The bears say that the 17.4% rally in the S&P 500 between June 16 and August 16 was a short-covering rally. Now that the index is down 8.8% from its recent high, they say the bear market isn't over and will soon take out its recent low. The bulls (including us) believe that the latest bear market's bottom will hold, and won't be retested. A true test of who is right is likely to occur on September 13 when August's CPI will be released. We're expecting a bullish number.

We weren't surprised by the recent drop in the market. Our August 21 QuickTakes was titled "Market Call: Risk Off." We wrote: "The stock market is overbought."

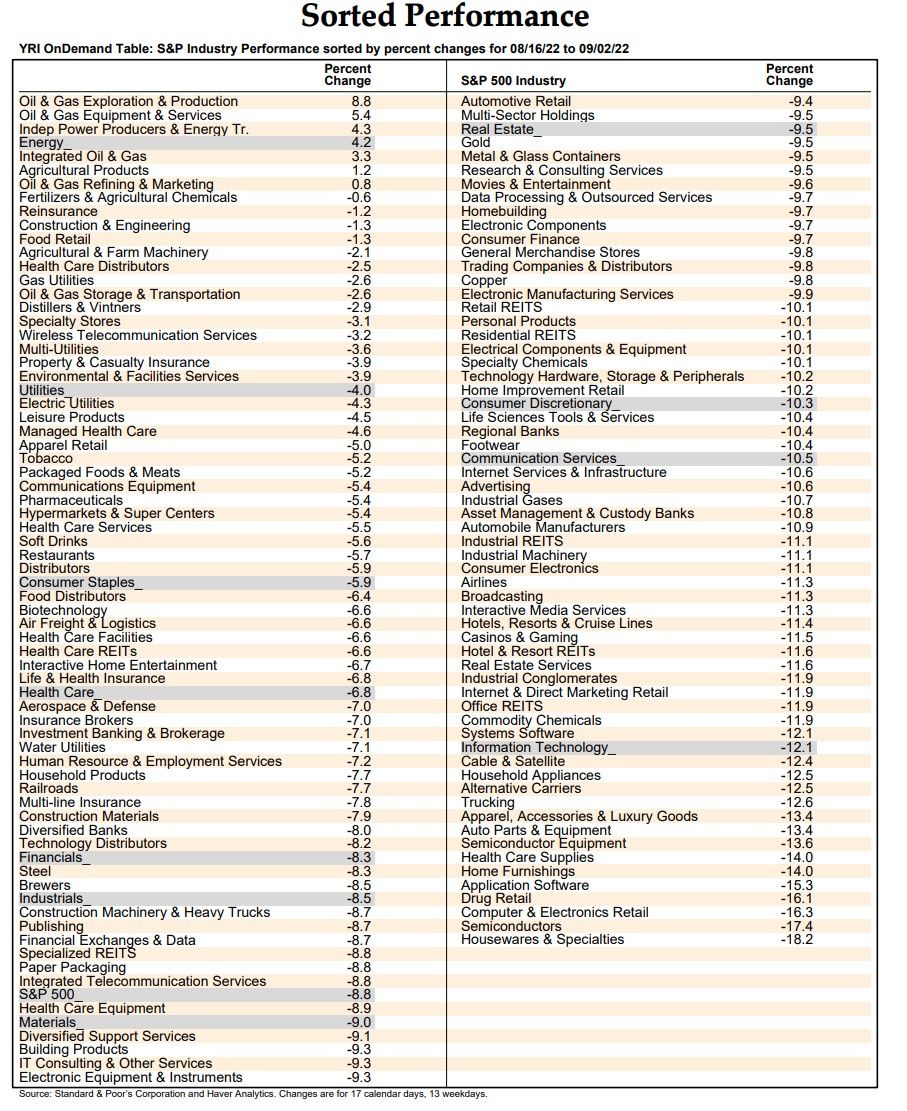

The market has gotten oversold very quickly as evidenced by negative indicators like the percent of S&P 500 stocks above their 50-dma and 200-dma, with readings of only 30.9% and 25.9% on Friday. The Bull-Bear Ratio was only 1.28 during the August 30 week. As during the bear market during H1-2022, only the Energy sector was up during the recent selloff (table below).

We asked markets maven Joe Feshbach for his latest perspective on the stock market. Here it is: "We’ve had six days in a row of elevated put/call ratios which suggest that the nasty downside potential will soon dissipate. The only caveat I’d mention is that they were vacation numbers, so I’d like to see the numbers stay high Tuesday and Wednesday, when traders and investors are back from the beach. The other issue the market has is too much negative breadth. This problem started to occur towards the end of the prior rally. This doesn’t resolve overnight. So when the downside risk subsides shortly, the market should enter a trading range for a while." Joe's indicators suggest the market might bottom this week.