Fed Chair Jerome Powell did pivot on Friday morning at Jackson Hole in his 8-minute speech on the outlook for monetary policy. He turned much more hawkish than the financial markets expected. In his short talk, he managed to walk back any hint of dovishness he might have conveyed during his previous public appearance in a press conference on July 27.

Back then, his often ambiguous off-the-cuff responses to reporters led investors to think that the FOMC might raise the federal funds rate by 50bps rather than 75bps at the committee's next meeting on September 21, and then pause for a while. Back then, Powell suggested that the Fed had a path to lower inflation without causing a recession.

Instead, on Friday, in prepared remarks, Powell promised to take "forceful and rapid steps" to bring down inflation. He acknowledged that will "bring some pain." So forget about any pause in monetary policy tightening and forget about a painless path to lowering inflation. Instead, he reminded everyone what Paul Volcker had to do to bring inflation down in the late 1970s and early 1980s.

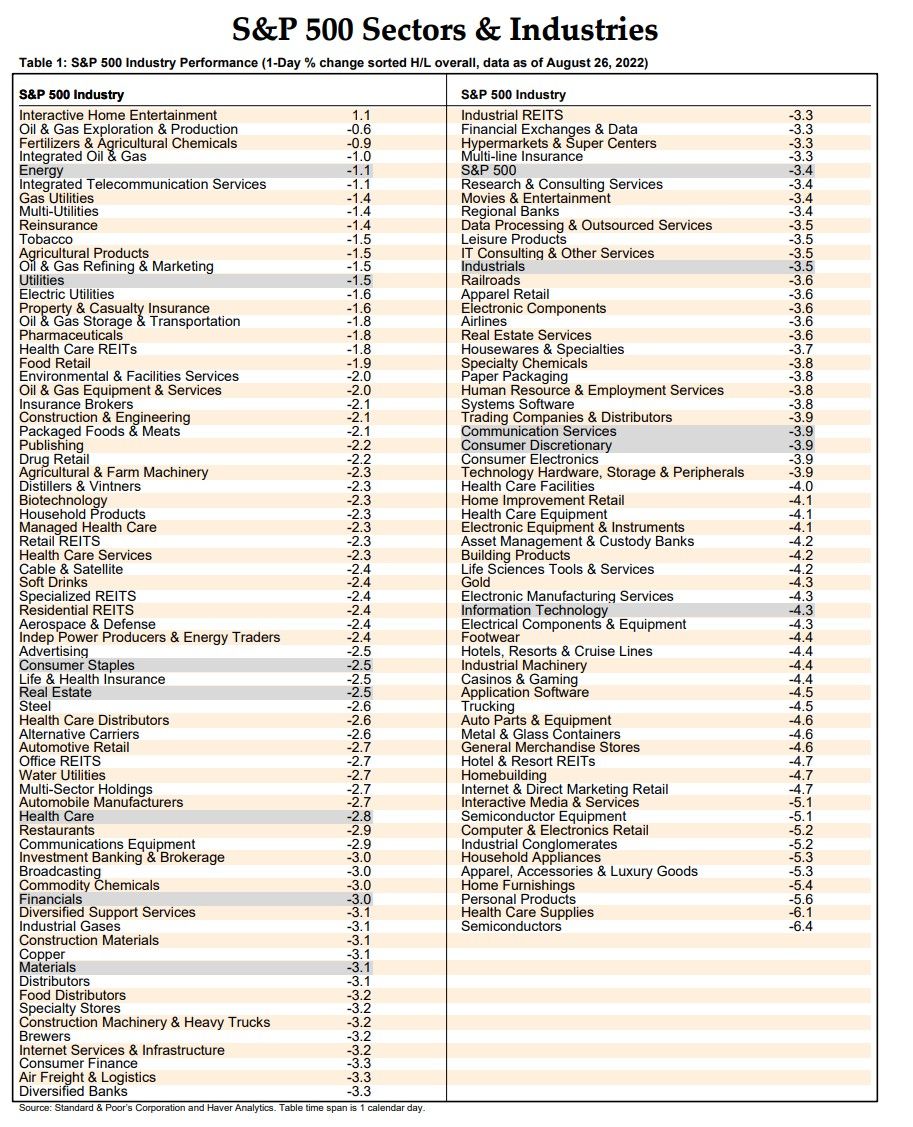

The result on Friday was carnage in the stock market with all 11 sectors of the S&P 500 taking hits on Friday (table below). Only one of the 100+ industries we track was up on the day.

In our August 21 QuickTakes, we wrote that the stock market is overbought ("Market Call: Risk Off"). That's no longer the case. We expect that the tug-of-war between the bulls and the bears will continue for a while.

Which way will Powell pivot next? Stay tuned.