The S&P 500 has been holding up quite well as the the nattering nabobs of negativism beat their drums more loudly. Today's batch of economic indicators gave the bears plenty to growl about. Consider the following:

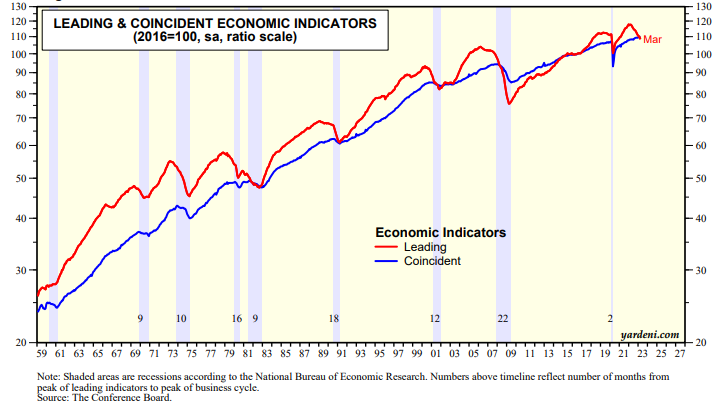

(1) LEI. The Index of Leading Economic Indicators (LEI) peaked at a record high during February 2022 (chart). It's been falling since then. It was down during March of this year by 1.2% to the lowest level since November 2020. A recession should be imminent according to the LEI. Then again, the Index of Coincident Economic Indicators rose to yet another record high in March!

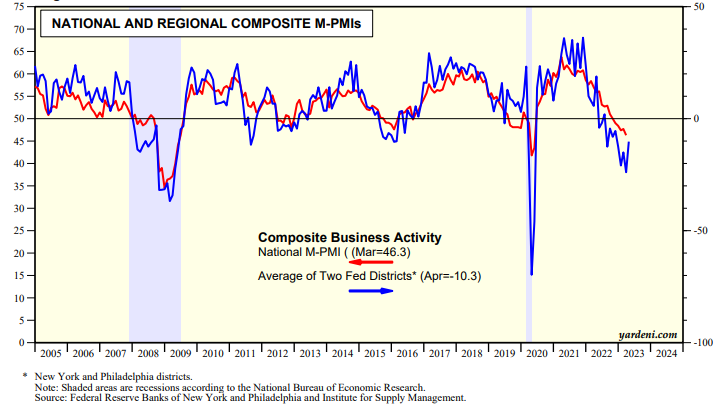

(2) Philly survey. Today's release of the Philly Fed business survey for April was remarkably downbeat. However, on Monday, the NY Fed's business survey for April was surprisingly upbeat. On balance, the average of the two surveys showed an uptick in business conditions this month (chart)

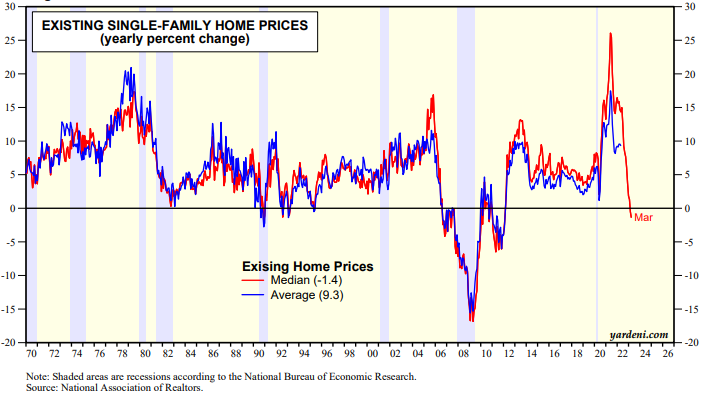

(3) Existing home sales. Existing home sales dropped 2.4% during March, but that's after surging 14.5% during February. A shortage of homes for sales is depressing activity. That's why home prices are holding up so well. The median single family existing home price was down just 1.4% y/y during March.

(4) Jobless claims. Initial claims for state unemployment benefits rose 5,000 to a seasonally adjusted 245,000 for the week ended April 15. That's still a low number, and lots of other indicators show that jobs remain plentiful. The combination of spring breaks and people who have exhausted their severance packages following a rush of layoffs in the technology sector and other areas of the economy sensitive to interest rates, could account for part of the rise in claims last week.

(5) Beige book. The Fed's latest Beige Book report on Wednesday described job gains as having "moderated somewhat" in early April "as several districts reported a slower pace of growth" than in recent reports. It also said contacts reported the labor market becoming less tight, noting "a small number of firms reported mass layoffs," which were "centered at a subset of the largest companies."

Though the report said several districts noted that banks had tightened lending standards, the impact has not yet been visible in most economic data.

(6) Oil price. The nearby futures price of a barrel of crude oil peaked at $83.26 on April 12, after OPEC+ announced a surprise oil output cut on April 2. It was back down to $77.41 this afternoon, about $2 above where it was before the announcement.

(7) Bottom line. We remain in the soft landing camp and see no reason to join the hard-landers based on this latest batch of economic indicators. So far, stock and bond investors also seem to be in our camp.

Based on these latest numbers we expect the Fed to pause. If the FOMC votes for another 25bps hike in the federal funds rate at the May 2-3 meeting of the committee, Fed Chair Jerome Powell is likely to announce a pause in additional hikes for the time being.