Will the S&P 400 MidCaps and the S&P 600 SmallCaps (i.e., SMidCaps) finally outperform the S&P 500 LargeCaps this year? Maybe. They’re overdue to do so. However, we think investors would be better off focusing on select SMidCaps sectors rather than the broad indexes. We would overweight the same SMidCap sectors as we recommend overweighting in the S&P 500: Financials, Industrials, and Health Care.

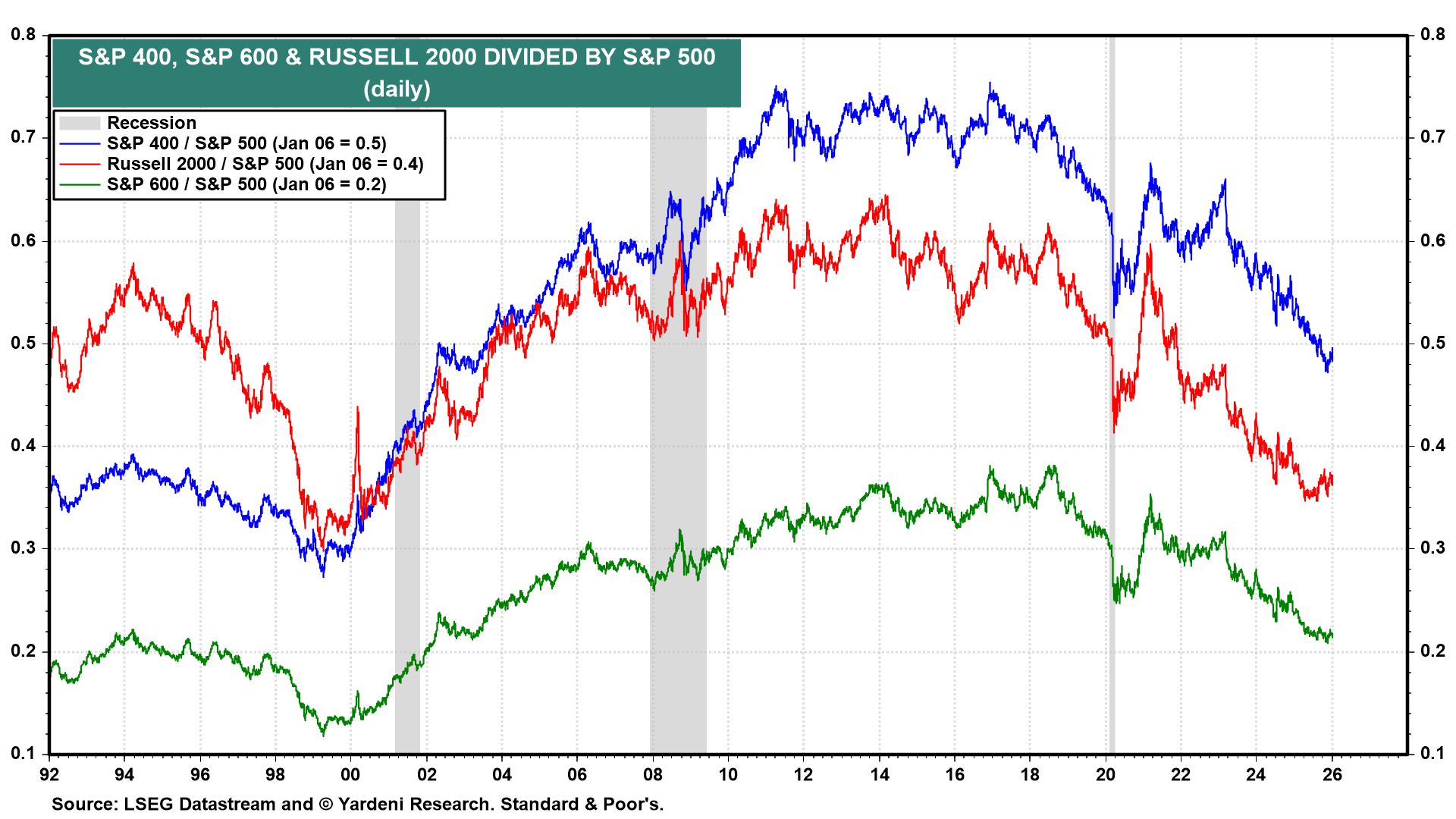

The SMidCaps have been underperforming the LargeCaps since about 2018 (chart). They briefly outperformed in 2020 and 2021 following the Fed's dramatic easing of monetary policy in March 2020 in response to the pandemic. SMidCaps tend to underperform when investors fear a recession is coming, as in 2022 and 2023. But recession fears abated in 2024 and 2025, yet the SMidCaps continued to underwhelm.

The problem is that the forward earnings of both the S&P 400 and S&P 600 have been mostly flat since late 2022, while the forward earnings of the S&P 500 has soared to new record highs (chart). We think it's mostly because LargeCap companies buy the most promising SMidCap companies before their earnings really take off. Then again, we have seen some improvement in the forward earnings of the SMidCaps in recent weeks.