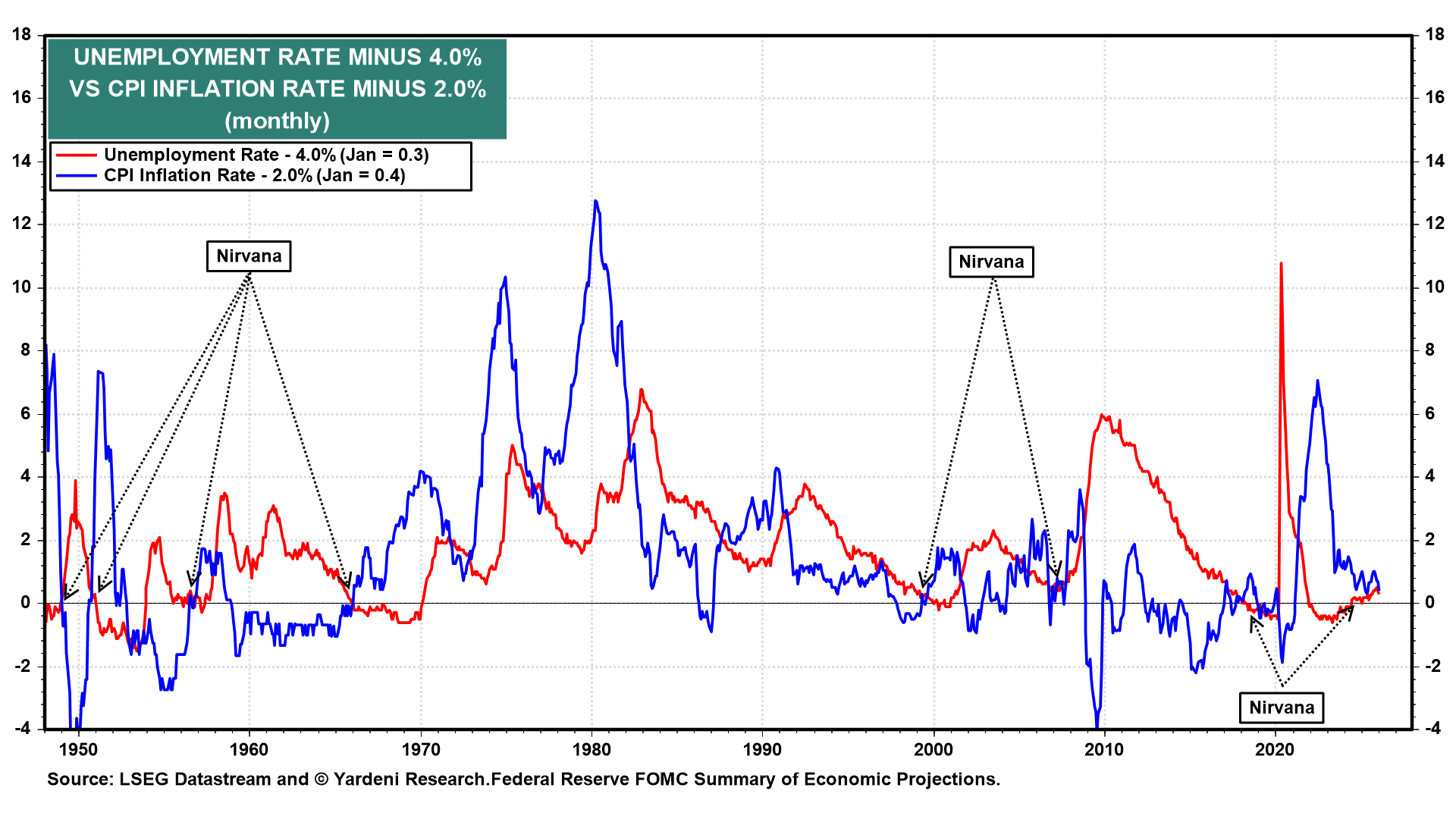

The Fed achieved its congressional dual mandate in January. The unemployment rate fell to 4.3%, and the CPI inflation rate was down to 2.4% y/y. Those round down to what we call “Nirvana” readings, i.e., the low unemployment level of 4.0% and the Fed’s inflation target of 2.0% (chart). Fed officials should celebrate and go on a long vacation. They can leave the federal funds rate (FFR) alone at its current 3.50%-3.75%. By their own definition, that must be the "neutral" FFR, the level that’s consistent with full employment and stable prices. Why mess with success?

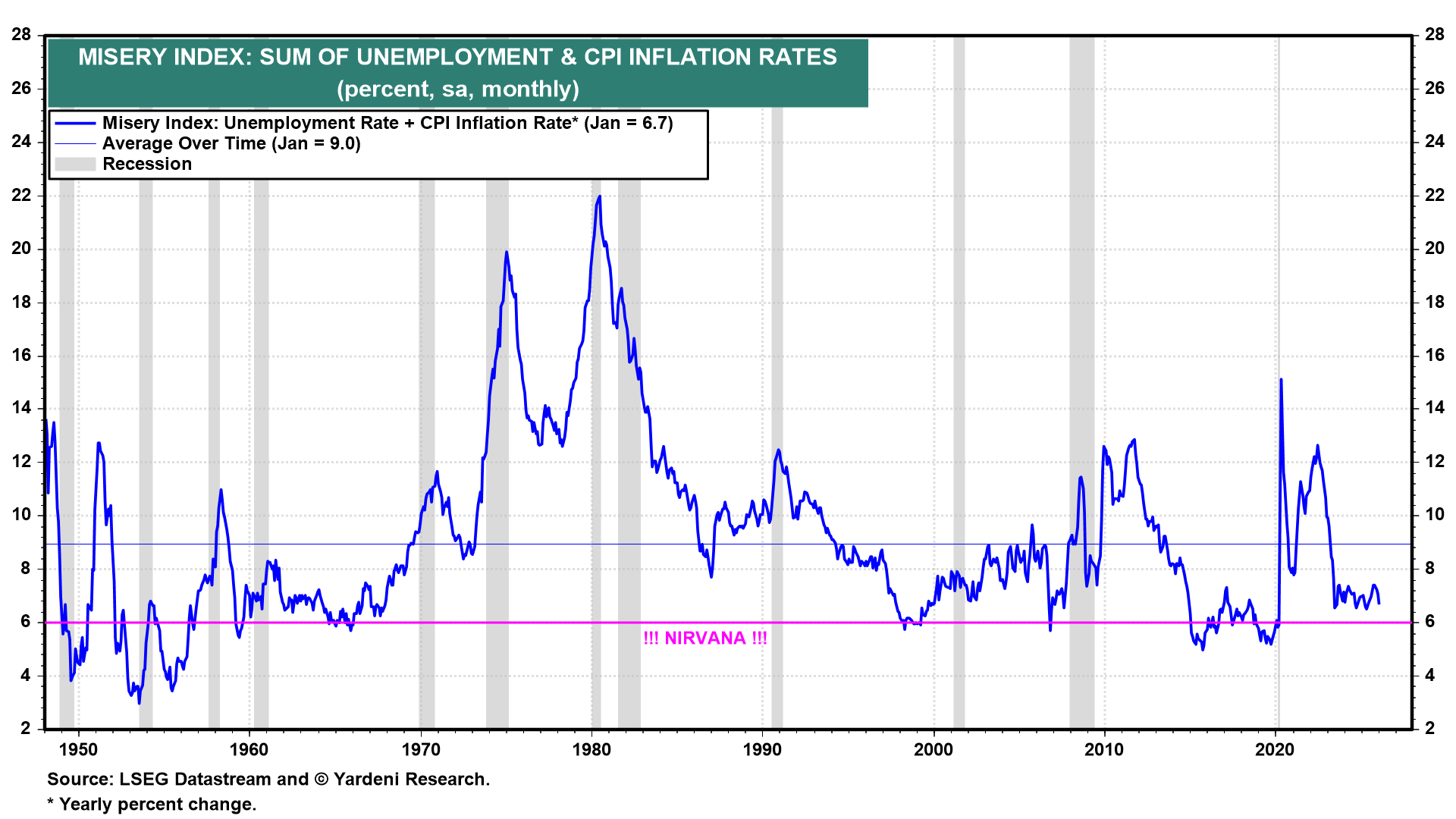

The Misery Index is the sum of the unemployment and inflation rates (chart). It was 6.7% in January, only 0.7 percentage points above the Nirvana sum and well below the long-term average of 9.0% (chart). It has been fluctuating around 7.0% since June 2023. We've been in Nirvana for a while!

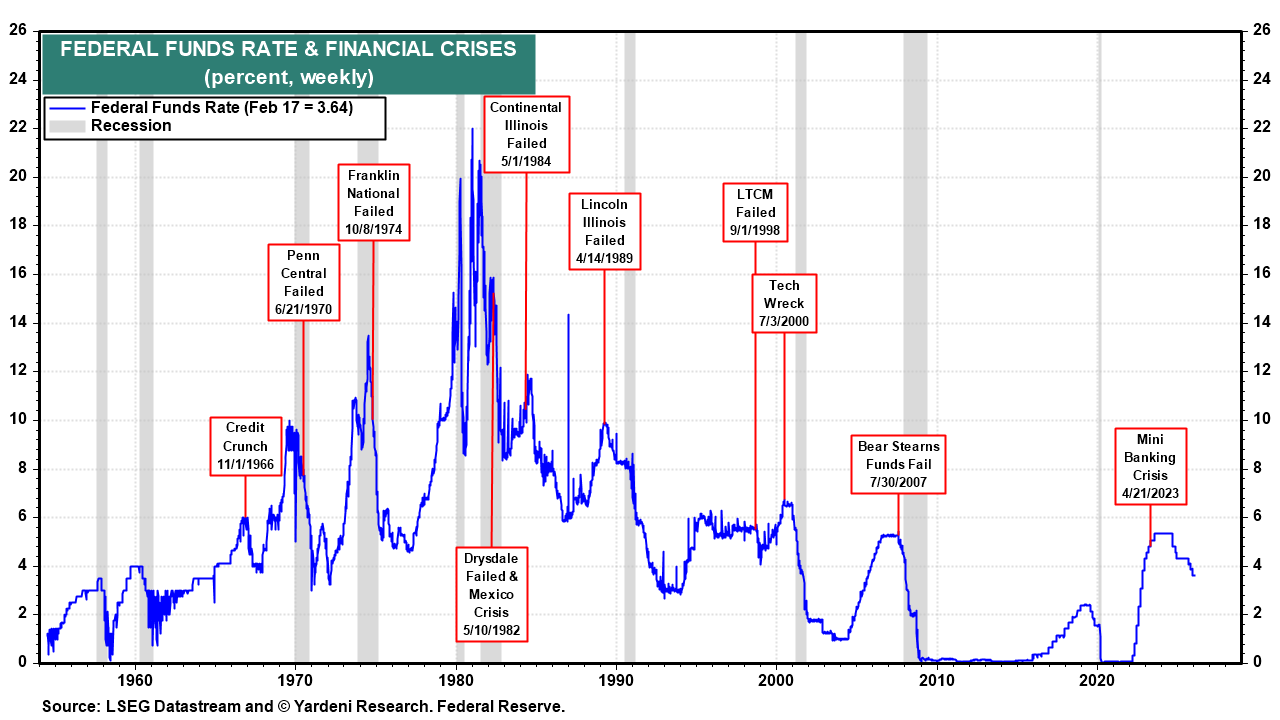

The Fed has cut the FFR by 175bps since September 2024 (chart). It's not obvious to us that this easing was necessary to keep us in Nirvana. In the past, the Fed slashed the FFR in an emergency response to financial crises that rapidly morphed into economy-wide credit crunches, triggering recessions. That's not the scenario now.

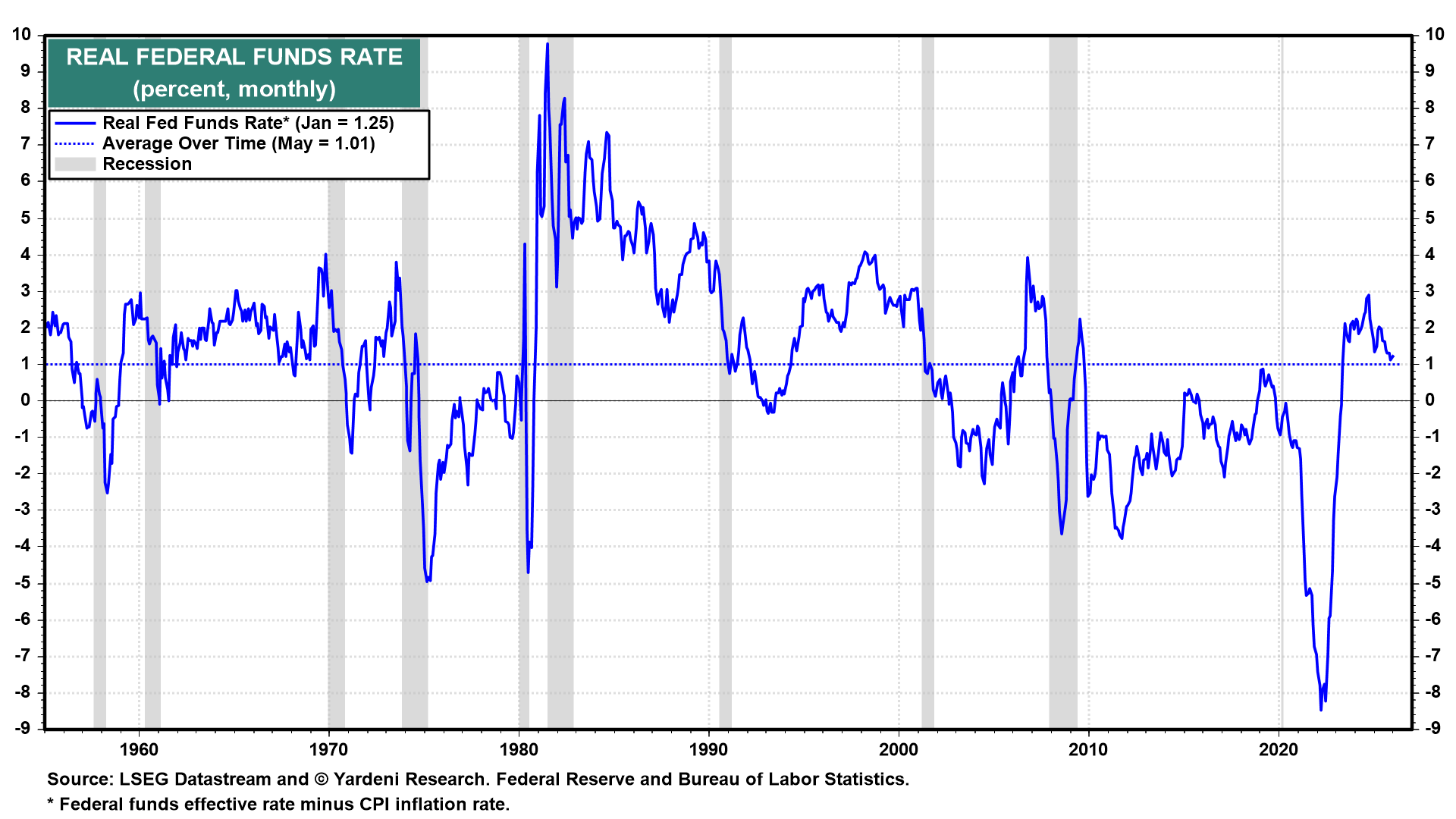

The inflation-adjusted FFR is back down to its long-term average of 1.01% (chart). There is no reason to lower this real FFR from here.

The steepening yield curve and the acceleration in bank loan growth confirm that monetary policy has eased enough (chart).