Stock market sentiment remains bearish, which is bullish for longer-term investors with a contrarian streak. Consider the following:

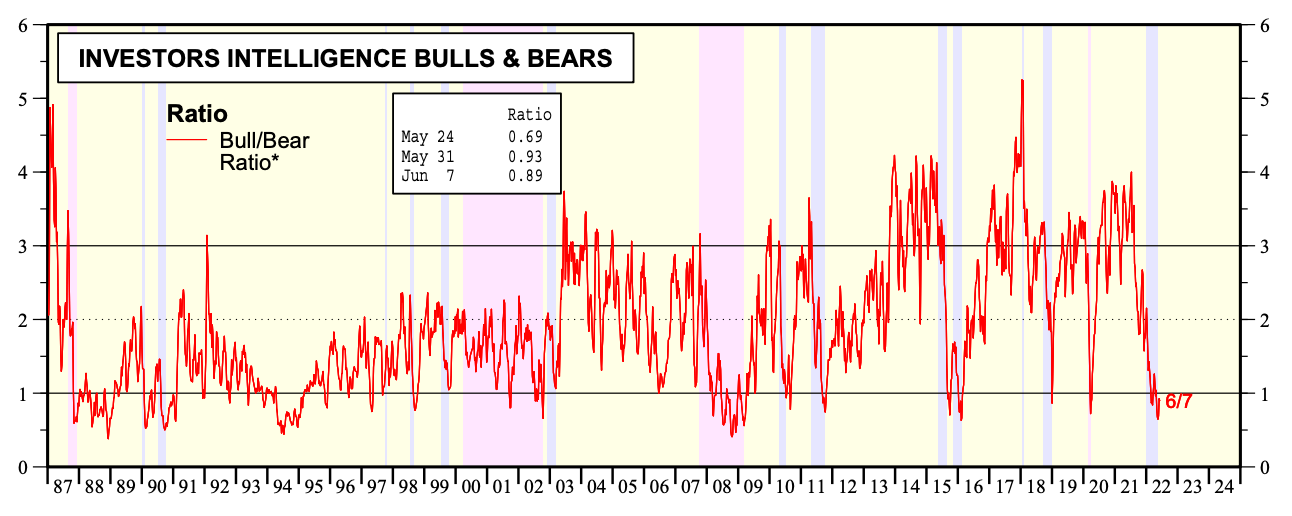

(1) Investors Intelligence Bull/Bear Ratio (BBR) was below 1.00 for the sixth successive week this week—slipping to 0.89 this week, after climbing the prior two weeks from 0.65 (the lowest since mid-February 2016) to 0.93 over the period. The BBR has been bouncing around 1.00 since late February.

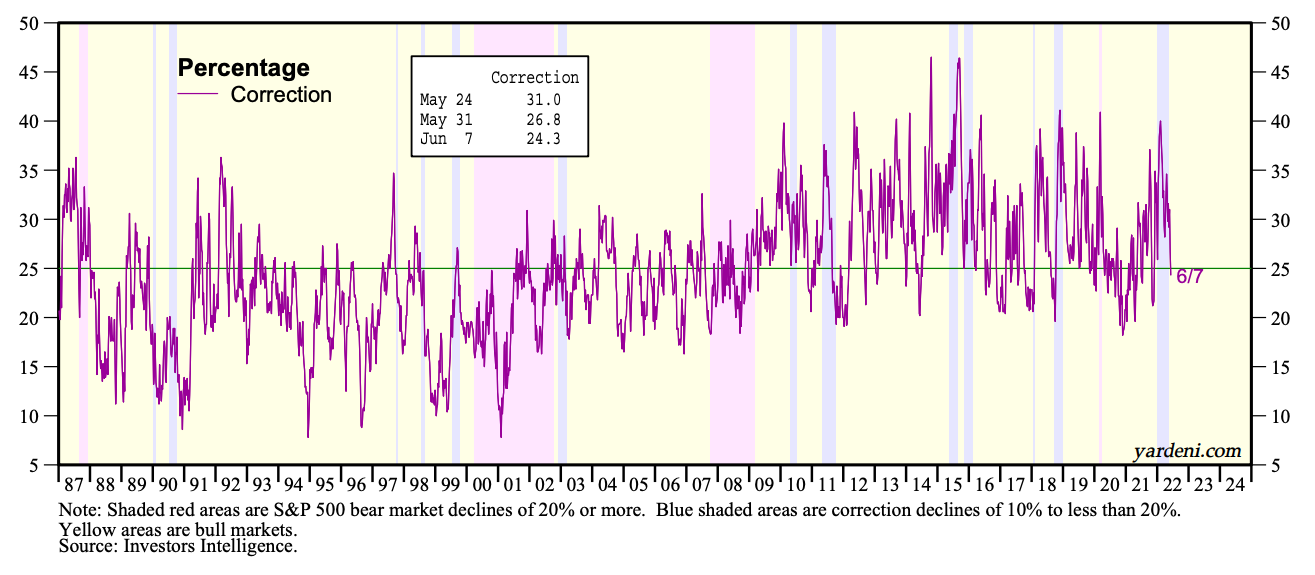

(2) The percentage in the correction camp has dropped for the fifth time in seven weeks from 34.6% to 24.3%; it was as high as 40.0% in early February.

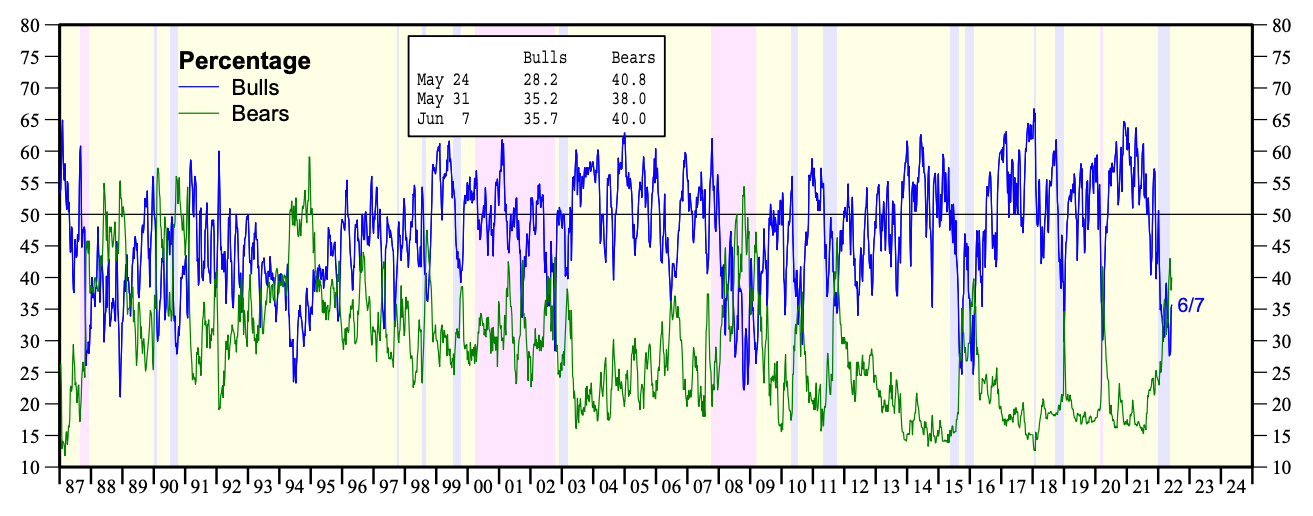

(3) Bullish sentiment climbed for the fourth week from 27.6% to 35.7% —with most of the gain occurring last week. Bearish sentiment increased to 40.0% this week after falling the prior two weeks from 43.0% (the highest since October 2011) to 38.0%.

(4) The AAII BBR jumped to 46.4% last week after falling from 34.0% to 27.1% the previous week, with bullish sentiment rebounding from 19.9% to 32.0% and bearish sentiment sliding from 53.5% to 37.1%.

(5) Sentiment is volatile and so is the market.