The S&P 500 Energy sector has been weak recently, but it is still the only one of the index's 11 sectors with a gain so far this year at 28.0% ytd. Here are a few quick takeaways:

(1) The price of a barrel of Brent crude oil has been volatile around $100 recently and looking toppy. The outlook has become extremely controversial. On July 1, a JPMorgan Chase & Co. analyst warned that this price could reach a “stratospheric” $380 a barrel if US and European penalties prompt Russia to inflict retaliatory crude-output cuts. On July 5, analysts at Citi warned that the price could tumble to $65 by the end of the year if an "increasingly likely" recession hits the global economy.

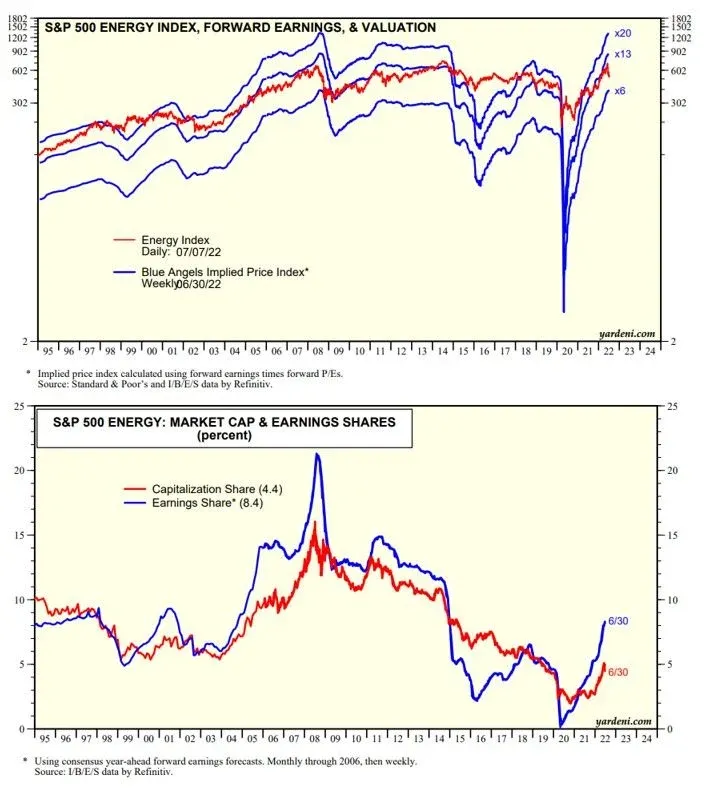

(2) For now, industry analysts' consensus forward earnings continues to increase (chart). Energy's earnings share of the S&P 500 has risen from zero in early 2020 (during the lockdown recession) to 8.4% recently (chart). It's market capitalization share is only 4.4%, and likely to trend higher over the next few years.

(3) During Q1, Berkshire Hathaway added to its Chevron bet significantly, making the energy stock the conglomerate’s fourth biggest equity holding. Berkshire has also scooped up shares of Occidental Petroleum during Q1.