Go figure: When industry analysts raised their earnings estimates during the first half of the year, investors thought they were delusional. Investors proceeded to trash stocks because they feared a recession. Now that analysts are finally cutting their estimates, investors have been snapping up stocks since June 16 because they were cheap, especially now that recession fears have abated.

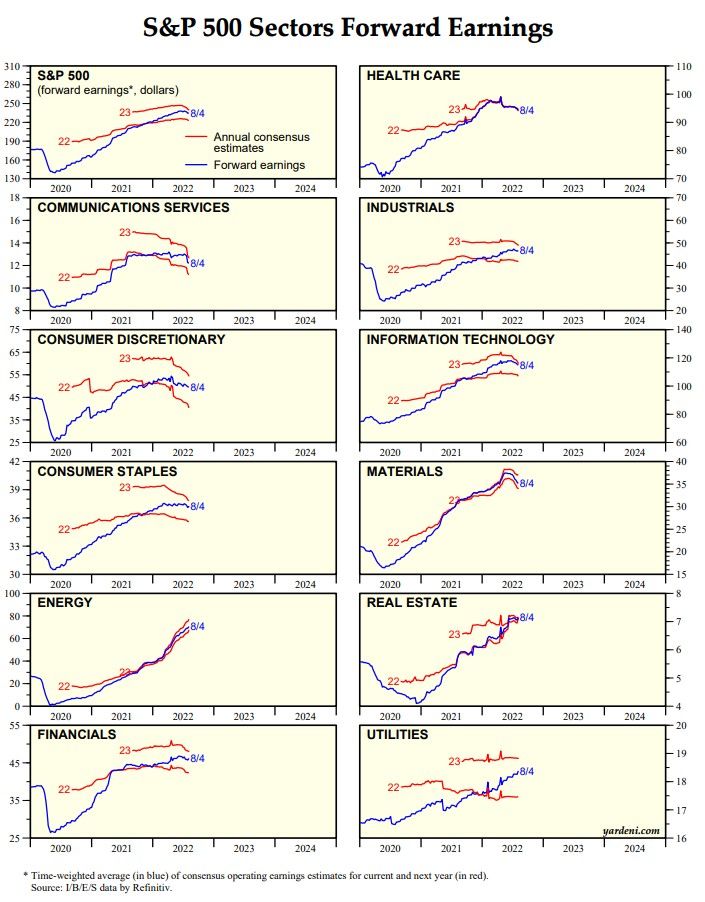

The charts below show that analysts collectively have been reducing their 2022 and 2023 estimates since the start of the Q2 earnings season in early July. They've been doing so for eight of the 11 sectors of the S&P 500 with the exception of Energy, Real Estate, and Utilities.

Leading the stock market rally since June 16 have been the sectors that took the biggest hits in their valuation multiples, and are doing so even though they are seeing analysts cutting their earnings now.

Our QT: S&P 500's forward P/E is getting stretched again and forward earnings is likely to flatten in coming weeks. The rally could stall for a while. September and October are coming.