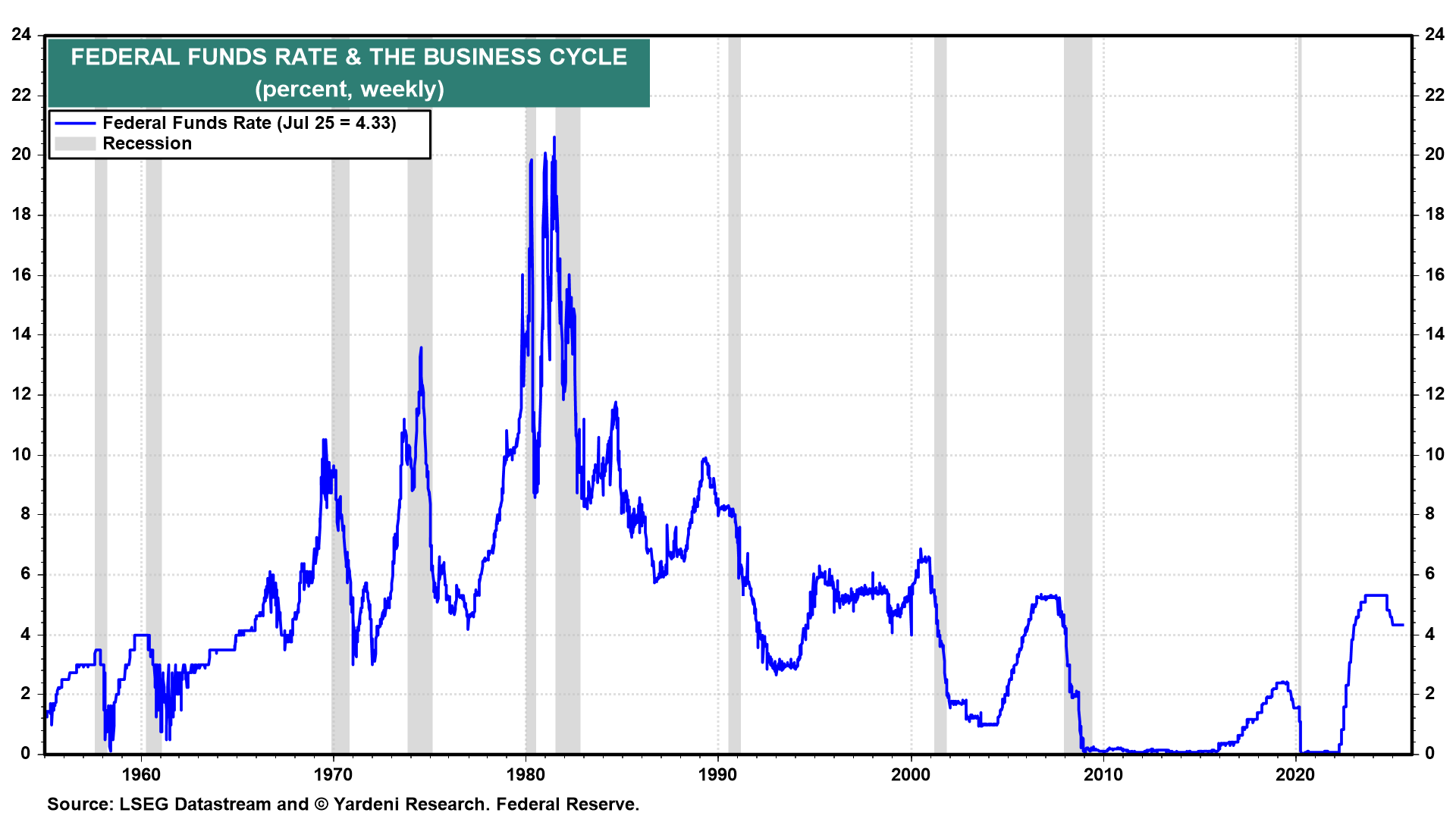

On Wednesday, the Federal Open Market Committee will announce its latest monetary policy decision. Odds are that it will be a non-event, i.e., the federal funds rate will remain unchanged (chart). The only drama will be whether the FOMC sticks to the current party line: "We are in no rush to lower interest rates." Or, will it signal a dovish pivot?

If Governors Christopher Waller and Michelle Bowman dissent from the vote, then the rest of the FOMC's voting members have decided to stick with the relatively hawkish party line. If they don't dissent, then expect that the FOMC's participants, including Fed Chair Jerome Powell, will signal that they will be considering a rate cut at their September meeting. President Donald Trump selected Waller and Bowman to serve as Fed governors, and both are dovish.

Another significant development for the financial markets may occur on Wednesday morning when the US Treasury outlines its plans for financing the federal government's borrowing needs through the issuance of Treasury securities. The Quarterly Refunding Statement (QRS) provides detailed plans for auctions of notes, bonds, Treasury Inflation-Protected Securities (TIPS), and Floating Rate Notes (FRNs) to refund maturing securities and raise new cash (chart).