Hooray! The US government won't default on its debts. There are plenty of jobs. Unit-labor-cost inflation is moderating. The banking crisis is abating. The recession is still a no-show. Earnings were better than expected during Q1 and are probably bottoming during the current quarter. The FOMC likely will pause its rate hiking for at least one meeting. AI will boost productivity if it doesn't kill us. Summer is coming. No wonder the S&P 500 sailed to a new 2023 high today. Here are today's sunny numbers:

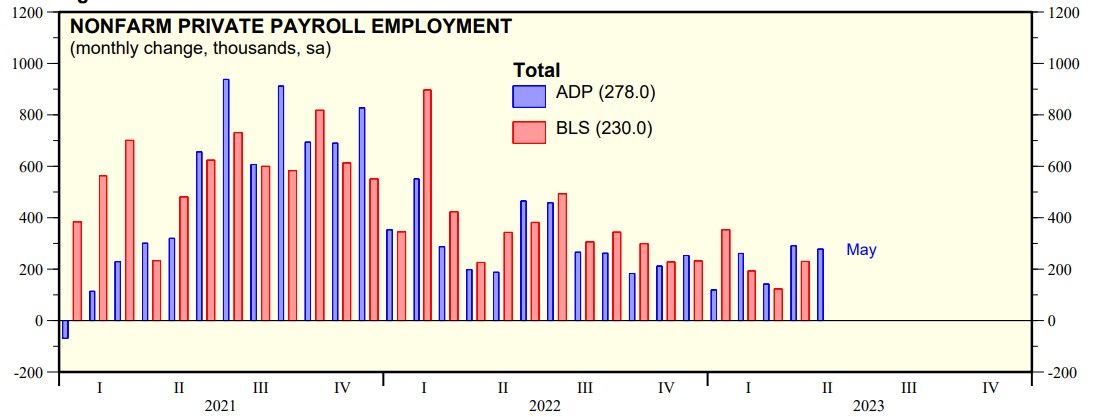

(1) Today's ADP private sector payrolls for May showed a solid gain of 278,000 (chart). Interestingly, large companies cut their headcount by 106,000, while medium and small companies gained 375,000 employees.

“This is the second month we've seen a full percentage point decline in pay growth for job changers,” said Nela Richardson, chief economist, ADP. “Pay growth is slowing substantially, and wage-driven inflation may be less of a concern for the economy despite robust hiring.”

(2) Today's Productivity & Costs release for Q1-2023 showed that hourly compensation rose just 2.1% (saar) and 3.0% y/y (chart). That's well below the latest comparable y/y readings for AHE (4.4%) and ECI (4.8%). Productivity, however, fell 0.8% y/y. So unit labor cost rose 3.8% y/y, which is still below last year's peak.