Halloween is a month away. The Q3 earnings season starts early next month. But analysts and investors are already getting spooked by a rotten Apple forecast and frightening guidance from FedEx:

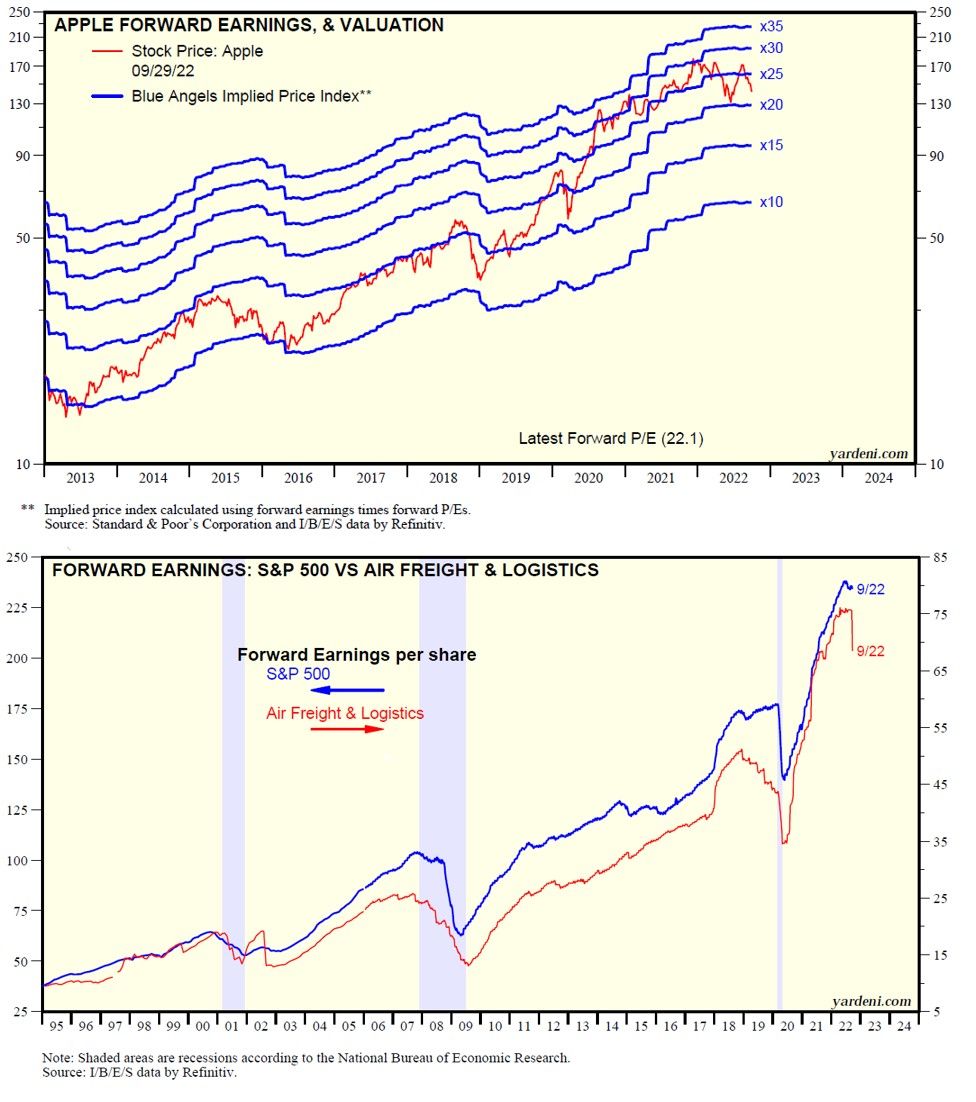

(1) Apple shares declined nearly 5% today as Bank of America cut its rating to neutral from buy (chart). It fell yesterday on a report that the company has told suppliers to scrap plans to increase iPhone 14 production. A family member of ours said she isn't upgrading to the new phone because there aren't enough new bells and whistles. So Apple's problem may be that rather than a sign of weak consumer spending.

(2) The latest stock market selloff started after FedEx’s recent warning. The package delivery giant delivered a terrible preannouncement about its fiscal Q1 (ended August) on Thursday evening, September 15. FedEx said that it expects Q1 earnings, excluding some items, to be roughly 33% below the analysts’ consensus estimate. It also withdrew its earnings forecast for 2023, saying that macroeconomic trends have “significantly worsened,” both internationally and in the US, and are likely to deteriorate further. That heightened fears of a broad-based earnings decline (chart).

(3) The strength of the dollar may also weigh on Q3 results. For example, the FAANGMs derived 48% of their revenues outside the US. Here’s how they ranked by foreign sales exposure (as of their last 10K): Apple 58%, Meta 56%, Netflix 56%, Alphabet 54%, Microsoft 49%, Amazon 33%. The dollar index (DXY) is up 19% y/y.