Needless to say, the recent turmoil in the banking sector is raising renewed fears of a recession and a resumption of last year's bear market. The rolling recession could turn into a full-blown recession if the turmoil roils the banking system significantly. Bankers could become more cautious lenders especially among the smaller regional and community banks. On the other hand, the Fed probably stabilized the situation with its announcement last Sunday , March 12, of the new Bank Term Funding Program. It is aimed "to help assure banks have the ability to meet the needs of all their depositors."

Meanwhile, the latest batch of economic indicators continues to support our view that the economy has been in a rolling recession since early last year, when the Fed started to tighten monetary policy. Consider the following;

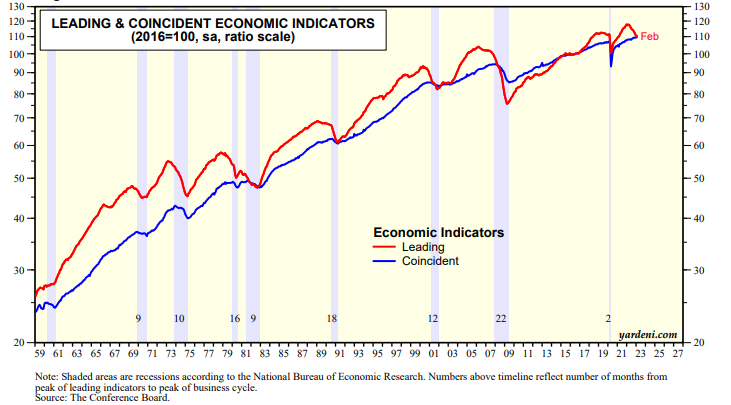

(1) LEI & CEI. The index of leading economic indicators fell 0.3% in February—the 11th decline in a row—continuing to signal an upcoming recession (chart). On the other hand, there is still no recession in the index of coincident economic indicators, which rose to yet another record high last month.