The latest correction in the S&P 500 was led by a short and shallow bear market in the Magnificent-7 stocks. Trump’s Tariff Turmoil clearly drove lots of the selling pressure. However, the stock market selloff this year was also attributable to the downward rerating of the elevated valuation multiples of S&P 500 Information Technology sector stocks, and particularly the Mag-7, which began after the release of open-source Deep Seek on January 24 triggered investor fear that capital spending on AI infrastructure would nosedive. Consider the following:

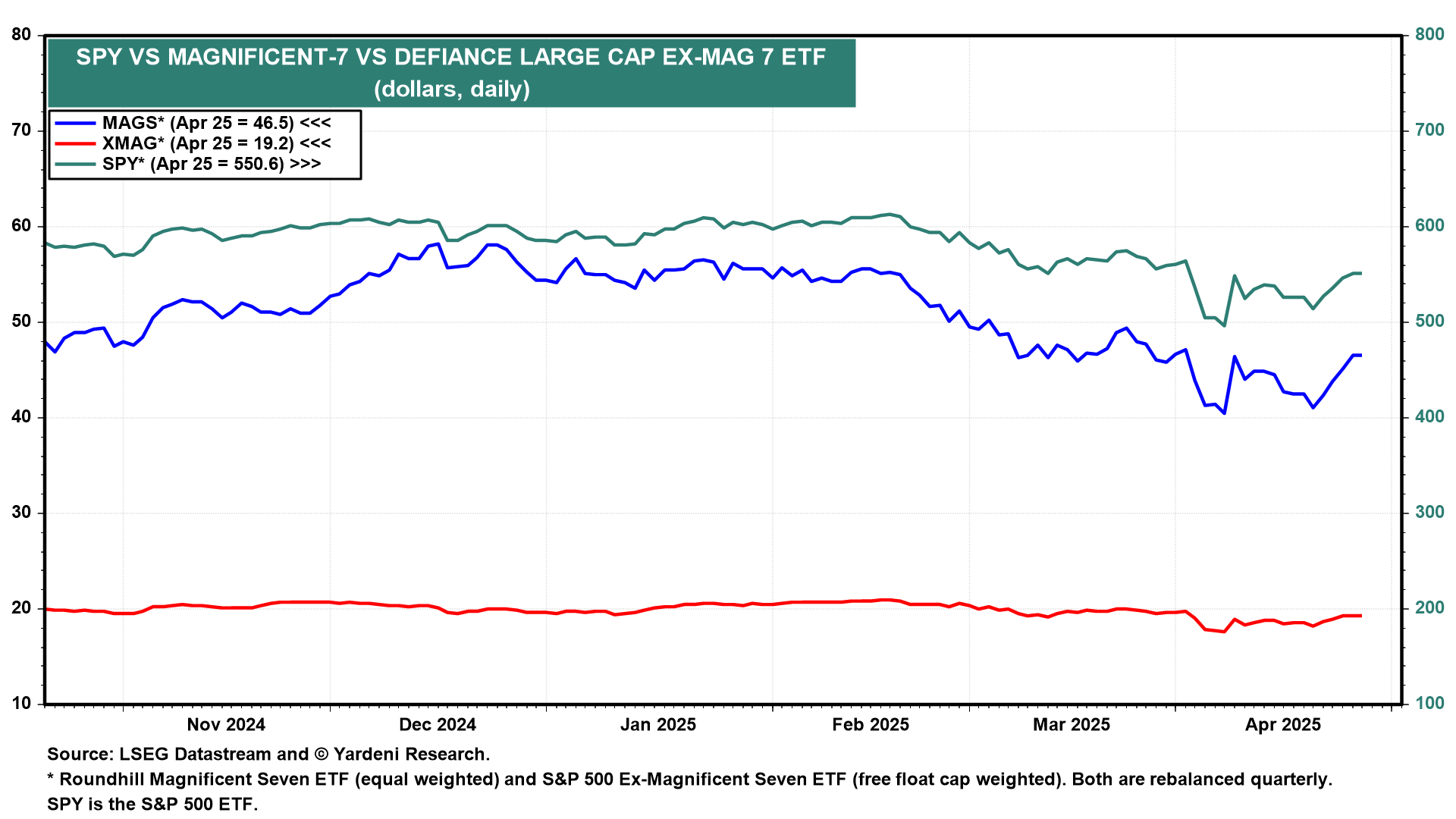

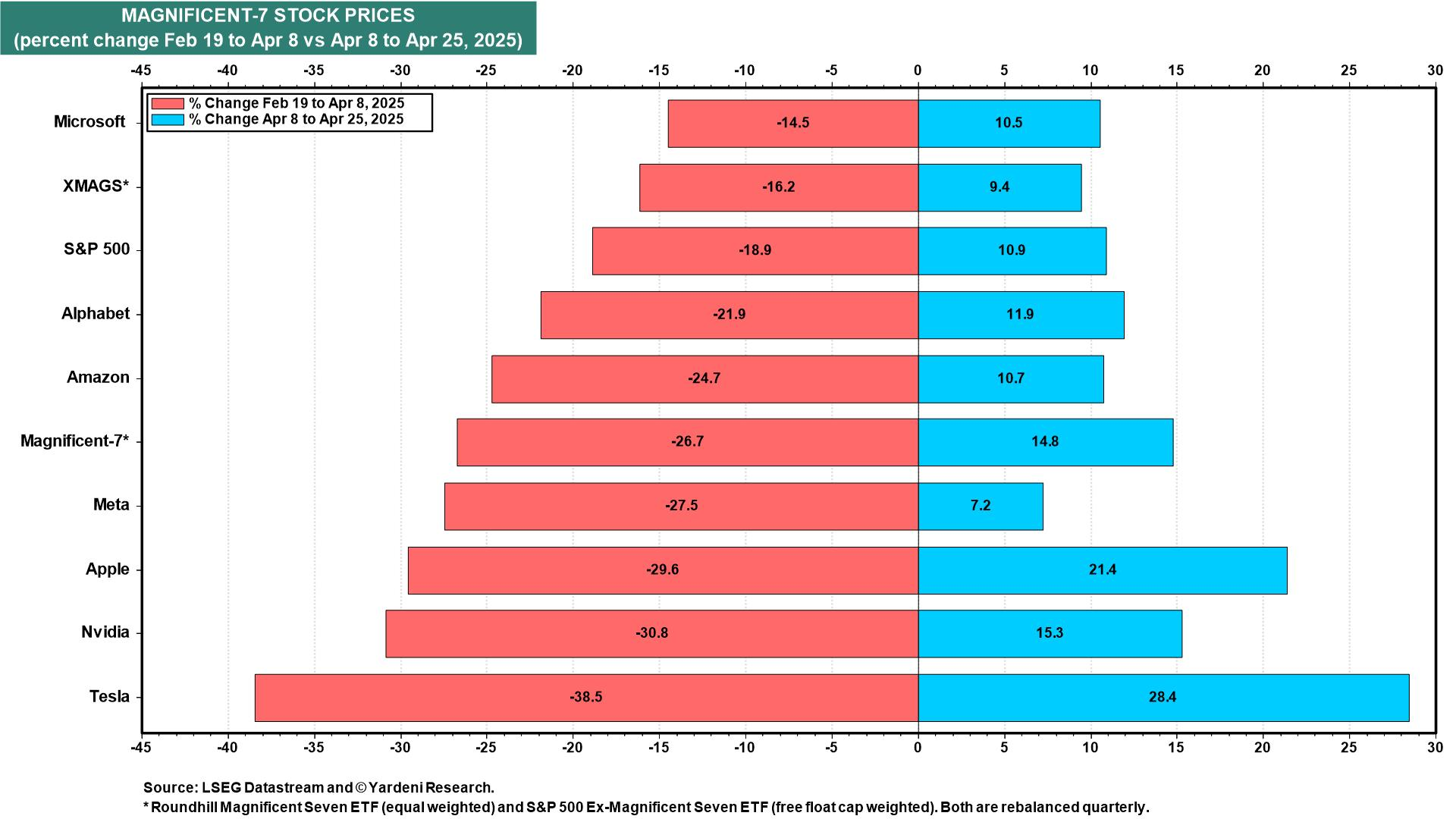

(1) SPY (the S&P 500 ETF) fell 19.0% from February 19 through April 8. The Roundhill Magnificent Seven ETF (MAGS), which is equal-weighted and rebalanced quarterly, dropped 26.7%, while the XMAG ETF (which is free-float cap-weighted) declined only 16.2% over this period (Fig. 11 below and Fig. 12 below). Since April 8, SPY is up 10.9%, with MAGS up 14.8% and XMAG up 9.4%.