The week ahead is a light one for economic indicators. Monday starts out with May's Treasury International Capital System data on net capital inflows into the US. April's data showed a near-record $1.5 trillion in private net capital inflows, which certainly explains why the dollar has been so strong. This is consistent with our TINAC theme, that "there is no alternative country" to invest in currently given the unsettled and unsettling geopolitical mess.

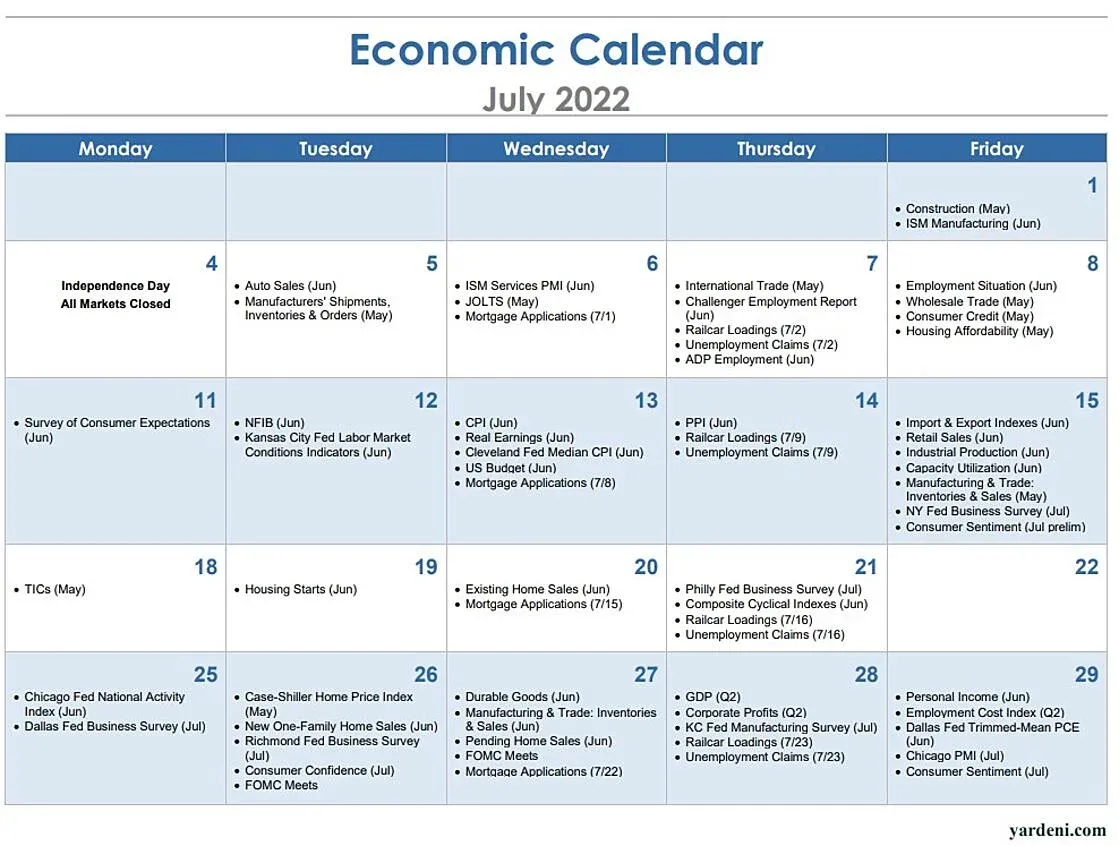

On Tuesday and Wednesday, June's housing starts and existing home sales data will be released. Weekly mortgage applications for new purchases, which will be updated on Wednesday, fell sharply in June, suggesting that housing demand remains depressed.

The Philly Fed's regional business survey for July comes out on Thursday. Last week, the NY Fed's regional business survey showed a slight rebound in business, a sharp drop in delivery times, and some easing of pricing pressures.

We'll be focusing on June's Index of Leading Economic Indicators on Thursday. It was down during the past three months, and was likely down again during June. The Index of Coincident Economic Indicators should also be down slightly from May's record high. So we can expect more chatter about an impending recession.