More important than any economic indicators this week will be whether there is more bad news indicating that the banking crisis is far from over. No news would be good news. That's what we're rooting for.

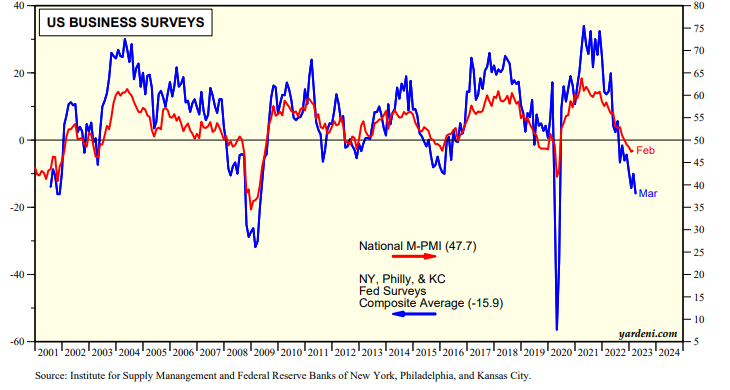

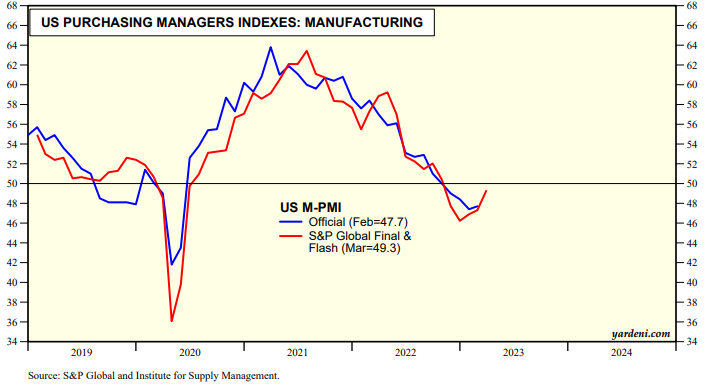

We are expecting some bad news from the March regional business surveys conducted by the Federal Reserve Banks of Dallas (Mon) and Richmond (Wed), confirming the recessionary readings of the NY, Philly, and KC surveys. If so, then we can expect that March's M-PMI will remain under 50.0 (chart).

On the other hand, the S&P Global flash estimate for the US M-PMI rebounded closer to 50.0 during March (chart). Go figure.

There will be several consumer-related indicators out this week. March consumer confidence (Tue) and consumer sentiment (Fri). They should continue to show modest improvements reflecting falling inflationary expectations. Then again, the banking crisis could weigh on consumers. The personal income release (Fri) should show an upward revision for January and a modest increase for February. The PCED inflation rate probably continued to moderate during February.

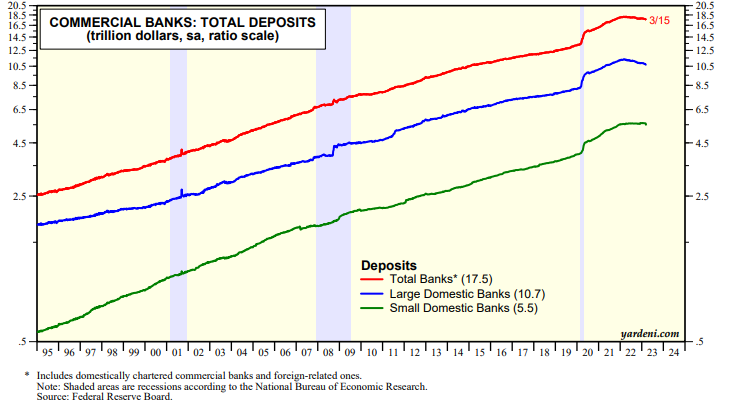

Friday afternoon at 4:00 p.m., we will get another reading on the banking crisis when the Fed releases its H.8 report on the assets and liabilities of large and small US banks. During the week of March 15, deposits at small domestically chartered banks fell $120 billion, but rose $67 billion at large domestically chartered banks (chart).