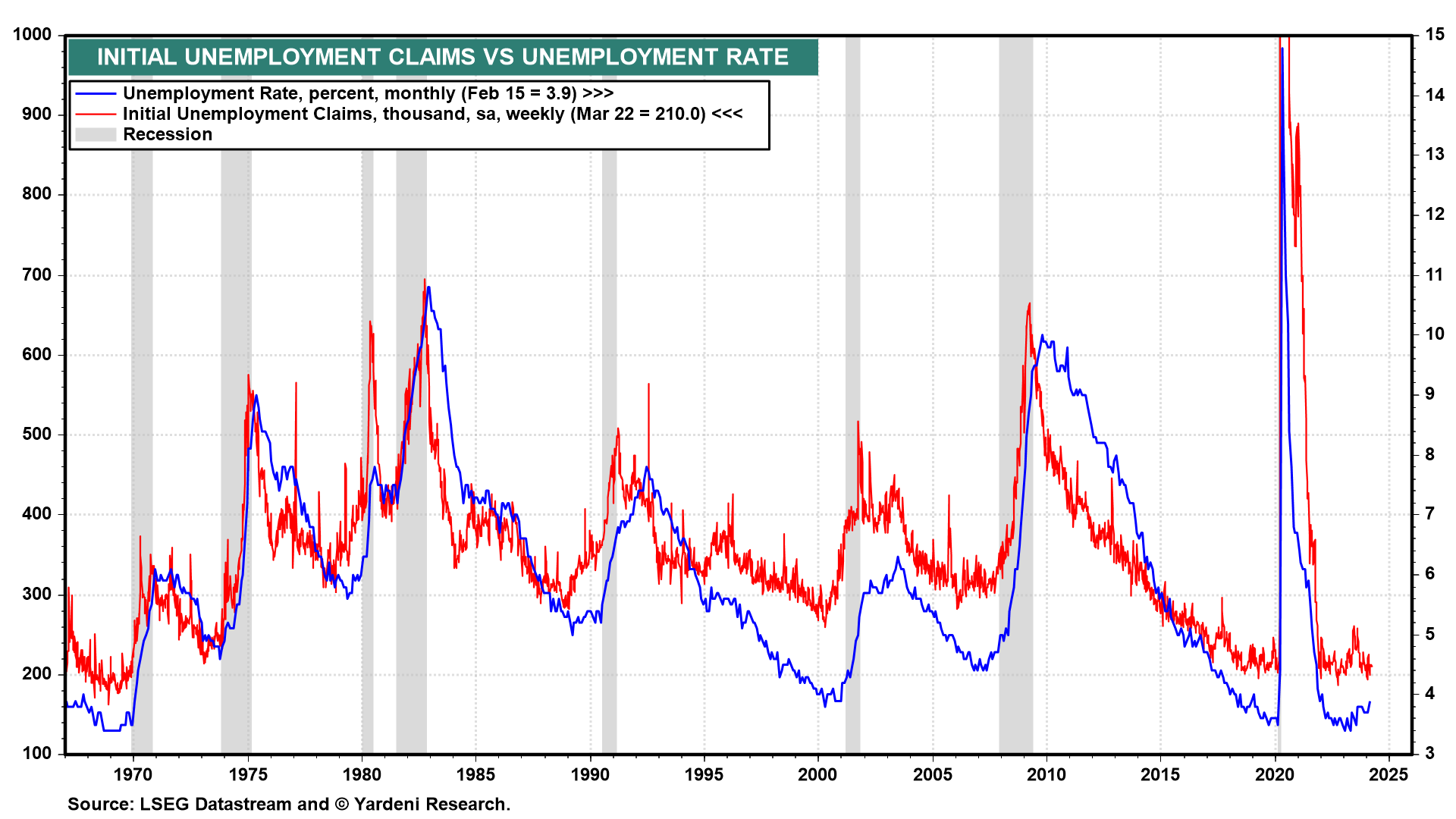

Today's batch of economic indicators was mostly sweet. Q4's real GDP was revised from 3.2% to 3.4% (chart). The Atlanta Fed GDPNow model is projecting 2.1% for Q1-2024. Consumer spending was revised up from 3.0% to 3.3% despite fears that it would be depressed by the resumption of student loan payments. We disputed that notion by observing that real wages and salaries were growing solidly during the last three months of 2023. We also disputed the running-out-of-excess-savings thesis promoted by the hard landers. Corporate profits rose to a record high at the end of last year.

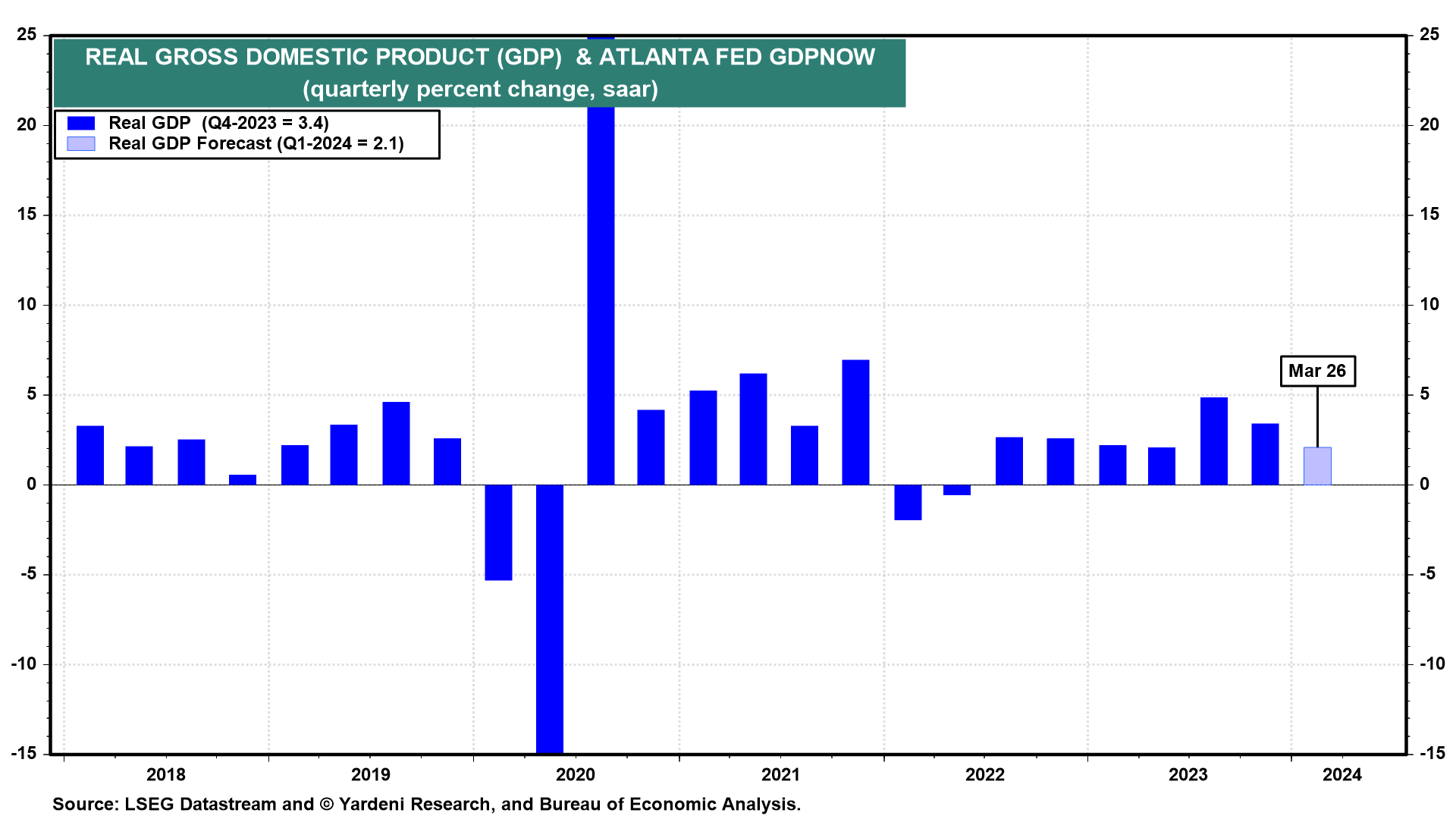

The PCED rose 2.0% (q/q, saar) during Q4 for the second quarter in a row (chart). It is still up 3.2% y/y, but we expect to see that rate closer to the Fed's 2.0% target for the core PCED by the end of this year.

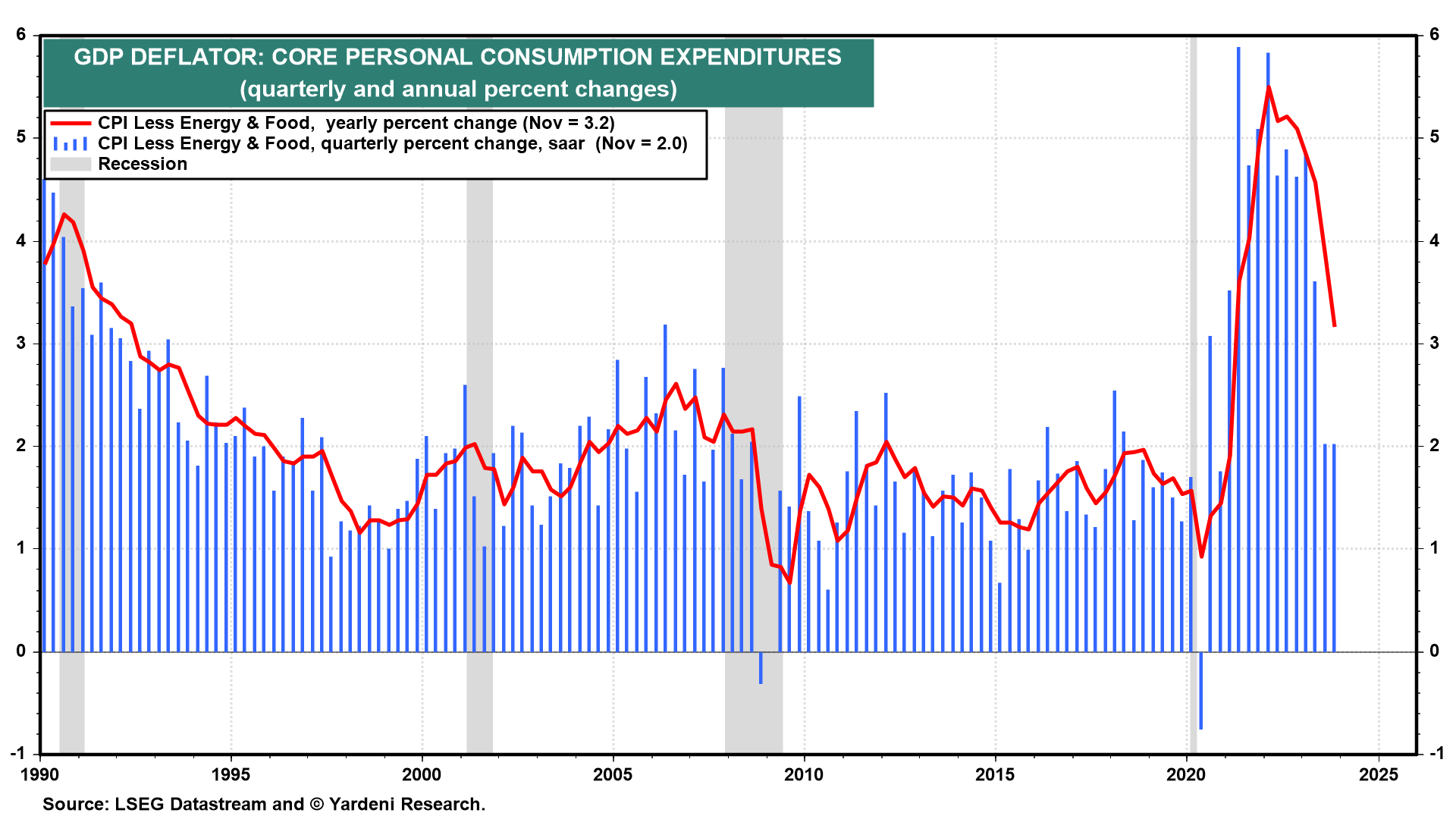

The March Consumer Sentiment Index survey showed that consumers expect inflation to be 2.9% over the next 12 months, despite the rebound in gasoline prices during the month (chart). Fed officials should be pleased with that number for expected inflation.

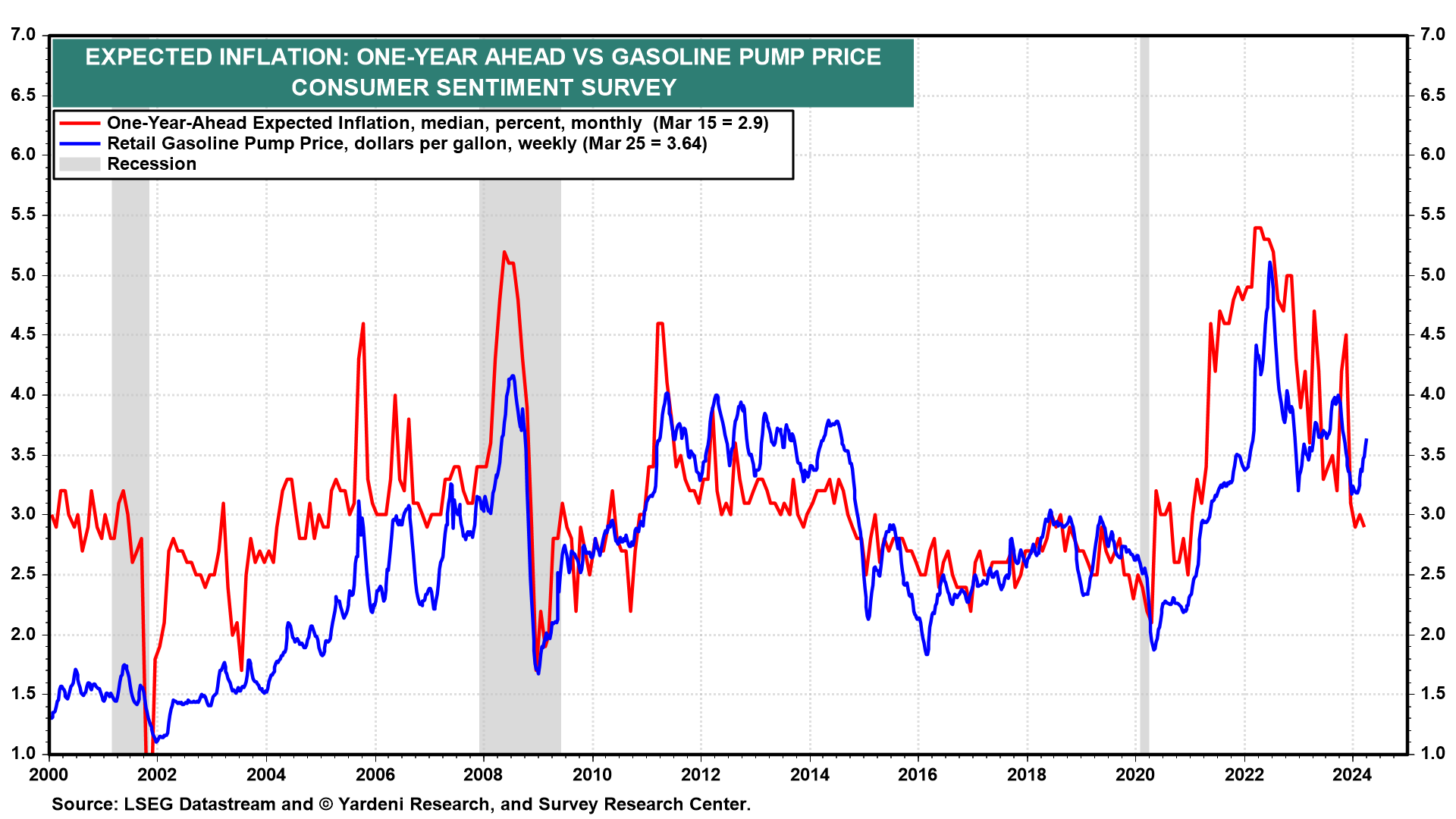

Last, but not least, initial unemployment claims remained low at 210,000 during the March 22 week (chart). This suggests that the unemployment rate might have remained below 4.0% during March for the 26th month in a row.