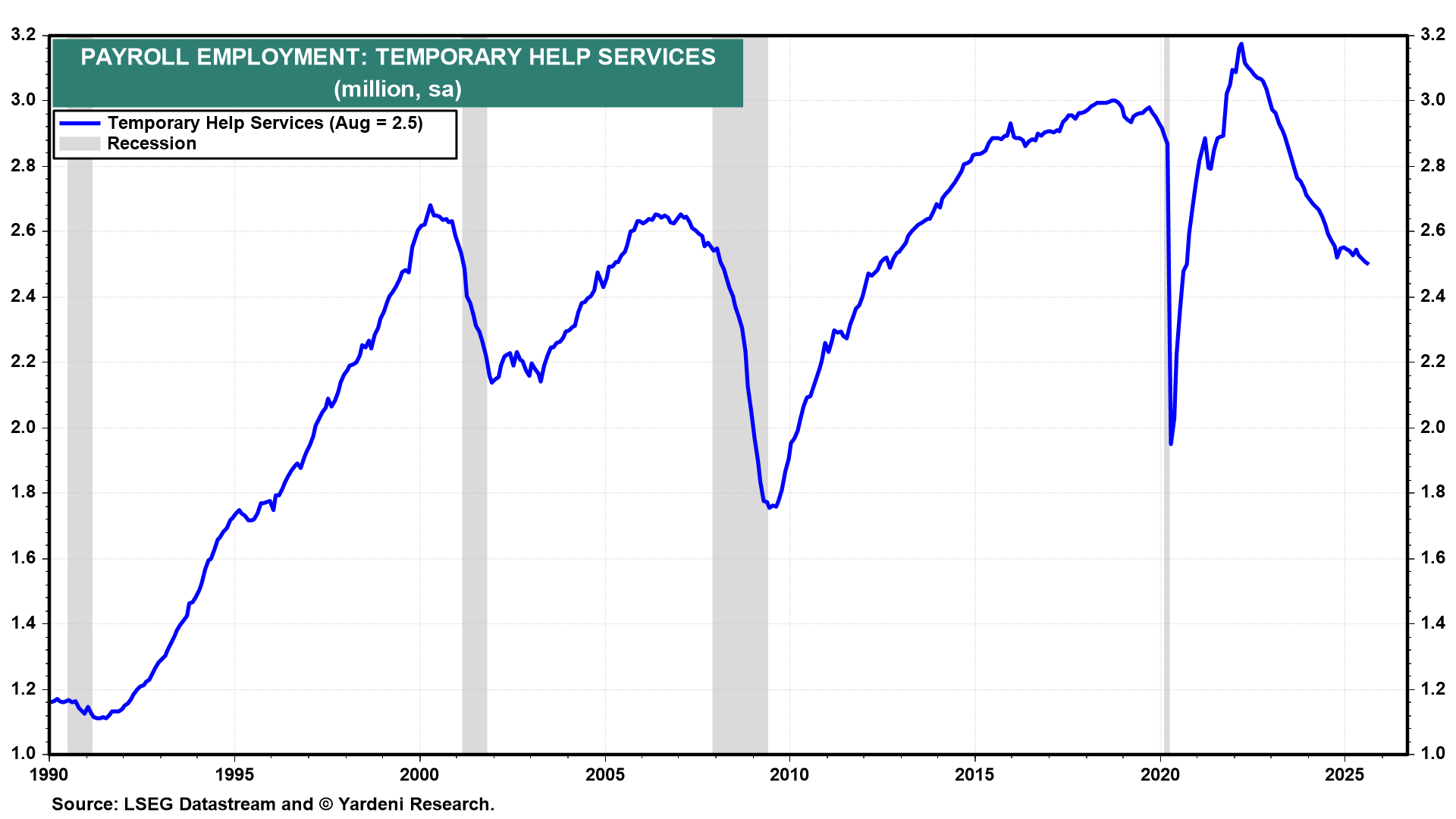

August's employment report was released this morning. It was weaker than expected. The month's payrolls rose by just 22,000. June's number was revised down by 27,000 to a decline of 13,000, while July's number was revised up by 6,000 to 79,000. August's big losers were goods producers (-25,000), professional & business services (-17,000, with temporary help services down 9,800), and government (-16,000) (chart).

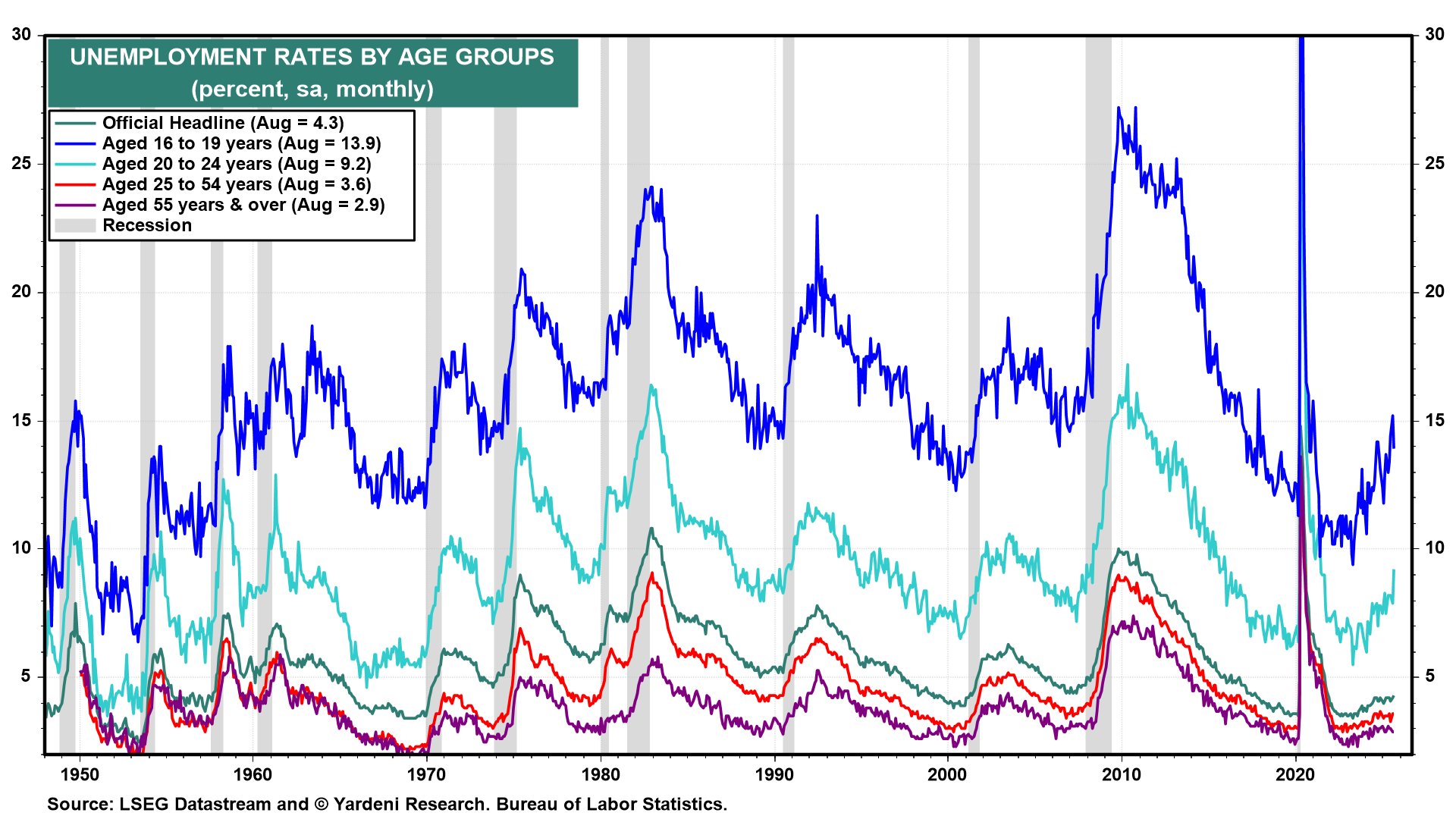

Yet, the unemployment rate edged up only slightly from 4.2% in July to 4.3% last month, suggesting that the labor market remains at full employment. The unemployment rates for workers aged 25 years or more remained relatively unchanged below 4.0% (chart). The jobless rate for teens fell to 13.9%, while it increased to 9.2% for workers aged 20 to 24. It is getting tougher for college graduates to find jobs.

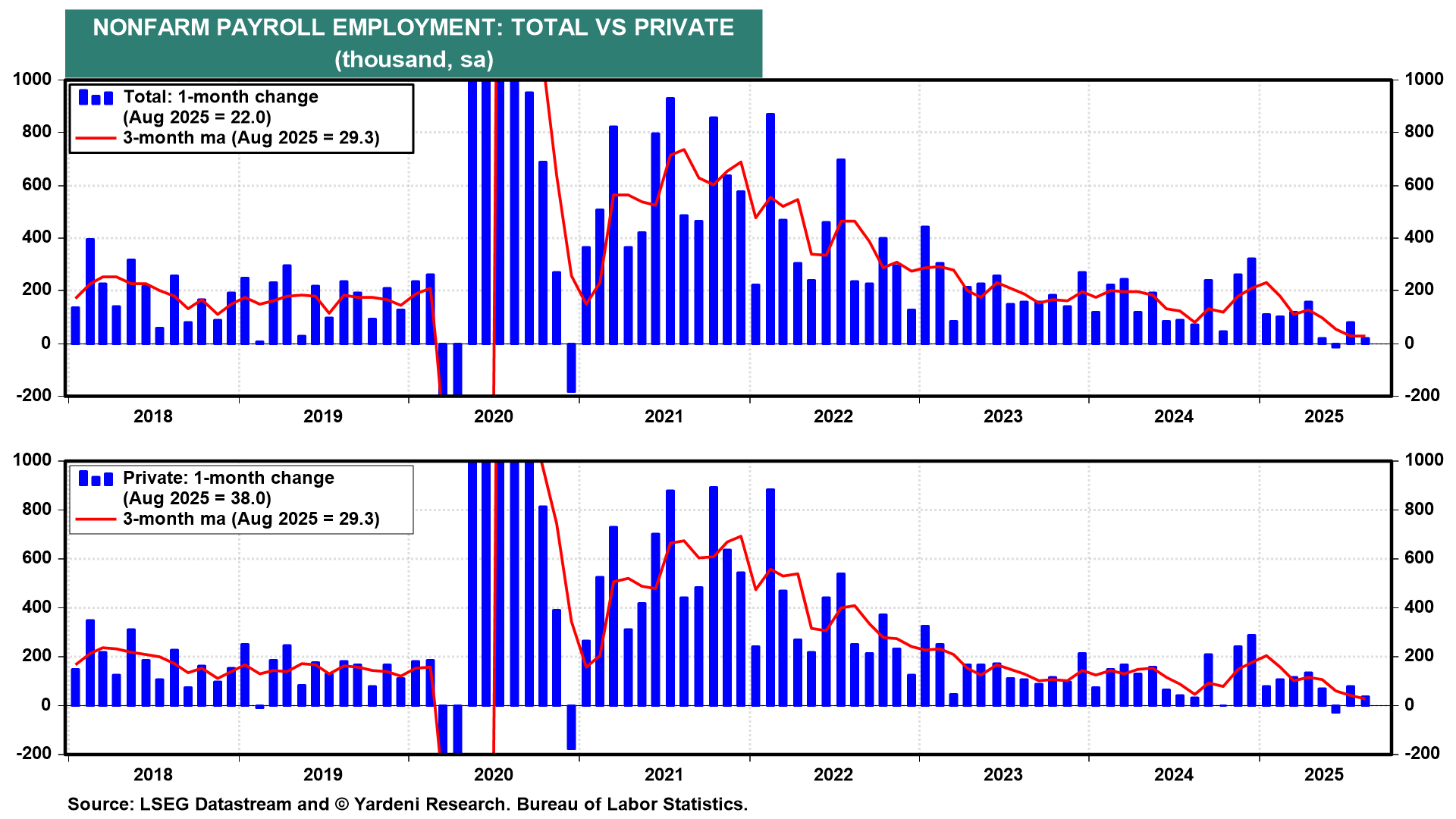

Over the past three months, payroll gains averaged just 29,300 per month (chart). That is low, but it might be close to the new "breakeven" pace necessary to keep the unemployment rate from rising. Labor force growth has been weak due to limited immigration and increasing deportations. Therefore, the labor market needs to create fewer jobs to maintain a low unemployment rate.

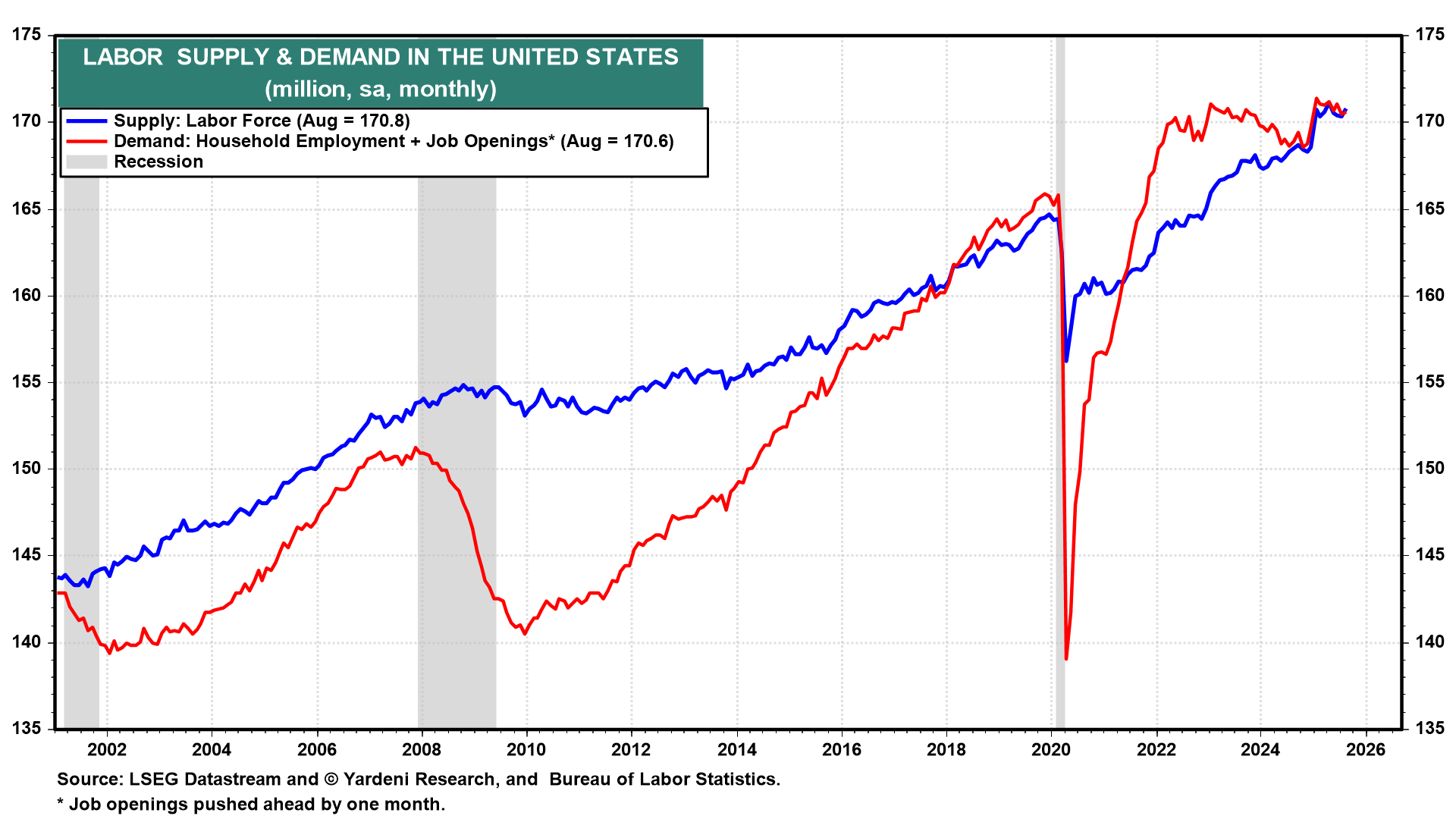

During August, the supply of labor (i.e., the labor force) matched the demand for labor (i.e., household employment plus job openings) (chart). The difference between the two is one of Fed Chair Jerome Powell's favorite labor market indicators. It shows that the job market is in equilibrium currently.

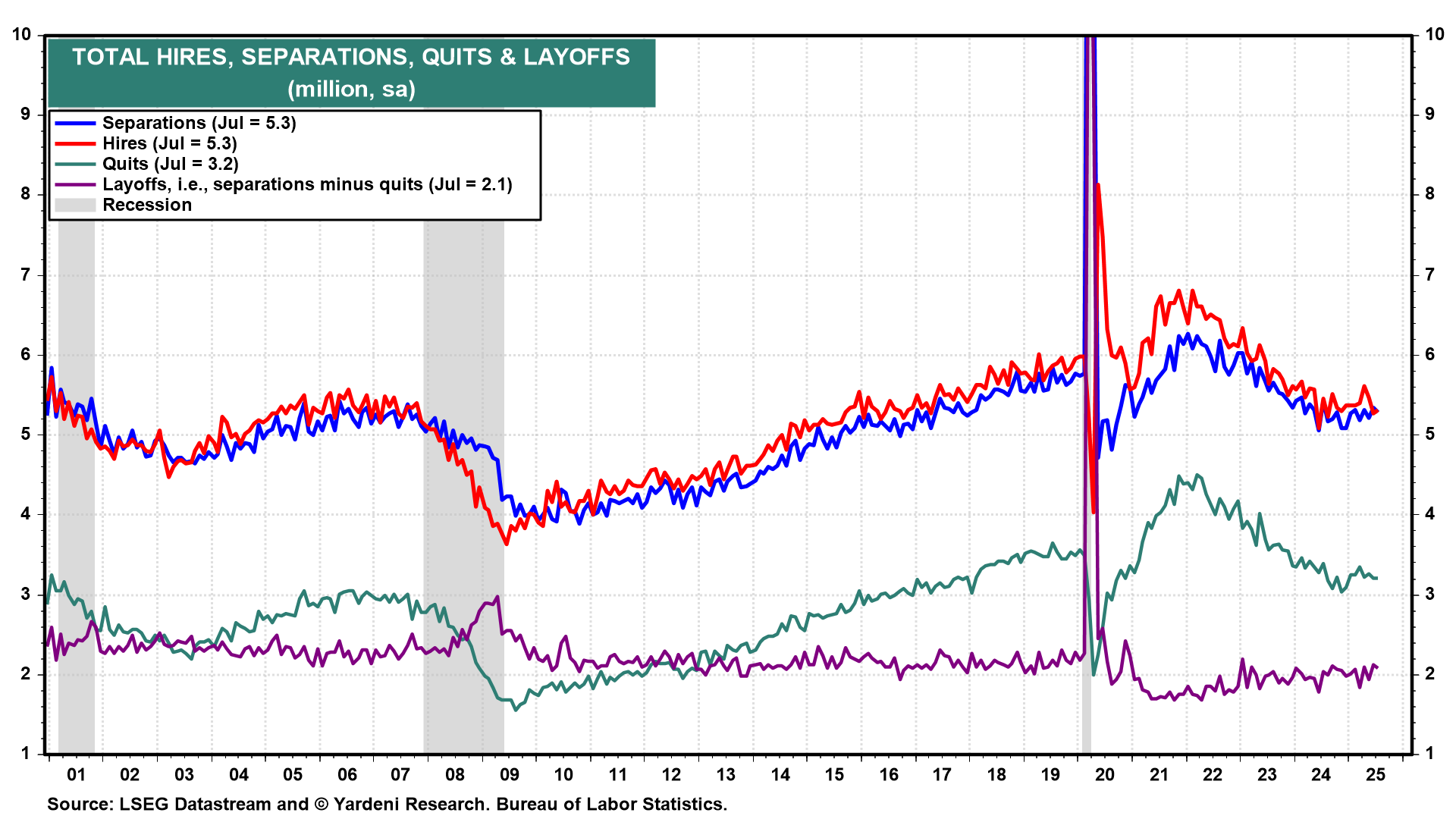

A few pundits have recently described the labor market as being in a "don't-fire-don't-hire" mode. That's not an accurate description. During August, 5.3 million workers were hired (chart). It was matched by 5.3 million in separations, with quits at 3.2 million and layoffs at 2.1 million. These are all relatively normal readings!

As noted above, employment in temporary help services fell during August (chart). It has been falling for the past couple of years, providing a misleading indicator of the economy's weakness. It is likely to continue to decline if AI reduces the demand for temporary workers, as seems likely. An increase in productivity would offset that.

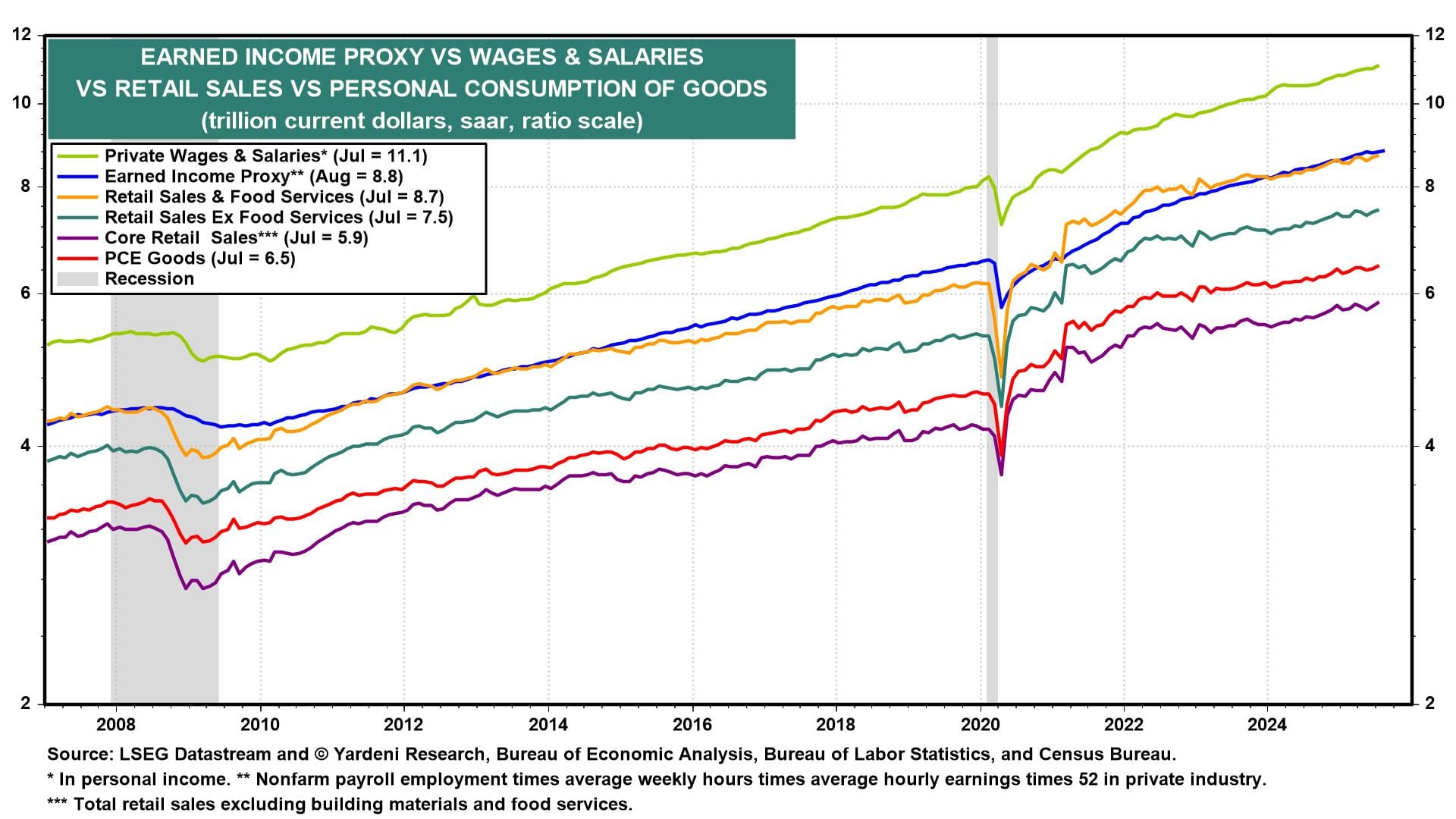

Our Earned Income Proxy rose only 0.3% m/m as wages rose by the same amount, while hours worked were unchanged in August (chart). If productivity growth offsets the slowdown in employment growth, then real wages should increase at a faster pace in the coming months, thus boosting consumption growth.