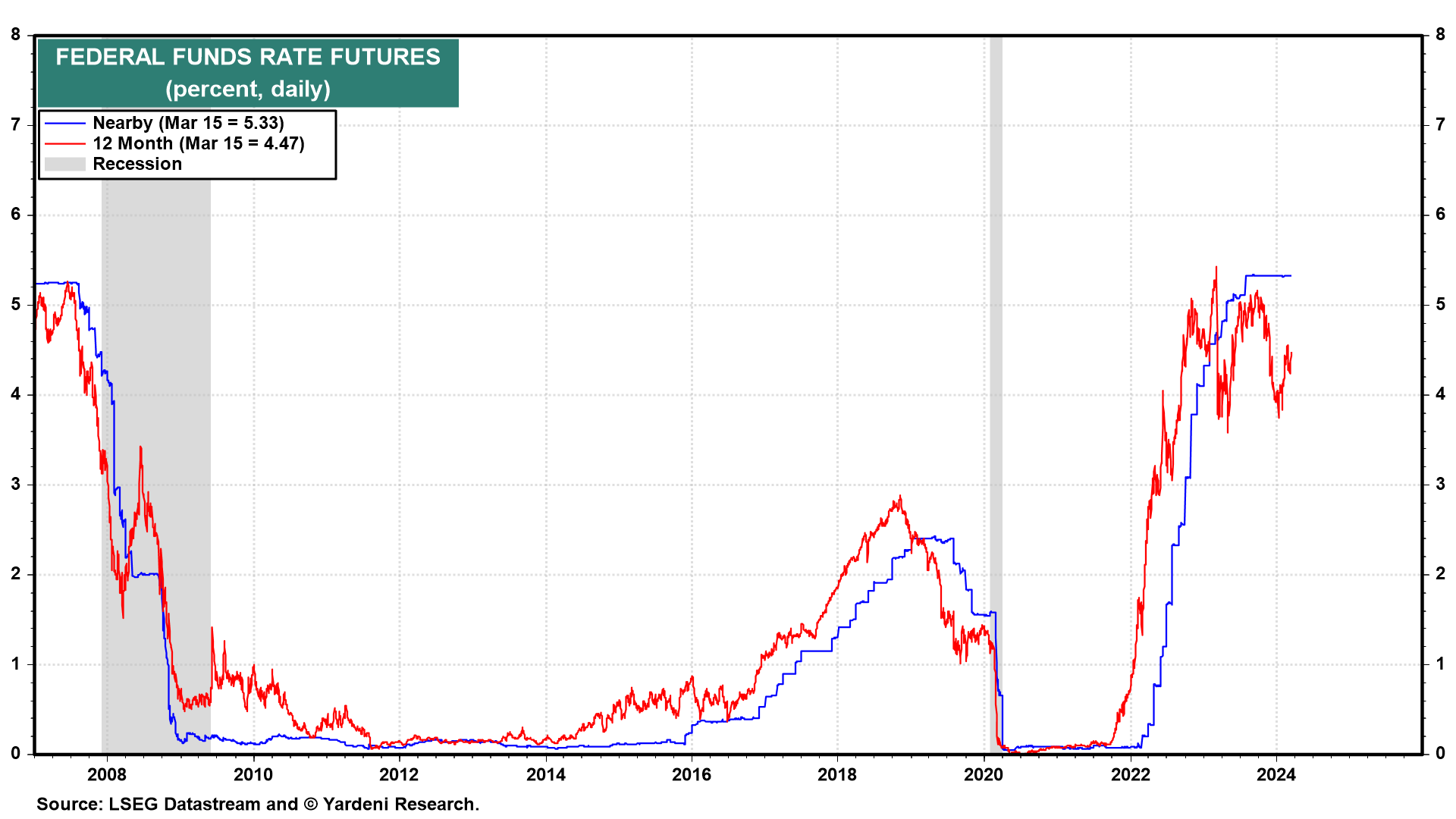

Notwithstanding last week’s hotter-than-expected CPI and PPI reports, the financial markets are still anticipating that the Federal Reserve will cut the federal funds rate three times over the next 12 months. On Friday, the nearby federal funds rate futures was 5.33%, while the 12-month futures was 4.47% (Fig. 1 below). That 86-basis-point spread implies that investors expect at least three cuts of 25 basis points each by March of next year.

On January 15, that spread was 159 basis points, implying six such rate cuts. At that point, the markets were certainly out of sync with the December 13, 2023 Summary of Economic Projections (SEP) released by the Federal Open Market Committee (FOMC). It showed that the median projection of committee members and Federal Bank presidents for the federal funds rate represents a decline from 5.40% in 2023 to 4.60% in 2024. That 80-basis-point spread implied that the FOMC anticipated making three rate cuts of 25 basis points each, not six.

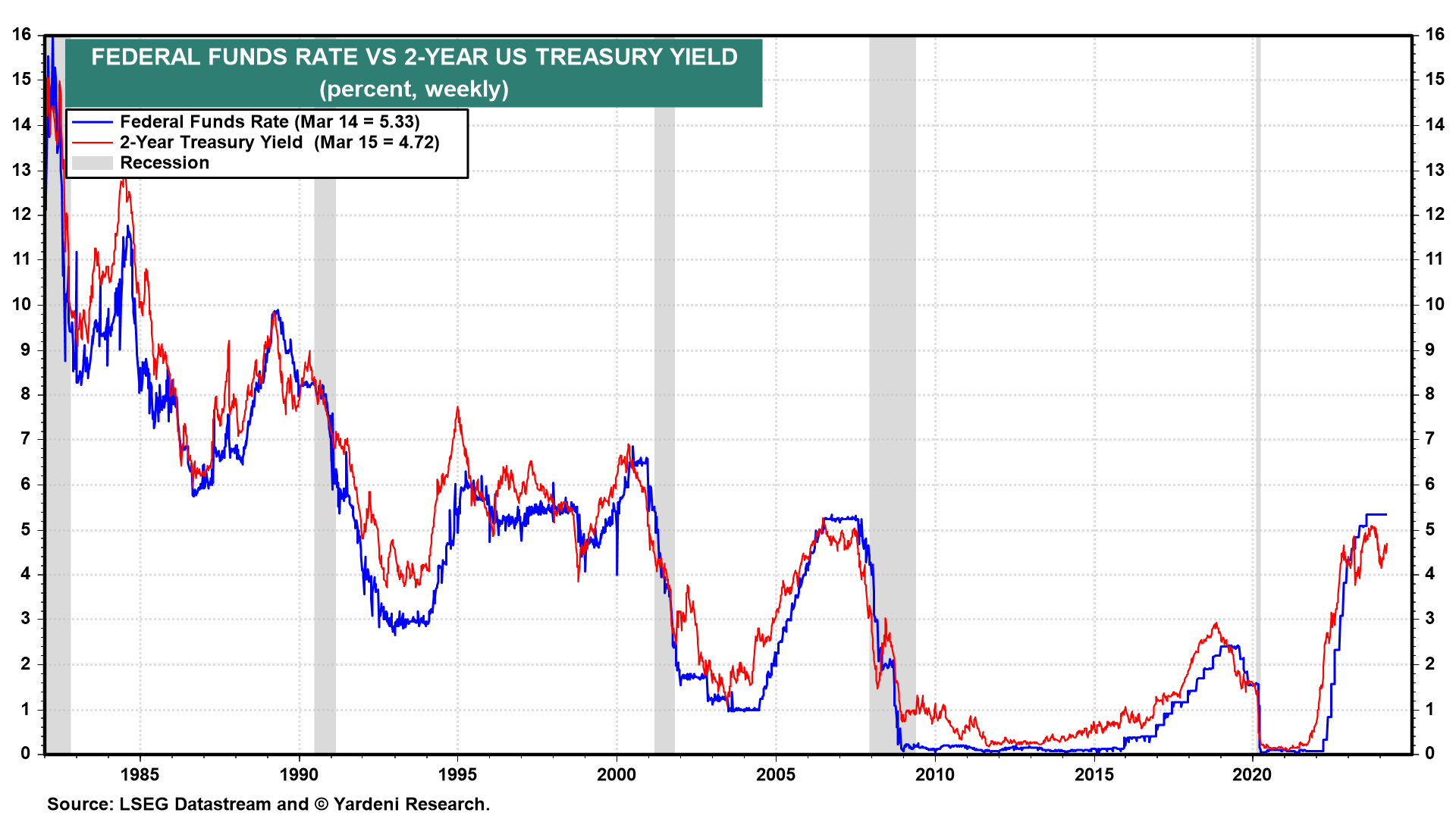

We view the spread between the federal funds rate and the 2-year US Treasury note yield as another measure of the market’s forecast for the change in the federal funds rate over the next 12 months (Fig. 2 below). The latter closed at 4.72% on Friday, implying two rate cuts through March 2024. We think the latest quarterly SEP, coming out this Wednesday, might very well suggest two, rather than the December SEP’s three, rate cuts over this period, occurring later rather than sooner this year.

So the markets are now more in sync with the FOMC’s projections than they were in mid-January. Both anticipate two or three cuts, either this year or by March 2025.

Then again, this is a presidential election year. So consider the following:

(1/4) Cutting interest rates just before the November election might be widely viewed as favoring the Biden administration. In an interview with 60 Minutes that aired Sunday, February 4, Fed Chair Jerome Powell was asked “to what degree does politics determine your timing” of when to reduce interest rates? Powell firmly replied that “we do not consider politics in our decisions. We never do. And we never will.”