The Fed lifted the federal funds rate range by 75bps to 3.00%-3.25%. Stocks sold off as Fed Chair Jerome Powell reiterated during his presser today the main points he made in his hawkish speech at Jackson Hole in late August. He stressed that monetary policy may have to be restrictive for a while to bring inflation down, and that the process may be painful.

There wasn't much new in either the FOMC's statement or Powell's presser. There was, of course, an update of the FOMC's Summary of Economic Projections (SEP). Here are the highlights:

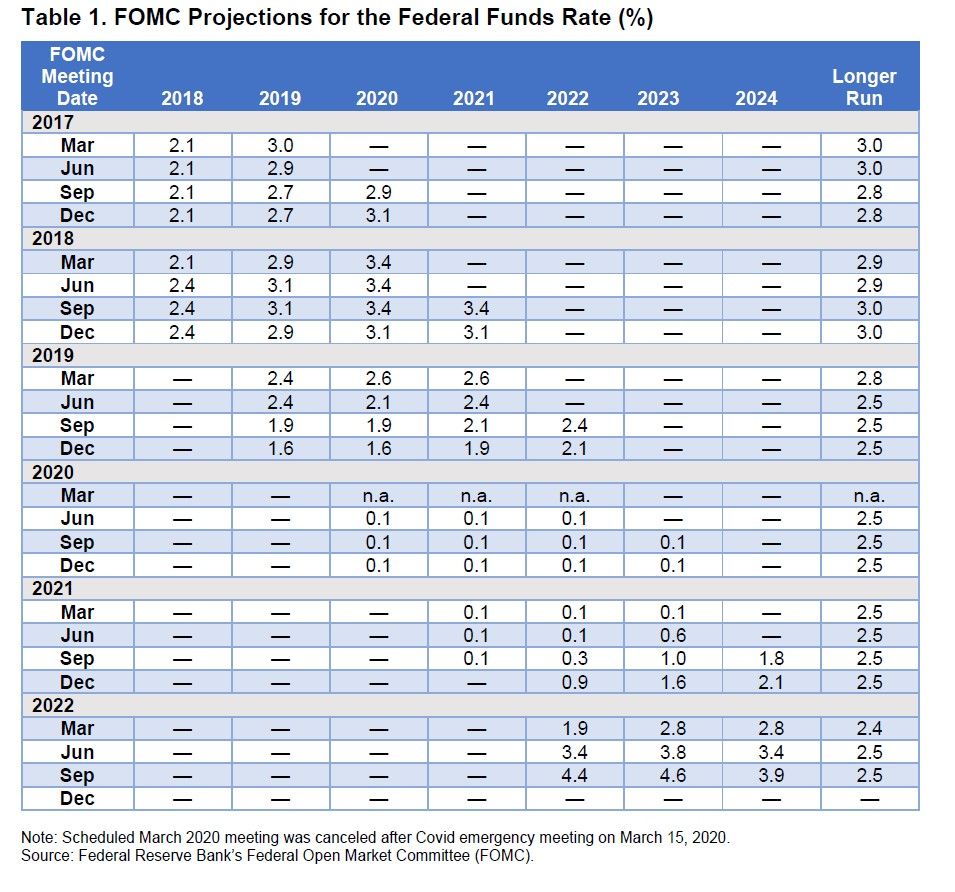

(1) The committee's median federal funds rate forecast was raised from 3.4% to 4.4% this year and from 3.8% to 4.6% next year (table below). The SEP shows a drop in 2024 to 3.9%. That's consistent with Powell's higher-for-longer stance on restrictive monetary policy, especially since the committee judges that the long-run neutral rate is 2.5%. That's the one number that didn't change in the SEP.

(2) The Fed now shares our "growth recession" prediction for real GDP, which is expected to grow by a mere 0.2%, down from the previous estimate of 1.7%. Next year's growth rate was also lowered from 1.7% to 1.2%. That compares to the committee's estimate that the long-run growth of the economy is only 1.8%. Unlike us, they are obviously not expecting much productivity growth in coming years.

(3) The SEP shows that the headline PCE inflation rate is expected to be 5.4% this year, 2.8% next year, and 2.3% in 2024. The committee expects that will be accomplished by pushing the unemployment rate up from 3.8% this year to 4.4% in 2023 and in 2024. The long-run jobless rate is deemed to be 4.0%. (See our easier-to-read summary of the Fed's summary.)

(4) Of course, we all know that the Fed's forecasts have been wide off the mark since the pandemic. So our contrarian perspective is that the Fed's forecast might actually work out.