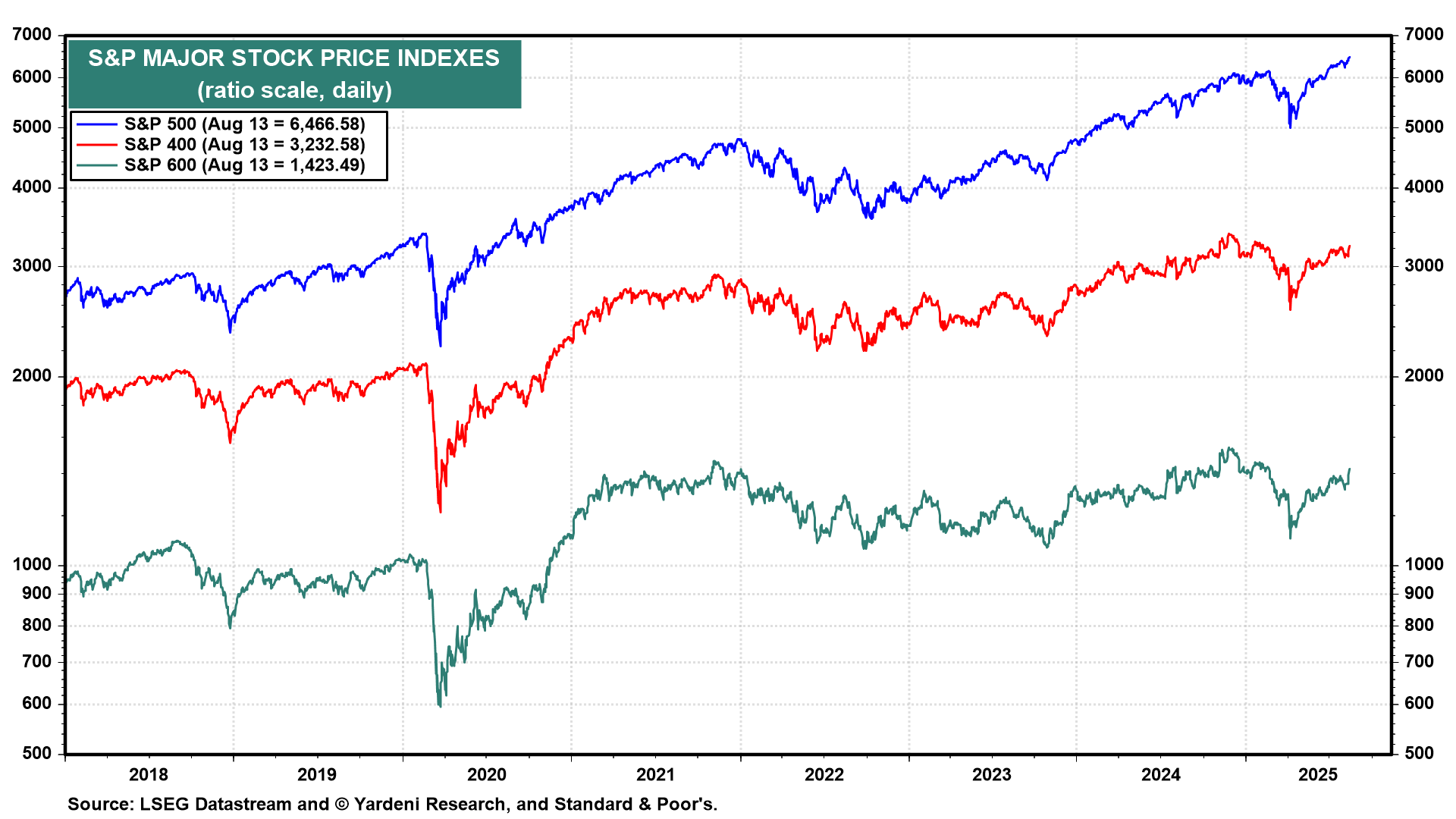

Are SMidCaps coming back into fashion? They had a good day today. They outperformed the LargeCaps. The S&P 500 LargeCaps was up 0.3%, while the S&P 400 MidCaps and the S&P 600 SmallCaps rose 1.6% and 2.0% (chart). The Russell 2000 SmallCaps rose 2.0% as well.

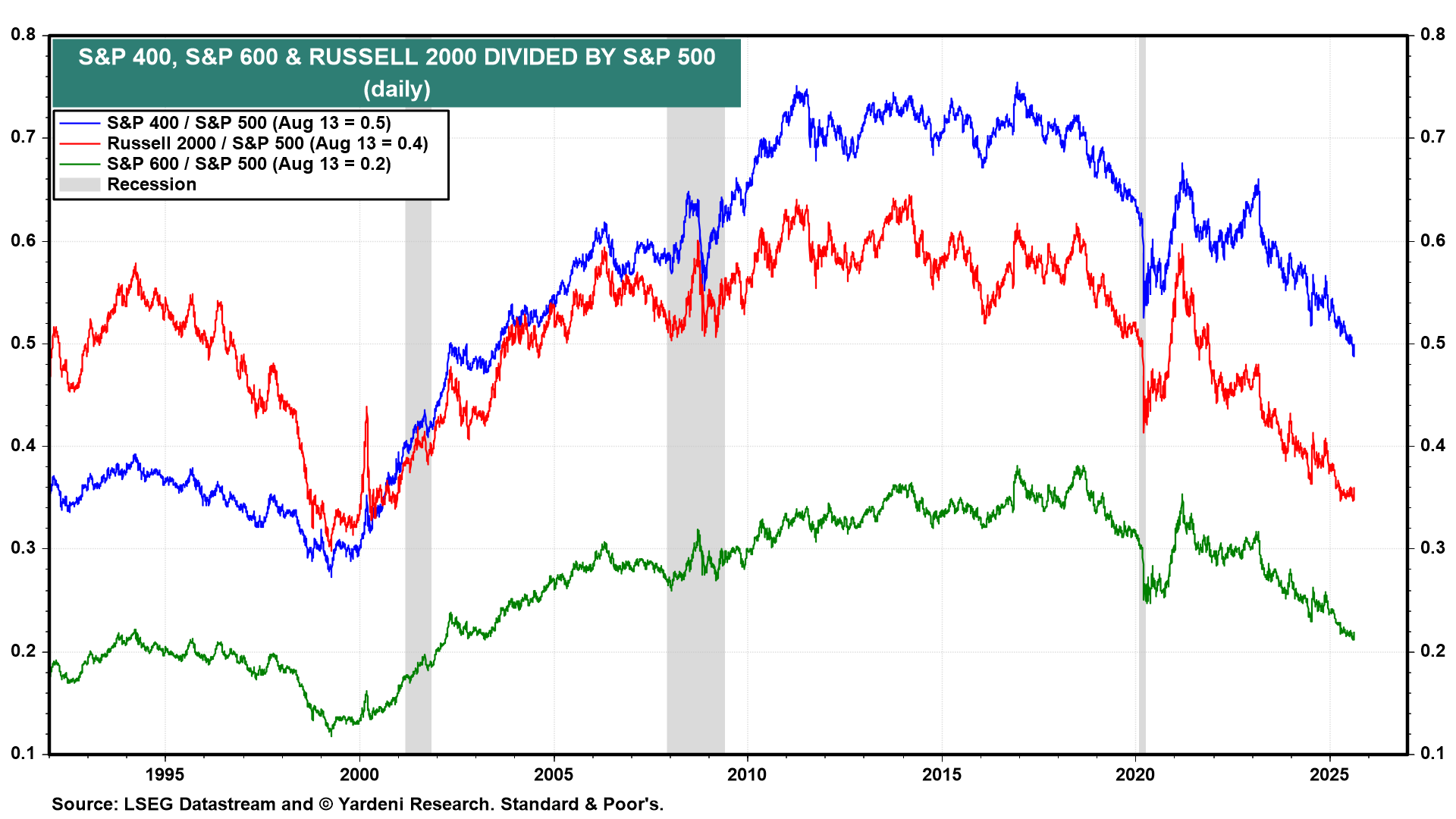

That led lots of market commentators to declare after the close that the SMidCaps may be finally starting to outperform the LargeCaps. That's something they haven't done consistently since roughly 2018 (chart). And there have been lots of similar calls since then that haven't panned out.

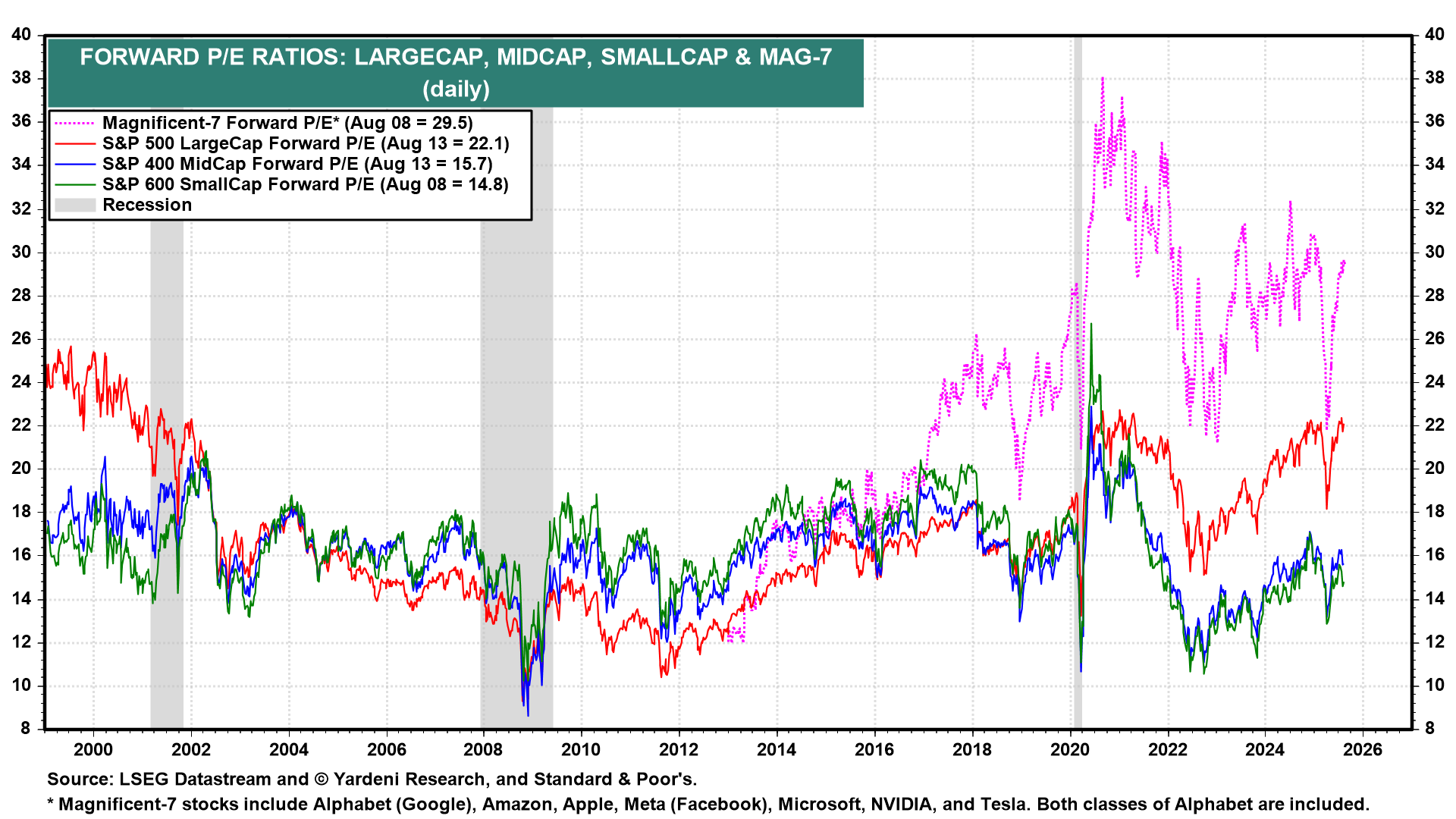

Of course, the explanation for why the SMidCaps might outperform the LargeCaps for a while is that they should do better if the Fed is about to lower the federal funds rate some more, as is widely expected. They are certainly cheaper than the LargeCaps (chart).

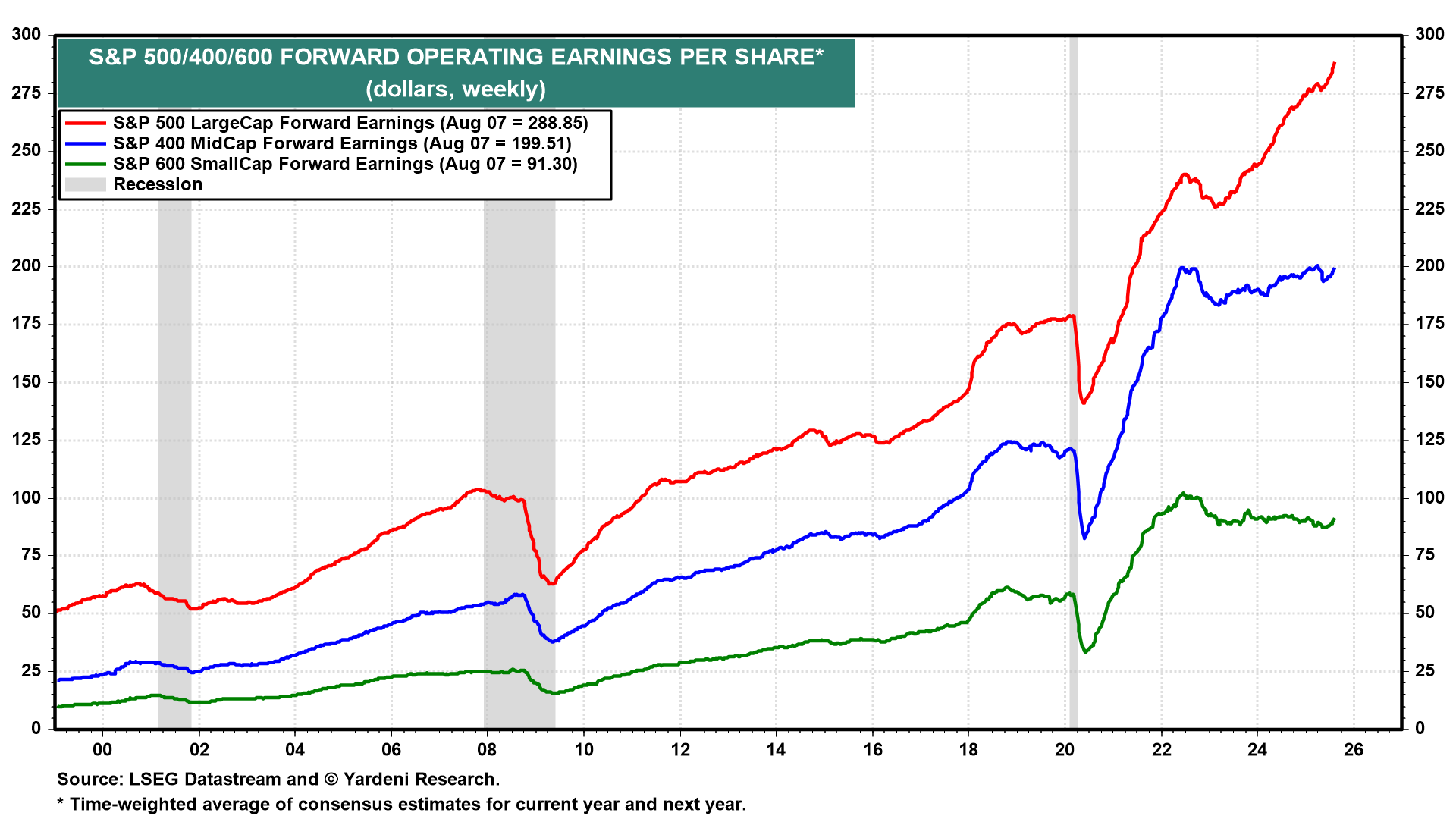

The problem is that the SMidCaps are cheap for a reason. Their forward earnings have been in a coma (i.e., flatlining) since 2022 (chart). The forward earnings of the S&P 500 has been rising to new record highs since mid-2023! We doubt that the forward earnings of the SMidCaps will finally start rising just because the Fed starts easing again. The Fed did so at the end of last year, cutting the federal funds rate by 100bps from September 19 through December 19, 2024. Yet SMidCaps continued to underperform.

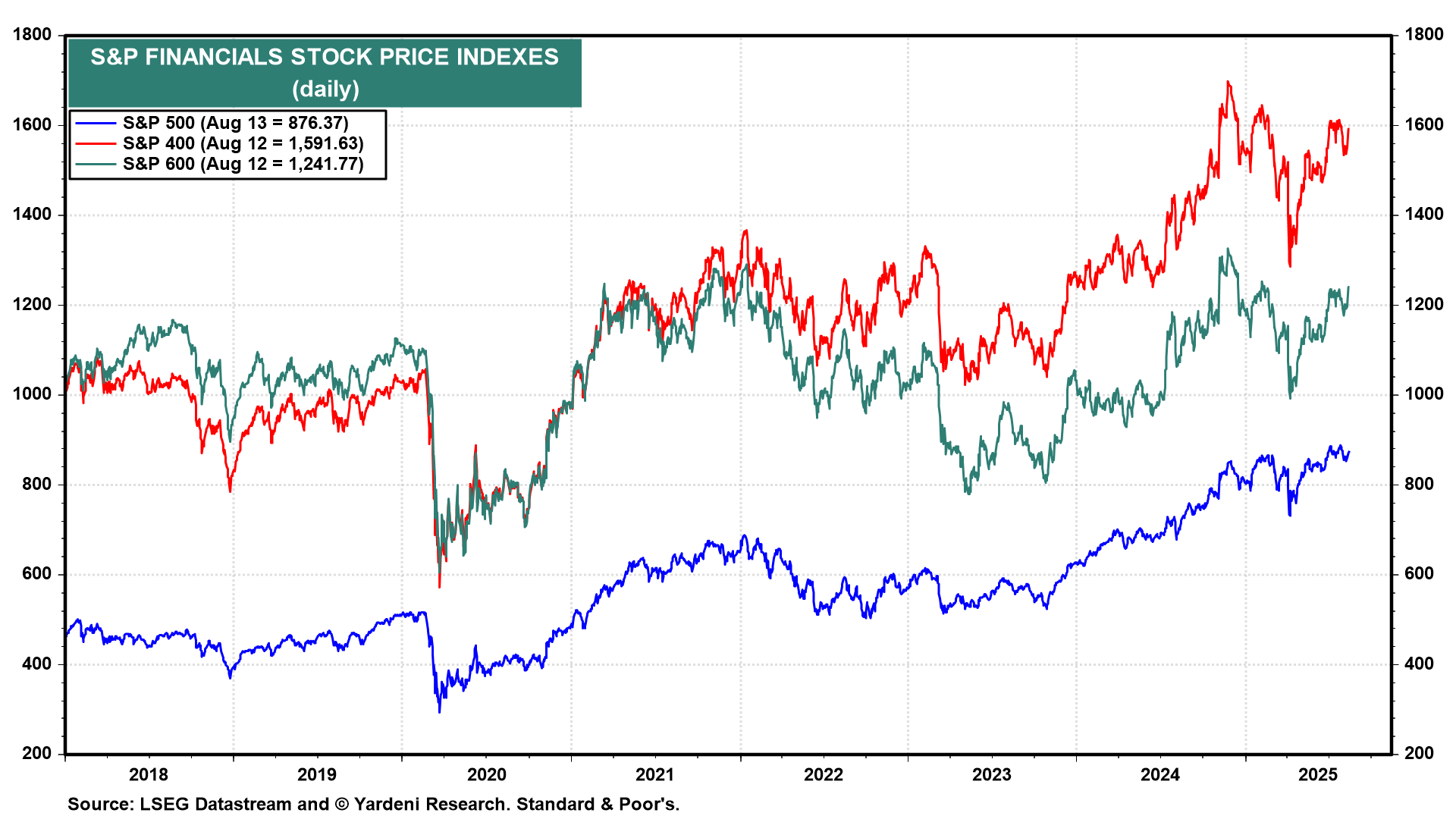

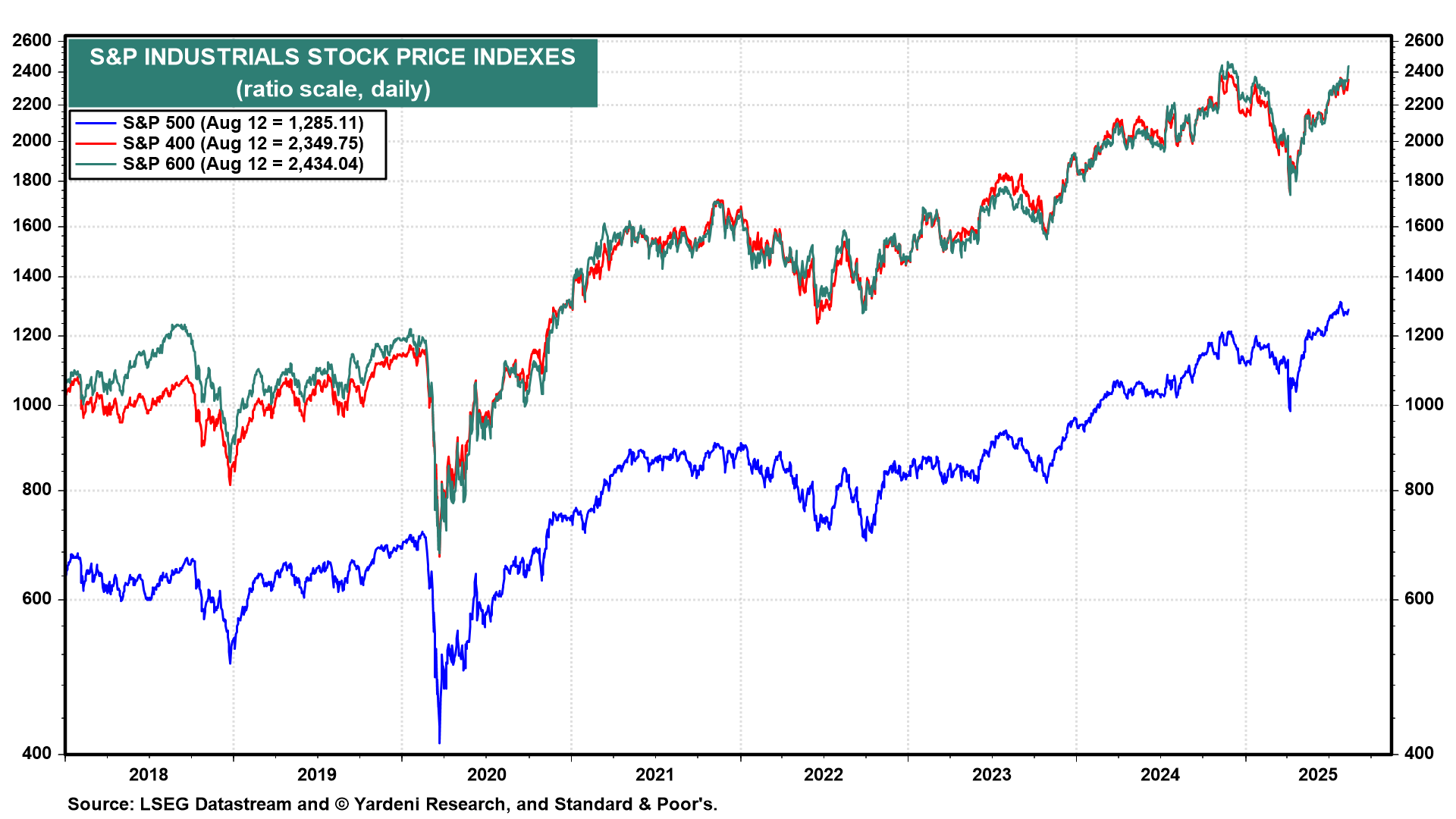

Nevertheless, among the sectors, SMidCaps could outperform LargeCaps in the Financials and Industrials, in our opinion (charts).