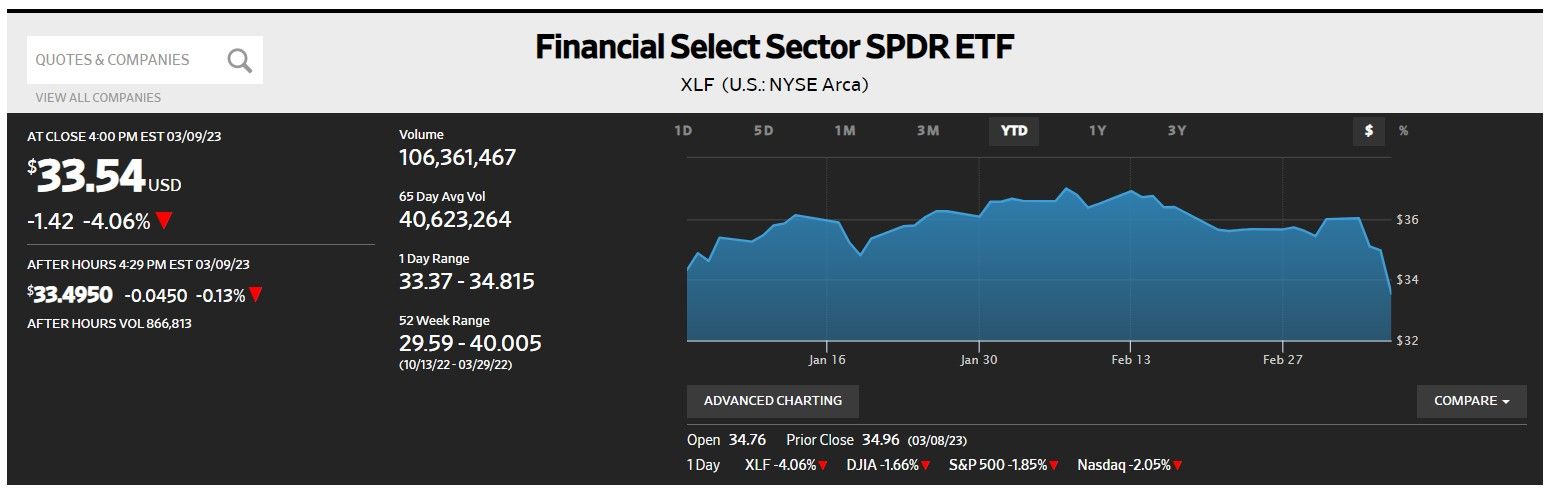

JPMorgan Chase CEO Jamie Dimon has been warning that a recession is coming. Today, ironically, the bank stocks took it on the chin sending the overall stock market lower because the economy is widely deemed to be too strong, and a solid gain is expected in February's payroll employment tomorrow. Furthermore, fears that next Tuesday's CPI report for February might be higher than expected raised concerns the Fed might be forced to raise the federal funds rate higher for longer.

The jitters started yesterday when Silvergate Capital, a central lender to the crypto industry, said that it is shuttering its banking operations. The stock plunged more than 36% in after-hours trading. Bankrupt crypto exchange FTX was a major Silvergate customer. Today, Silicon Valley Bank’s stock price plummeted 60% as investors rushed to sell shares after the bank announced that it would take extraordinary and immediate steps to shore up its finances. The bank is a major provider of credit to tech start-ups and their employees.

The stock prices of both the money center banks and the regional banks were hard hit today. The Financial Select Sector SPDR ETF (XLF) fell 4.1% (chart).

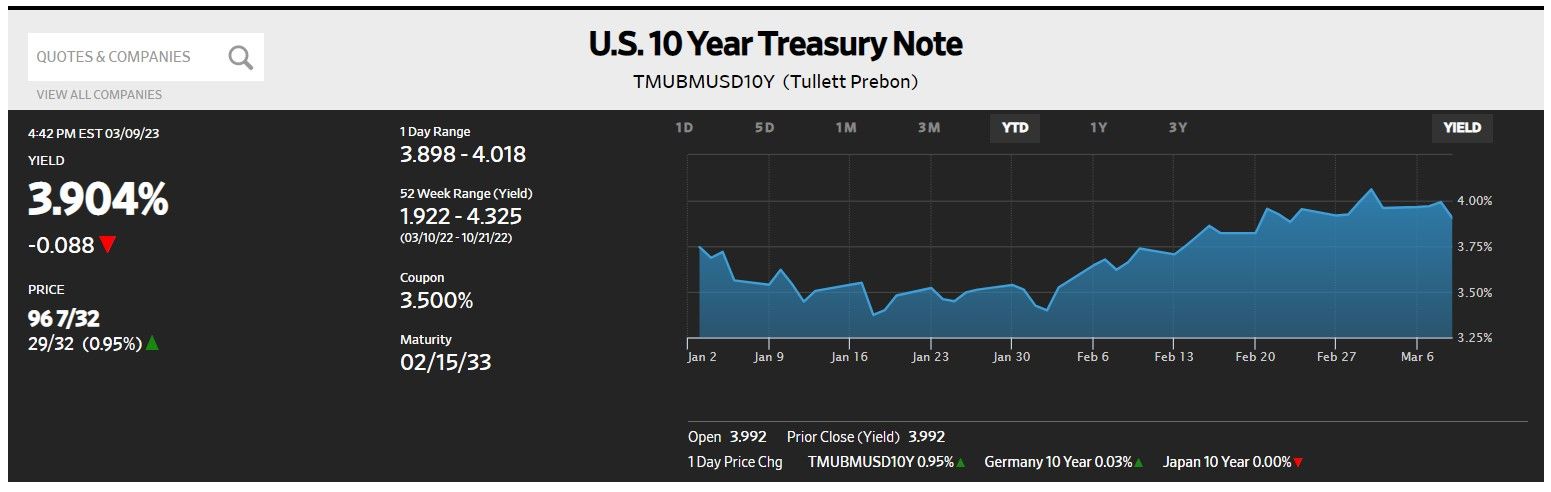

Rising interest rates have boosted the banks' interest margin. But they also increase the risks that something will break in the financial system. That is why the 10-year Treasury bond yield fell to 3.91% from a recent high of 4.06% on March 2 (chart).

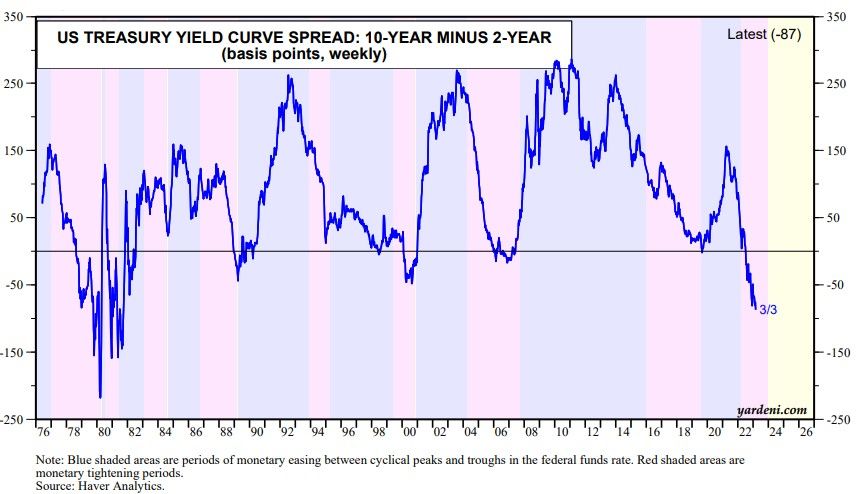

The yield curve remains significantly inverted (chart). In the past, inverted yield curves signaled that investors feared that if the Fed continued to tighten, something would break in the financial system causing a credit crunch and a recession. Is it different this time? Maybe not, but we think that both the credit system and the economy will remain surprisingly resilient to the jump in interest rates since early last year.