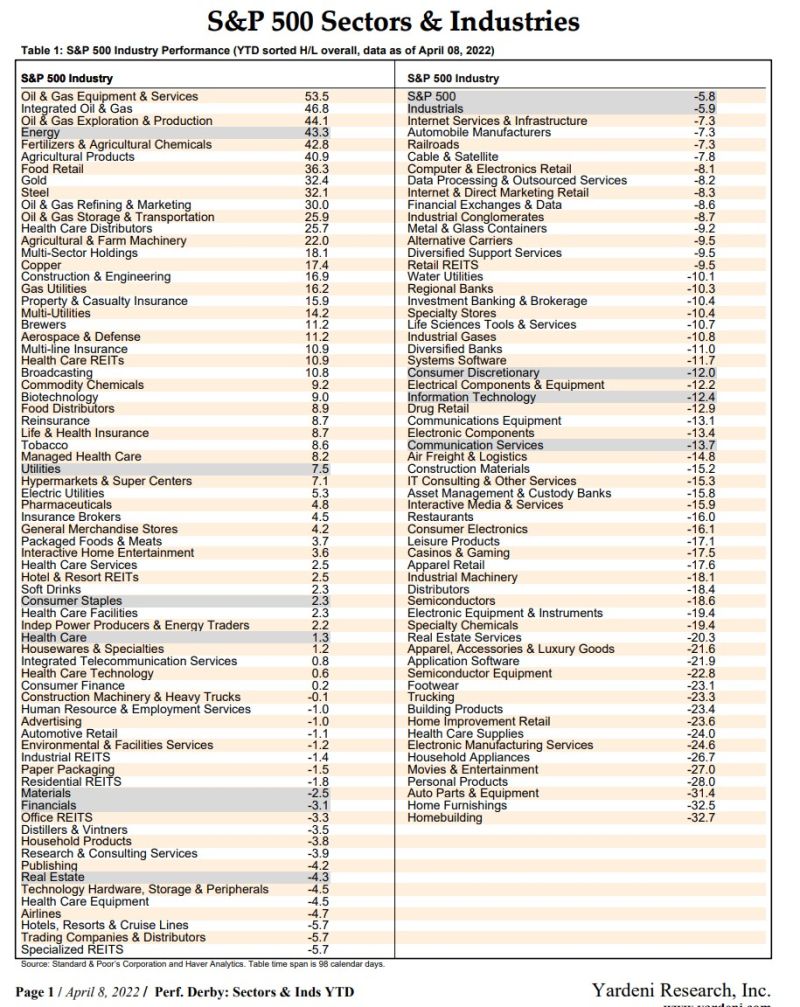

The S&P 500 is down 5.8% ytd. Under the circumstances--e.g., war in Ukraine, continued supply-chain difficulties, high inflation, Fed in tightening mode, rising bond yields, and recession fears--that's not too bad. However, when we look under the hood, only four of the S&P 500's 11 sectors are up ytd: Energy (43.3%), Utilities (7.5), Consumer Staples (2.3), and Health Care (1.3). The rest are down ytd, with four sectors underperforming the S&P 500: Industrials (-5.9), Consumer Discretionary (-12.0), Information Technology (-12.4), and Communication Services (-13.7). Again, that's not too bad under the circumstances.

The war in Ukraine has boosted the prices of agricultural, energy, and metals commodities. Food-related S&P 500 industries have done especially well so far this year. A more hawkish Fed has raised worries about a recession, weighing on reopening trades, housing, transportation, banks, and retailers:

(1) The best-performing industry ytd has been Oil & Gas Equipment & Services (53.5%), while the worst has been Homebuilding (-32.7).

(2) Transportation stocks have also underperformed: Railroads (-7.3%), Air Freight & Logistics (-14.8), and Trucking (-23.3).

(3) Ditto the banks: Regional Banks (-10.3%), Investment Banking & Brokerage (-10.4), Diversified Banks (-11.0), and Asset Management & Custody Banks (-15.8).

(4) Ditto retailers, for example: Specialty Stores (-10.4%), Apparel (-17.6), and Home Improvement (-23.6).

The last shall be first again when inflation peaks and the Fed turns less hawkish. That could happen as soon as H2-2022.